Prepared by:

HALBORN

Last Updated 10/15/2024

Date of Engagement: April 22nd, 2024 - July 19th, 2024

Summary

100% of all REPORTED Findings have been addressed

All findings

24

Critical

0

High

0

Medium

1

Low

4

Informational

19

Table of Contents

- 1. Introduction

- 2. Assessment summary

- 3. Test approach and methodology

- 4. Risk methodology

- 5. Scope

- 6. Assessment summary & findings overview

- 7. Findings & Tech Details

- 7.1 Logic issue on vault removal

- 7.2 Potential denial of service on prepare withdrawal function

- 7.3 Unchecked return values of erc20 functions

- 7.4 Denial of service on _getstrategy function

- 7.5 Claimrouter contract is using a mock interface

- 7.6 Single step ownership transfer process

- 7.7 Owner can renounce ownership

- 7.8 A single compromised account can lock up the protocol

- 7.9 Potential denial of service on removevault with block gas limit

- 7.10 Checked increments in for loops increases gas consumption

- 7.11 Incomplete error handling in retirestrategy

- 7.12 Missing checks for index out of bounds

- 7.13 Use external instead of public methods

- 7.14 Push0 is not supported by all chains

- 7.15 Missing zero address checks

- 7.16 Checked increments in for loops increases gas consumption

- 7.17 Lack of validation on protectstrategy

- 7.18 Duplicated imports

- 7.19 Events for function calls

- 7.20 Centralization risk: lack of access control in requestfunds

- 7.21 Missing zero address checks on constructor

- 7.22 Unrestricted reward enabling

- 7.23 Centralization risk: retirestrategy

- 7.24 No events for claim function

1. Introduction

Concrete engaged Halborn to conduct a security assessment on their smart contracts. This report includes four assessments carried out on the following schedules:

Money Printer assessment beginning on April 22nd, 2024 and ending on May 1st, 2024.

Money Printer Code Updates assessment beginning on May 20th, 2024 and ending on June 5th, 2024.

Earn diff assessment beginning on June 10th, 2024 and ending on June 17th, 2024.

Silo and Radiant Strategies assessment beginning on July 16th, 2024 and ending on July 19th, 2024.

2. Assessment Summary

The team at Halborn was provided one week for the engagement and assigned a full-time security engineer to verify the security of the smart contract. The security engineer is a blockchain and smart-contract security expert with advanced penetration testing, smart-contract hacking, and deep knowledge of multiple blockchain protocols.

The purpose of this assessment is to:

Ensure that smart contract functions operate as intended.

Identify potential security issues with the smart contracts.

In summary, Halborn identified some security risks that were mostly addressed/acknowledged by the Concrete team.

3. Test Approach and Methodology

Halborn performed a combination of manual and automated security testing to balance efficiency, timeliness, practicality, and accuracy in regard to the scope of this assessment. While manual testing is recommended to uncover flaws in logic, process, and implementation; automated testing techniques help enhance coverage of the code and can quickly identify items that do not follow the security best practices. The following phases and associated tools were used during the assessment:

Research into architecture and purpose.

Smart contract manual code review and walkthrough.

Graphing out functionality and contract logic/connectivity/functions (solgraph).

Manual assessment of use and safety for the critical Solidity variables and functions in scope to identify any arithmetic related vulnerability classes.

Manual testing by custom scripts.

Testnet deployment (Foundry).

3.1 Out-of-scope

External libraries and financial-related attacks.

Files located under src/examples/* folder.

4. RISK METHODOLOGY

4.1 EXPLOITABILITY

Attack Origin (AO):

Attack Cost (AC):

Attack Complexity (AX):

Metrics:

| EXPLOITABILITY METRIC () | METRIC VALUE | NUMERICAL VALUE |

|---|---|---|

| Attack Origin (AO) | Arbitrary (AO:A) Specific (AO:S) | 1 0.2 |

| Attack Cost (AC) | Low (AC:L) Medium (AC:M) High (AC:H) | 1 0.67 0.33 |

| Attack Complexity (AX) | Low (AX:L) Medium (AX:M) High (AX:H) | 1 0.67 0.33 |

4.2 IMPACT

Confidentiality (C):

Integrity (I):

Availability (A):

Deposit (D):

Yield (Y):

Metrics:

| IMPACT METRIC () | METRIC VALUE | NUMERICAL VALUE |

|---|---|---|

| Confidentiality (C) | None (I:N) Low (I:L) Medium (I:M) High (I:H) Critical (I:C) | 0 0.25 0.5 0.75 1 |

| Integrity (I) | None (I:N) Low (I:L) Medium (I:M) High (I:H) Critical (I:C) | 0 0.25 0.5 0.75 1 |

| Availability (A) | None (A:N) Low (A:L) Medium (A:M) High (A:H) Critical (A:C) | 0 0.25 0.5 0.75 1 |

| Deposit (D) | None (D:N) Low (D:L) Medium (D:M) High (D:H) Critical (D:C) | 0 0.25 0.5 0.75 1 |

| Yield (Y) | None (Y:N) Low (Y:L) Medium (Y:M) High (Y:H) Critical (Y:C) | 0 0.25 0.5 0.75 1 |

4.3 SEVERITY COEFFICIENT

Reversibility (R):

Scope (S):

Metrics:

| SEVERITY COEFFICIENT () | COEFFICIENT VALUE | NUMERICAL VALUE |

|---|---|---|

| Reversibility () | None (R:N) Partial (R:P) Full (R:F) | 1 0.5 0.25 |

| Scope () | Changed (S:C) Unchanged (S:U) | 1.25 1 |

| Severity | Score Value Range |

|---|---|

| Critical | 9 - 10 |

| High | 7 - 8.9 |

| Medium | 4.5 - 6.9 |

| Low | 2 - 4.4 |

| Informational | 0 - 1.9 |

5. SCOPE

- src/vault/ConcreteMultiStrategyVault.sol

- src/swapper/Swapper.sol

- src/swapper/OraclePlug.sol

- ef76d69

- b285ec0

- https://github.com/Blueprint-Finance/money-printer/pull/25/commits/7e47dfd39dba59e02fd9b236390321c2c5dba0a0

- https://github.com/Blueprint-Finance/money-printer/pull/26/commits/167bbc342f1b836763767b0dfbc503bc4240f7ad

- https://github.com/Blueprint-Finance/money-printer/pull/27/commits/2306e730a5deeee15eb77f6f2aa3d5e61a0d0ff2

- 949c177

6. Assessment Summary & Findings Overview

Critical

0

High

0

Medium

1

Low

4

Informational

19

| Security analysis | Risk level | Remediation Date |

|---|---|---|

| Logic issue on vault removal | Medium | Solved - 07/30/2024 |

| Potential Denial of Service on prepare withdrawal function | Low | Risk Accepted |

| Unchecked Return Values of ERC20 Functions | Low | Solved - 07/30/2024 |

| Denial of service on _getStrategy function | Low | Solved - 06/10/2024 |

| ClaimRouter contract is using a mock interface | Low | Risk Accepted |

| Single step ownership transfer process | Informational | Acknowledged |

| Owner can renounce Ownership | Informational | Acknowledged |

| A single compromised account can lock up the protocol | Informational | Acknowledged |

| Potential denial of service on removeVault with block gas limit | Informational | Solved - 06/10/2024 |

| Checked increments in for loops increases gas consumption | Informational | Solved - 05/08/2024 |

| Incomplete Error Handling in retireStrategy | Informational | Solved - 07/30/2024 |

| Missing checks for index out of bounds | Informational | Solved - 05/08/2024 |

| Use external instead of public methods | Informational | Solved - 05/08/2024 |

| PUSH0 is not supported by all chains | Informational | Acknowledged |

| Missing zero address checks | Informational | Acknowledged |

| Checked increments in for loops increases gas consumption | Informational | Acknowledged |

| Lack of validation on ProtectStrategy | Informational | Acknowledged |

| Duplicated Imports | Informational | Solved - 07/31/2024 |

| Events for Function Calls | Informational | Acknowledged |

| Centralization risk: Lack of Access Control in requestFunds | Informational | Acknowledged |

| Missing zero address checks on constructor | Informational | Solved - 07/30/2024 |

| Unrestricted Reward Enabling | Informational | Acknowledged |

| Centralization risk: retireStrategy | Informational | Acknowledged |

| No Events for claim function | Informational | Acknowledged |

7. Findings & Tech Details

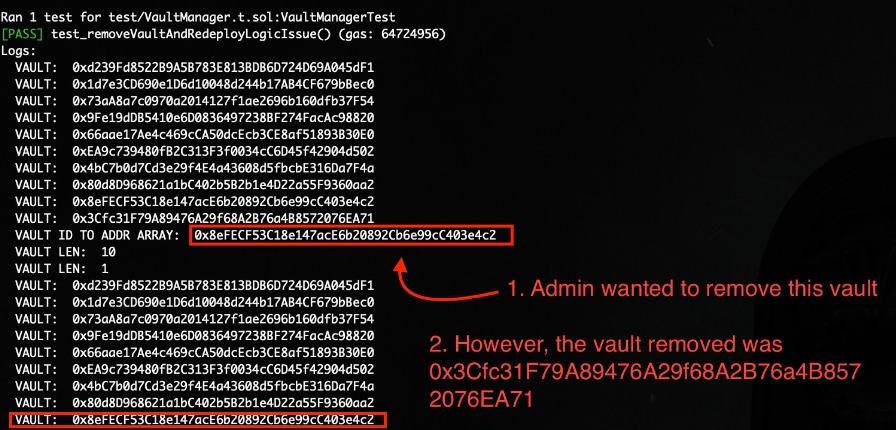

7.1 Logic issue on vault removal

//

Description

There's a logic issue on removeVault on VaultRegistry.sol. If the admin of vault manager chooses a wrong address vault and a correct vault ID to be removed (removeVault(address vault_, bytes32 vaultId_)), will be removed the wrong ones. This issue could lead to a wrong vault removal due to this logic issue. Consider checking if the vault ID that will be removed corresponds with the vault address passed as first parameter.

Moreover, the value of vaultIdToAddressArray[vaultId_] will never be removed from the mapping since the vault is not equal to the value of the mapping on the check inside _handleRemoveVault function.

function removeVault(address vault_, bytes32 vaultId_) external onlyOwner {

console.log("VAULT ID TO ADDR ARRAY: ",vaultIdToAddressArray[vaultId_][0]);

vaultExists[vault_] = false;

_handleRemoveVault(vault_, allVaultsCreated);

_handleRemoveVault(vault_, vaultIdToAddressArray[vaultId_]);

assert(vaultsByToken[IERC4626(vault_).asset()].remove(vault_));

}Proof of Concept

The following Foundry test was used in order to prove the aforementioned issue:

function test_removeVaultAndRedeployLogicIssue() public {

for (uint256 index = 0; index < 10; index++) { //_deployVault(false)

ImplementationData memory data =

ImplementationData({implementationAddress: implementation, initDataRequired: true});

vm.prank(admin);

vaultManager.registerNewImplementation(keccak256(abi.encode("Test", index)), data);

(bytes memory initData, Strategy[] memory strategies) = _getInitData();

vm.prank(admin);

vaultAddress.push(vaultManager.deployNewVault(keccak256(abi.encode("Test", index)), initData));

}

for (uint256 index = 0; index < 10; index++) {

address[] memory vaults = vaultRegistry.getAllVaults();

console.log("VAULT: ",vaults[index]);

}

//(address vault,) = _deployVault(false);

vm.prank(admin);

vaultManager.removeVault(vaultAddress[9], keccak256(abi.encode("Test", 8))); //admin wanted to remove the vault ID 8, however the vault removed was vault 9.

for (uint256 index = 0; index < 9; index++) {

address[] memory vaults = vaultRegistry.getAllVaults();

console.log("VAULT: ",vaults[index]);

}

address[] memory vaults = vaultRegistry.getAllVaults();

console.log("LEN OLD VAULT: ",vaults.length);

//assertEq(vaults.length, 0, "Length");

vm.warp(block.timestamp + 1);

ImplementationData memory data =

ImplementationData({implementationAddress: implementation, initDataRequired: true});

(bytes memory initData, Strategy[] memory strategies) = _getInitData();

vm.prank(admin);

address vaultAddress2 = vaultManager.deployNewVault(keccak256(abi.encode("Test", 9)), initData);

address[] memory newVaults = vaultRegistry.getAllVaults();

console.log("LEN NEW VAULT: ",newVaults.length);

for (uint256 index = 0; index < 10; index++) {

address[] memory vaults = vaultRegistry.getAllVaults();

console.log("VAULT: ",vaults[index]);

}

vm.prank(admin);

vaultManager.removeVault(vaultAddress2, keccak256(abi.encode("Test", 9)));

for (uint256 index = 0; index < 9; index++) {

address[] memory vaults = vaultRegistry.getAllVaults();

console.log("VAULT: ",vaults[index]);

}

//assertEq(newVaults.length, 1, "Length");

}Evidence:

BVSS

Recommendation

Consider checking that the address exists in both arrays, to make sure that the id and the address are correct.

Remediation

SOLVED : The Concrete team solved the issue. The issue is already fixed in the commit id sent. We are checking if the vault address exists for the vaultId. The fix is at the end of the function _handleRemoveVault.

7.2 Potential Denial of Service on prepare withdrawal function

//

Description

There's a logic issue on the WithdrawaQueue contract. The problem arises when the vault wanted to finalize a request withdrawal ID before preparing a withdrawal with a request ID-1.

/// @dev preapares a request to be transferred

/// Emits WithdrawalClaimed event

//TODO test this function

//-next-line naming-convention

function prepareWithdrawal(uint256 _requestId, uint256 _avaliableAssets)

external

onlyOwner

returns (address recipient, uint256 amount, uint256 avaliableAssets)

{

console.log("LAST FINALIZED REQUEST ID: ",lastFinalizedRequestId);

console.log("_requestId: ",_requestId);

if (_requestId == 0) revert InvalidRequestId(_requestId);

if (_requestId < lastFinalizedRequestId) revert RequestNotFoundOrNotFinalized(_requestId);

WithdrawalRequest storage request = _requests[_requestId];

if (request.claimed) revert RequestAlreadyClaimed(_requestId);

recipient = request.recipient;

WithdrawalRequest storage prevRequest = _requests[_requestId - 1];

amount = request.cumulativeAmount - prevRequest.cumulativeAmount;

console.log("amount: prepare withdrawal: ",amount);

console.log("_avaliableAssets: ",_avaliableAssets);

if (_avaliableAssets > amount) {

assert(_requestsByOwner[recipient].remove(_requestId));

avaliableAssets = _avaliableAssets - amount;

request.claimed = true;

//This is commented to fit the requirements of the vault

//instead of this we will call _withdrawStrategyFunds

//IERC20(TOKEN).safeTransfer(recipient, realAmount);

emit WithdrawalClaimed(_requestId, recipient, amount);

}

}Since the owner is the vault and the only way the vault can call _finalize is through batchClaimWithdrawal, the issue has been downgraded from high to low due to the protocol design. However, be sure before production or future releases that the _finalize external function is not called by the vault for security reasons.

The batchClaimWithdrawal function, is calling first the prepareWithdrawal (claimWithdrawal private function) instead of _finalize.

/**

* @notice Claims multiple withdrawal requests starting from the lasFinalizedRequestId.

* @dev This function allows the contract owner to claim multiple withdrawal requests in batches.

* @param maxRequests The maximum number of withdrawal requests to be processed in this batch.

*/

function batchClaimWithdrawal(uint256 maxRequests) external onlyOwner nonReentrant {

if (address(withdrawalQueue) == address(0)) revert QueueNotSet();

uint256 availableAssets = getAvailableAssetsForWithdrawal();

uint256 lastFinalizedId = withdrawalQueue.getLastFinalizedRequestId();

uint256 lastCreatedId = withdrawalQueue.getLastRequestId();

uint256 newLastFinalized = lastFinalizedId;

uint256 max = lastCreatedId < lastFinalizedId + maxRequests ? lastCreatedId : lastFinalizedId + maxRequests;

console.log("MAX: ",max);

for (uint256 i = lastFinalizedId + 1; i <= max;) {

uint256 newAvailiableAssets = claimWithdrawal(i, availableAssets);

// -next-line incorrect-equality

if (newAvailiableAssets == availableAssets) break;

availableAssets = newAvailiableAssets;

newLastFinalized = i;

unchecked {

i++;

}

}

if (newLastFinalized != lastFinalizedId) {

withdrawalQueue._finalize(newLastFinalized);

}

}BVSS

Recommendation

Consider ensuring as internal the _finalize function.

Remediation

RISK ACCEPTED: The Concrete team accepted the risk of this finding. They will not make the function internal. The vault doesn't have any way to directly call that function. The only way to do it is through impersonation using Foundry or Hardhat.

7.3 Unchecked Return Values of ERC20 Functions

//

Description

ERC20(token).approve reverted if the underlying ERC20 token approve did not return boolean. When transferring the token, the protocol uses safeTransfer and safeTransferFrom, but when approving the payout token, the safeApprove is not used for non-standard token such as USDT, calling approve will revert because the OpenZeppeling ERC20 enforces the underlying token return a boolean.

function approve(address spender, uint256 value) public virtual returns (bool) {

address owner = _msgSender();

_approve(owner, spender, value);

return true;

}While the token such as USDT does not return boolean: https://etherscan.io/address/0xdac17f958d2ee523a2206206994597c13d831ec7#code#L126

USDT or other ERC20 token that does not return boolean for approve is not supported as the payout token. It has been observed on the SiloV1Strategy contract, missing require on the approve function.

baseAsset_.approve(address(silo), type(uint256).max);BVSS

Recommendation

Consider using safeApprove instead of approve.

Remediation

SOLVED: The Concrete team solved the issue by applying recommendations.

Remediation Hash

7.4 Denial of service on _getStrategy function

//

Description

There is a potential denial of service (DoS) vulnerability in the _getStrategy function. The vaults array, which stores all vaults created for a specific token, lacks an upper limit on its size. Consequently, the contract owner could theoretically create an infinite number of vaults. This array retrieves all vaults associated with a particular token, which means an infinite number of vaults could be created for a given token. This would cause a denial of service when the _getStrategy function is called due to the excessive size of the vaults array.

function _getStrategy(address tokenAddress, uint256 amount) internal returns (address, bool) {

//retrieves all vaults created for an specific token

address[] memory vaults = vaultRegistry.getVaultsByToken(tokenAddress);

//TODO change to a criteria where when can decidede base on yield

address selectedProtectionStrat = address(0x0);

bool requiresFunds = true;

//Iterates over array of vaults to find the best vault to withdraw from

uint256 len = vaults.length;

uint256 maxYieldFound = type(uint256).max;

for (uint256 i; i < len; i++) {

IConcreteMultiStrategyVault currentVault = IConcreteMultiStrategyVault(vaults[i]);

address protectionStrat = currentVault.protectStrategy();

//only considers vaults with protection strategies

if (protectionStrat == address(0x0)) {

continue;

}

uint256 protectionStratYield = IMockStrategy(protectionStrat).highWatermark();

//if the protection strategy has enough assets to withdraw we are done with the search

if (

IMockStrategy(protectionStrat).getAvailableAssetsForWithdrawal() >= amount

&& (protectionStratYield < maxYieldFound || requiresFunds == true)

) {

console.log("hola puto");

selectedProtectionStrat = protectionStrat;

requiresFunds = false;

maxYieldFound = protectionStratYield;

}

if (requiresFunds == false) {

continue;

}

if (currentVault.getAvailableAssetsForWithdrawal() >= amount && protectionStratYield < maxYieldFound) {

selectedProtectionStrat = protectionStrat;

requiresFunds = true;

maxYieldFound = protectionStratYield;

}

}

return (selectedProtectionStrat, requiresFunds);

}Gas Consumption Concern

Additionally, the getVaultsByToken function consumes a significant amount of gas when handling a large number of vaults. This issue is particularly evident if an unusually large number of vaults are created for a specific token (as demonstrated in the proof of concept).

function getVaultsByToken(address asset) external view virtual returns (address[] memory vaults) {

return vaultsByToken[asset].values();

}Irreversibility of the Operation

The operation is irreversible for the affected token. Once a vast number of vaults are created for a token, all subsequent operations on vaults associated with that token will fail. Given that the operation requires privileged access, the severity of this issue has been downgraded to low.

BVSS

Recommendation

Implement a limit on the number of vaults that can be created for each token.

Optimize the

getVaultsByTokenfunction to handle large arrays more efficiently.Consider adding mechanisms to reverse or mitigate the creation of excessive vaults.

By addressing these recommendations, the potential for a denial of service can be significantly reduced, ensuring the robustness and reliability of the contract.

Remediation

SOLVED: The Concrete team solved this issue.

Remediation Hash

7.5 ClaimRouter contract is using a mock interface

//

Description

It has been observed that the user blueprint did not receive the asset tokens, since the executeBorrowClaim function is executed without code.

/// @notice Function to request assets from the vault.

/// @dev Requests assets from the vault and executes a borrow claim through the protection strategy.

/// @param tokenAddress The address of the token.

/// @param amount_ The amount of assets to request.

/// @param userBlueprint The address of the user's blueprint contract.

function requestToken(VaultFlags, address tokenAddress, uint256 amount_, address payable userBlueprint)

external

onlyBlueprint

{

uint256 amount = amount_;

(address protectionStrat, bool requiresFunds) = _getStrategy(tokenAddress, amount);

console.log(protectionStrat);

if (protectionStrat == address(0x0)) {

//iterates over array

uint256 len = tokenCascade.length;

for (uint256 i; i < len; i++) {

//We avoid using the same token as the one that failed

if (tokenAddress == tokenCascade[i]) continue;

//TODO change amount

amount = _convertFromTokenToStable(tokenAddress, amount_);

//We control both the length of the array and the external call

// slither-disable-next-line calls-loop

(protectionStrat, requiresFunds) = _getStrategy(tokenCascade[i], amount);

if (protectionStrat != address(0x0)) {

break;

}

}

}

if (protectionStrat == address(0x0)) {

revert NoProtectionStrategiesFound();

}

emit ClaimRequested(protectionStrat, amount, IMockProtectStrategy(protectionStrat).asset(), userBlueprint);

IMockProtectStrategy(protectionStrat).executeBorrowClaim(amount, userBlueprint);

}MockERC44656Protect.sol:

function executeBorrowClaim(uint256 amount, address recipient) external {

console.log("Entered to empty function from on scope contract");

//empty

}Since it's a mock, the issue has been downgraded, however it's not recommended using a mock contract within a contract. If for somehow this is not updated, then the wrong function will be executed with unexpected errors or behaviors for the users using the money printer.

BVSS

Recommendation

Consider changing the proper interface IProtectStrategy instead of IMockProtectStrategy on the scope contract ClaimRouter due to could lead to unexpected behavior since the critical code inside executeBorrowClaim is never run.

Remediation

RISK ACCEPTED: The Concrete team accepted the risk of this finding.

7.6 Single step ownership transfer process

//

Description

Ownership of the contracts can be lost as the RewardManager,TokenRegistry,ImplementationRegistry,DeploymentManager and VaultFactory contract is inherited from the Ownable contract, and their ownership can be transferred in a single-step process. The address the ownership is changed to should be verified to be active or willing to act as the owner.

function transferOwnership(address newOwner) public virtual onlyOwner {

require(newOwner != address(0), "Ownable: new owner is the zero address");

_transferOwnership(newOwner);

}

function _transferOwnership(address newOwner) internal virtual {

address oldOwner = _owner;

_owner = newOwner;

emit OwnershipTransferred(oldOwner, newOwner);

}

BVSS

Recommendation

Consider using the Ownable2Step https://github.com/OpenZeppelin/openzeppelin-contracts/blob/master/contracts/access/Ownable2Step.sol library over the Ownable library.

Remediation

ACKNOWLEDGED : The Concrete team acknowledged the issue. Since each of the contracts is owned by other contracts, the ability to transfer or renounce ownership is significantly limited. The use of Ownable2Step requires that the new owner accept ownership. Without a significant re-write of the existing contracts (which would negate the functionality of Ownable2Step) this is not feasible.

Remediation Hash

7.7 Owner can renounce Ownership

//

Description

Typically, the contract’s owner is the account that deploys the contract. As a result, the owner is able to perform certain privileged activities.

The Openzeppelin’s Ownable used in this project contract implements renounceOwnership. This can represent a certain risk if the ownership is renounced for any other reason than by design. Renouncing ownership will leave the contract without an owner, thereby removing any functionality that is only available to the owner.

function renounceOwnership() public virtual onlyOwner {

_transferOwnership(address(0));BVSS

Recommendation

To mitigate the risks associated with unintended or unauthorized ownership transfers, it is recommended to adopt a more secure ownership transfer mechanism, such as OpenZeppelin's Ownable2Step. This implementation requires a two-step process for ownership transfer: first, the current owner initiates the transfer by specifying a new owner, and then the new owner must accept the ownership. This process adds an additional layer of security by ensuring that ownership is only transferred after explicit confirmation from both parties involved.

Implementing Ownable2Step will not only enhance the security of the contracts by preventing accidental or malicious ownership transfers but also ensure that any systems or contracts relying on its authorization remain consistent and up-to-date. This recommendation aligns with best practices for contract ownership management and governance within the Ethereum ecosystem.

Remediation

ACKNOWLEDGED : The Concrete team acknowledged the issue. Since each of the contracts is owned by other contracts, the ability to transfer or renounce ownership is significantly limited. The use of Ownable2Step requires that the new owner accept ownership. Without a significant re-write of the existing contracts (which would negate the functionality of Ownable2Step) this is not feasible.

Remediation Hash

7.8 A single compromised account can lock up the protocol

//

Description

The ability to pauseVault() and unpauseVault() the protocol is unilaterally controlled by a single admin account, which if compromised could be exploited to attempt to lock up the protocol and extort users.

It is advised that these capabilities are separated into distinct roles in an effort to reduce the consolidation of power that could be wielded in the event of a protocol exploit.

BVSS

Recommendation

Consider adopting both an UNPAUSE_ROLE and PAUSE_ROLE.

Remediation

ACKNOWLEDGED : The Concrete team acknowledged the issue. The client belief that the likelihood of this is exceptionally low. The admin role will be granted to a multi-sig to prevent rogue action. If they were to introduce a pause and unpause role, the same multisig would be provided in both roles, negating any positive benefits and creating unnecessary overhead.

Remediation Hash

7.9 Potential denial of service on removeVault with block gas limit

//

Description

It has been observed that if a particular vault wanted to be removed, the _handleRemoveVault function iterates over all vaultArray consuming a lot of gas in case there's a huge amount of vault created on the array vaultArray_. If the array is big enough, the block gas limit will be reached and the transaction will never get processed. For that reason, it is recommended to add a require statement for limiting adding, for example, more than n different vault.

function _handleRemoveVault(address vault_, address[] storage vaultArray_) internal {

uint256 length = vaultArray_.length;

for (uint256 i = 0; i < length;) {

if (vaultArray_[i] == vault_) {

if (i < length - 1) {

vaultArray_[i] = vaultArray_[length - 1];

}

vaultArray_.pop();

break;

}

unchecked {

i++;

}

}

}BVSS

Recommendation

Consider ensuring a fixed created vaults in order to avoid potential denial of service on _handleRemoveVault function.

Remediation

SOLVED: The Concrete team solved this issue.

Remediation Hash

7.10 Checked increments in for loops increases gas consumption

//

Description

Most of the solidity for loops use an uint256 variable counter that increments by 1 and starts at 0. These increments don't need to be checked for over/underflow because the variable will never reach the max capacity of uint256 as it would run out of gas long before that happens.

BVSS

Recommendation

It is recommended to uncheck the increments in for loops to save gas. For example, instead of:

for (uint256 i; i < len; i++) {

Strategy memory strategy = strategies[i];

//We control both the length of the array and the external call

//-next-line calls-loop

uint256 withdrawable = strategy.strategy.previewRedeem(strategy.strategy.balanceOf(address(this)));

if (diff.mulDiv(strategy.allocation.amount, 10_000, Math.Rounding.Ceil) > withdrawable) {

revert InsufficientFunds(strategy.strategy, diff * strategy.allocation.amount, withdrawable);

}

uint256 amountToWithdraw = amount_.mulDiv(strategy.allocation.amount, 10_000, Math.Rounding.Ceil);

//We control both the length of the array and the external call

//-next-line unused-return,calls-loop

strategy.strategy.withdraw(amountToWithdraw, receiver_, address(this));

totalWithdrawn += amountToWithdraw;

}Use:

for (uint256 i; i < len;) {

Strategy memory strategy = strategies[i];

//We control both the length of the array and the external call

//-next-line calls-loop

uint256 withdrawable = strategy.strategy.previewRedeem(strategy.strategy.balanceOf(address(this)));

if (diff.mulDiv(strategy.allocation.amount, 10_000, Math.Rounding.Ceil) > withdrawable) {

revert InsufficientFunds(strategy.strategy, diff * strategy.allocation.amount, withdrawable);

}

uint256 amountToWithdraw = amount_.mulDiv(strategy.allocation.amount, 10_000, Math.Rounding.Ceil);

//We control both the length of the array and the external call

//-next-line unused-return,calls-loop

strategy.strategy.withdraw(amountToWithdraw, receiver_, address(this));

totalWithdrawn += amountToWithdraw;

unchecked {++i};

}Remediation

SOLVED : The Concrete team solved the issue by adding unchecked statement.

Remediation Hash

7.11 Incomplete Error Handling in retireStrategy

//

Description

The function retireStrategy calls _protocolWithdraw(balanceOfUnderlying(shares), 0) without verifying that balanceOfUnderlying returns a valid value. This could potentially cause issues if balanceOfUnderlying does not return the expected value.

function retireStrategy() external onlyOwner {

_getRewardsToStrategy();

uint256 shares = collateralToken.balanceOf(address(this));

_protocolWithdraw(balanceOfUnderlying(shares), 0);

}BVSS

Recommendation

Consider adding proper checks on the return of balanceOfUnderlying function.

Remediation

SOLVED: The Concrete team solved the issue by applying recommendations.

Remediation Hash

7.12 Missing checks for index out of bounds

//

Description

The functions pullFundsFromSingleStrategy, pushFundsIntoSingleStrategy, and addStrategy fail to implement checks for out-of-bounds access on the array of strategies with which the vault can interact.

/**

* @notice Pulls funds back from a single strategy into the vault.

* @dev Can only be called by the vault owner.

* @param index_ The index of the strategy from which to pull funds.

*/

function pullFundsFromSingleStrategy(uint256 index_) external onlyOwner {

Strategy memory strategy = strategies[index_];

// slither-disable-next-line unused-return

strategy.strategy.redeem(strategy.strategy.balanceOf(address(this)), address(this), address(this));

if (!IERC20(asset()).approve(address(strategy.strategy), 0)) revert ERC20ApproveFail();

}

/**

* @notice Pushes funds from the vault into a single strategy based on its allocation.

* @dev Can only be called by the vault owner. Reverts if the vault is idle.

* @param index_ The index of the strategy into which to push funds.

*/

function pushFundsIntoSingleStrategy(uint256 index_) external onlyOwner {

if (vaultIdle) revert VaultIsIdle();

Strategy memory strategy = strategies[index_];

// slither-disable-next-line unused-return

strategies[index_].strategy.deposit(

totalAssets().mulDiv(strategy.allocation.amount, 10_000, Math.Rounding.Floor), address(this)

);

}When the replace_ parameter is set to true, the function did not perform a check on the index.

function addStrategy(uint256 index_, bool replace_, Strategy calldata newStrategy_)

external

nonReentrant

onlyOwner

takeFees

{

//Ensure that allotments do not total > 100%

uint256 allotmentTotals = 0;

uint256 len = strategies.length;

for (uint256 i; i < len; i++) {

allotmentTotals += strategies[i].allocation.amount;

}

if (replace_) {

if (allotmentTotals - strategies[index_].allocation.amount + newStrategy_.allocation.amount > 10000) {

revert AllotmentTotalTooHigh();

}

// slither-disable-next-line unused-return

strategies[index_].strategy.redeem(

strategies[index_].strategy.balanceOf(address(this)), address(this), address(this)

);

if (!IERC20(asset()).approve(address(strategies[index_].strategy), 0)) revert ERC20ApproveFail();

emit StrategyReplaced(strategies[index_], newStrategy_);

strategies[index_] = newStrategy_;

if (!IERC20(asset()).approve(address(newStrategy_.strategy), type(uint256).max)) revert ERC20ApproveFail();

} else {

if (allotmentTotals + newStrategy_.allocation.amount > 10000) {

revert AllotmentTotalTooHigh();

}

strategies.push(newStrategy_);

if (!IERC20(asset()).approve(address(newStrategy_.strategy), type(uint256).max)) revert ERC20ApproveFail();

}

emit StrategyAdded(newStrategy_);

}BVSS

Recommendation

It is advisable to implement out-of-bounds checks when accessing arrays in Solidity. Additionally, providing an error message when attempting to fetch data beyond the array's limit can inform the user about the cause of the execution reversion.

Remediation

SOLVED : The Concrete team solved the issue by adding array index checks.

Remediation Hash

7.13 Use external instead of public methods

//

Description

The following methods are public and could be external. External is more gas optimize that public, so it should be used as much as possible.

swapTokensForReward() should be declared external:

Swapper.swapTokensForReward() (swapper/Swapper.sol#75-94).

setRewardManager() should be declared external:

Swapper.setRewardManager() (swapper/Swapper.sol#102-105).

disableTokenForSwap() should be declared external:

Swapper.disableTokenForSwap() (swapper/Swapper.sol#111-113).

BVSS

Recommendation

Use external instead of public methods.

Remediation

SOLVED : The Concrete team solved the issue by replacing public to external.

Remediation Hash

7.14 PUSH0 is not supported by all chains

//

Description

The compiler for Solidity 0.8.20 switches the default target EVM version to Shanghai, which means that the generated bytecode will include PUSH0 opcodes. Be sure to select the appropriate EVM version in case you intend to deploy on a chain other than mainnet like L2 chains that may not support PUSH0, otherwise deployment of your contracts will fail.

BVSS

Recommendation

It is important to consider the targeted deployment chains before writing smart contracts because, in the future, there might exist a need for deploying the contracts in a network that could not support new opcodes from Shanghai or Cancun EVM versions.

Remediation

ACKNOWLEDGED : The Concrete team acknowledged the issue. It is their stance that this a low probability over a given time horizon. Additionally, if the client elects to deploy to a chain that is incompatible with Shanghai, it can be created a contract that utilizes an older Solidity version.

Remediation Hash

7.15 Missing zero address checks

//

Description

Some missing zero addresses have been found:

The

addVaultfunction allows the addition of a vault with a zero address.The strategy struct permits passing a zero address during its initialization.

function addVault(address vault_, bytes32 vaultId_) external override onlyOwner {

if (vaultExists[vault_]) {

revert VaultAlreadyExists();

}

vaultExists[vault_] = true;

vaultIdToAddressArray[vaultId_].push(vault_);

allVaultsCreated.push(vault_);

assert(vaultsByToken[IERC4626(vault_).asset()].add(vault_));

console.log("VAULT ADDED: ",vault_);

emit VaultAdded(vault_, vaultId_);

}function initialize(

IERC20 baseAsset_,

string memory shareName_,

string memory shareSymbol_,

Strategy[] memory strategies_,

address feeRecipient_,

VaultFees memory fees_,

uint256 depositLimit_,

address owner_

) external initializer nonReentrant {

__ERC4626_init(IERC20Metadata(address(baseAsset_)));

__ERC20_init(shareName_, shareSymbol_);

__Ownable_init(owner_);

_queue_init();

if (address(baseAsset_) == address(0)) revert InvalidAssetAddress();

// Loop through provided strategies, validate them, and approve the base asset for each.

uint256 len = strategies_.length;

//console.log("Strategies len: ",len);

for (uint256 i; i < len;) {

//We control both the length of the array and the external call

// slither-disable-next-line calls-loop

if (strategies_[i].strategy.asset() != address(baseAsset_)) {

revert VaultAssetMismatch();

}

//console.log("Protection strats on concret init: ",strategies_[i].strategy.isProtectStrategy());

if (strategies_[i].strategy.isProtectStrategy()) {

if (protectStrategy != address(0x0)) revert MultipleProtectStrat();

protectStrategy = address(strategies_[i].strategy);

}

strategies.push(strategies_[i]);

//We control both the length of the array and the external call

// slither-disable-next-line calls-loop

if (!baseAsset_.approve(address(strategies_[i].strategy), type(uint256).max)) {

revert ERC20ApproveFail();

}

unchecked {

i++;

}

}BVSS

Recommendation

To address the identified issues of allowing zero addresses in the addVault and initialize functions, you need to add checks to ensure that zero addresses are not passed for vault_ in addVault and for strategy and other relevant addresses in initialize.

Remediation

ACKNOWLEDGED: The Concrete team acknowledged this finding.

7.16 Checked increments in for loops increases gas consumption

//

Description

Most of the solidity for loops use an uint256 variable counter that increments by 1 and starts at 0. These increments don't need to be checked for over/underflow because the variable will never reach the max capacity of uint256 as it would run out of gas long before that happens.

BVSS

Recommendation

It is recommended to uncheck the increments in for loops to save gas. For example, instead of:

for (uint256 i; i < vaults.length; i++) {

address protectionStrat = IConcreteMultiStrategyVault(vaults[i]).protectStrategy();

//only considers vaults with protection strategies

if (protectionStrat == address(0x0)) {

continue;

}

lastProtectionStrat = protectionStrat;

uint256 stratBorrowDebt = IMockProtectStrategy(protectionStrat).getBorrowDebt();

if (stratBorrowDebt == 0) continue;

uint256 amountToBeSent = amount_.mulDiv(stratBorrowDebt, totalBorrowDebt, Math.Rounding.Floor);

//this function is only called by the blueprint so we can trust the userBlueprint

totalSent += amountToBeSent;

//TODO HAndle cases where the amount sent is more the one expected

//the funtion should be able to set the rest as rewards in the case of the reapyment exceding the debt

//slither-disable-next-line arbitrary-send-erc20

IERC20(tokenAddress).safeTransferFrom(userBlueprint, protectionStrat, amountToBeSent);

if (isReward) {

emit RewardAdded(protectionStrat, amountToBeSent);

continue;

}

if (amountToBeSent > stratBorrowDebt) {

emit RewardAdded(protectionStrat, amountToBeSent - stratBorrowDebt);

emit Repayment(protectionStrat, stratBorrowDebt);

IMockProtectStrategy(protectionStrat).updateBorrowDebt(stratBorrowDebt);

} else {

emit Repayment(protectionStrat, amountToBeSent);

IMockProtectStrategy(protectionStrat).updateBorrowDebt(amountToBeSent);

}

}Use:

for (uint256 i; i < vaults.length; ) {

address protectionStrat = IConcreteMultiStrategyVault(vaults[i]).protectStrategy();

//only considers vaults with protection strategies

if (protectionStrat == address(0x0)) {

continue;

}

lastProtectionStrat = protectionStrat;

uint256 stratBorrowDebt = IMockProtectStrategy(protectionStrat).getBorrowDebt();

if (stratBorrowDebt == 0) continue;

uint256 amountToBeSent = amount_.mulDiv(stratBorrowDebt, totalBorrowDebt, Math.Rounding.Floor);

//this function is only called by the blueprint so we can trust the userBlueprint

totalSent += amountToBeSent;

//TODO HAndle cases where the amount sent is more the one expected

//the funtion should be able to set the rest as rewards in the case of the reapyment exceding the debt

//slither-disable-next-line arbitrary-send-erc20

IERC20(tokenAddress).safeTransferFrom(userBlueprint, protectionStrat, amountToBeSent);

if (isReward) {

emit RewardAdded(protectionStrat, amountToBeSent);

continue;

}

if (amountToBeSent > stratBorrowDebt) {

emit RewardAdded(protectionStrat, amountToBeSent - stratBorrowDebt);

emit Repayment(protectionStrat, stratBorrowDebt);

IMockProtectStrategy(protectionStrat).updateBorrowDebt(stratBorrowDebt);

} else {

emit Repayment(protectionStrat, amountToBeSent);

IMockProtectStrategy(protectionStrat).updateBorrowDebt(amountToBeSent);

}

unchecked {++i};

}Remediation

ACKNOWLEDGED: The Concrete team acknowledged this finding.

7.17 Lack of validation on ProtectStrategy

//

Description

It has been observed that no parameter passed into the constructor was properly validated.

constructor(

IERC20 baseAsset_,

address feeRecipient_,

address owner_,

uint256 rewardFee_,

address claimRouter_,

address vault_

) {

IERC20Metadata metaERC20 = IERC20Metadata(address(baseAsset_));

rewardFee = rewardFee_;

//This can be initially set to zero and then updated by the owner

//slither-disable-next-line missing-zero-check

claimRouter = claimRouter_;

RewardToken[] memory rewardTokenEmptyArray = new RewardToken[](0);

__StrategyBase_init(

baseAsset_,

string.concat("Concrete Earn Protect ", metaERC20.symbol(), " Strategy"),

string.concat("ctPct-", metaERC20.symbol()),

feeRecipient_,

type(uint256).max,

owner_,

rewardTokenEmptyArray,

vault_

);

//slither-disable-next-line unused-return

//baseAsset_.approve(claimRouter, type(uint256).max);

}

The only parameter that can be set again is claimRouter_ through the setClaimRouter function by the owner.

BVSS

Recommendation

Consider implementing proper validation for all parameters passed into the constructor. This will enhance the security and robustness of the contract by ensuring that invalid or malicious input cannot compromise its functionality. Specifically, consider adding checks to verify the validity of addresses, ensuring they are not zero addresses, and confirming that the rewardFee_ is within an acceptable range.

Remediation

ACKNOWLEDGED: The Concrete team acknowledged this finding.

7.18 Duplicated Imports

//

Description

The SafeERC20 and Math libraries are imported twice on the StrategyBase contract. This should be cleaned up to avoid confusion.

import {

ERC4626Upgradeable,

ERC20Upgradeable as ERC20,

IERC20,

IERC20Metadata,

IERC4626

} from "@openzeppelin/contracts-upgradeable/token/ERC20/extensions/ERC4626Upgradeable.sol";

import {Initializable} from "@openzeppelin/contracts/proxy/utils/Initializable.sol";

import {SafeERC20} from "@openzeppelin/contracts/token/ERC20/utils/SafeERC20.sol";

import {Math} from "@openzeppelin/contracts/utils/math/Math.sol";

import {ReentrancyGuard} from "@openzeppelin/contracts/utils/ReentrancyGuard.sol";

import {PausableUpgradeable} from "@openzeppelin/contracts-upgradeable/utils/PausableUpgradeable.sol";

import {OwnableUpgradeable} from "@openzeppelin/contracts-upgradeable/access/OwnableUpgradeable.sol";

import {SafeERC20} from "@openzeppelin/contracts/token/ERC20/utils/SafeERC20.sol";

import {Context} from "@openzeppelin/contracts/utils/Context.sol";

import {ContextUpgradeable} from "@openzeppelin/contracts-upgradeable/utils/ContextUpgradeable.sol";

import {Math} from "@openzeppelin/contracts/utils/math/Math.sol";

import {Errors} from "../interfaces/Errors.sol";

import {ReturnedRewards} from "../interfaces/IStrategy.sol";

import {

VaultFees,

VaultInitParams,

Strategy,

IConcreteMultiStrategyVault

} from "../interfaces/IConcreteMultiStrategyVault.sol";BVSS

Recommendation

Consider removing the duplicated imports.

Remediation

SOLVED: The Concrete team solved the issue by applying recommendations.

Remediation Hash

7.19 Events for Function Calls

//

Description

Consider to add events for critical state-changing functions to improve traceability and debugging.

/**

* @notice Sets the recipient address for protocol fees.

* @dev Can only be called by the contract owner.

* @param feeRecipient_ The address to which protocol fees will be sent.

*/

function setFeeRecipient(address feeRecipient_) external onlyOwner {

if (feeRecipient_ == address(0)) revert InvalidFeeRecipient();

feeRecipient = feeRecipient_;

}

/**

* @notice Sets the maximum limit for deposits into the strategy.

* @dev Can only be called by the contract owner.

* @param depositLimit_ The maximum amount that can be deposited.

*/

//TODO: Add events for these functions

//-next-line events-maths

function setDepositLimit(uint256 depositLimit_) external onlyOwner {

if (depositLimit_ == 0) revert InvalidDepositLimit();

depositLimit = depositLimit_;

}BVSS

Recommendation

Consider adding events:

event FeeRecipientUpdated(address indexed newFeeRecipient);

event DepositLimitUpdated(uint256 newDepositLimit);

function setFeeRecipient(address feeRecipient_) external onlyOwner {

if (feeRecipient_ == address(0)) revert InvalidFeeRecipient();

feeRecipient = feeRecipient_;

emit FeeRecipientUpdated(feeRecipient_);

}

function setDepositLimit(uint256 depositLimit_) external onlyOwner {

if (depositLimit_ == 0) revert InvalidDepositLimit();

depositLimit = depositLimit_;

emit DepositLimitUpdated(depositLimit_);

}Remediation

ACKNOWLEDGED: The Concrete team acknowledged this finding.

7.20 Centralization risk: Lack of Access Control in requestFunds

//

Description

The requestFunds function is marked with onlyProtect, but there's no mechanism to change or update the protectStrategy address once it is set. This could be a problem if the protectStrategy needs to be updated or changed due to unforeseen issues or upgrades.

function requestFunds(uint256 amount) external onlyProtect {

//tries toi send from balance

uint256 availableAssets = IERC20(asset()).balanceOf(address(this));

uint256 acumulated = availableAssets;

if (availableAssets < amount) {

acumulated = availableAssets;

uint256 len = strategies.length;

for (uint256 i; i < len; i++) {

IStrategy currentStrategy = strategies[i].strategy;

if (address(strategies[i].strategy) == protectStrategy) {

continue;

}

uint256 pending = amount - acumulated;

//calculate the max we can get from the strategy

uint256 avaliableInStrat = currentStrategy.getAvailableAssetsForWithdrawal();

if (avaliableInStrat == 0) {

continue;

}

uint256 toWithdraw = pending;

if (avaliableInStrat < pending) {

toWithdraw = avaliableInStrat;

}

acumulated += toWithdraw;

//We control both the length of the array and the external call

//-next-line unused-return,calls-loop

currentStrategy.withdraw(toWithdraw, address(this), address(this));

if (acumulated >= amount) {

break;

}

}

}

//after requesting funds deposits them into the protect strategy

if (acumulated < amount) {

revert InsufficientFunds(IStrategy(address(this)), amount, acumulated);

}

//-next-line unused-return

IStrategy(protectStrategy).deposit(amount, address(this));

emit RequestedFunds(protectStrategy, amount);

}BVSS

Recommendation

Consider addressing the limitation of not being able to update the protectStrategy address, it is recommended to introduce a function that allows for the modification of the protectStrategy address. This function should be restricted to a privileged role, such as the contract owner or an admin, to ensure security and prevent unauthorized changes.

Remediation

ACKNOWLEDGED: The Concrete team acknowledged this finding.

7.21 Missing zero address checks on constructor

//

Description

It has been observed missing zero address checks on the Radiant and Silo constructors:

constructor(

IERC20 baseAsset_,

address feeRecipient_,

address owner_,

uint256 rewardFee_,

address siloAsset_,

address siloRepository_,

address siloIncentivesController_,

address[] memory extraRewardAssets,

uint256[] memory extraRewardFees,

address vault_

) {

IERC20Metadata metaERC20 = IERC20Metadata(address(baseAsset_));

siloRepository = ISiloRepository(siloRepository_);

silo = ISilo(siloRepository.getSilo(siloAsset_));

if (address(silo) == address(0)) revert InvalidAssetAddress();

// validate the bridge asset

if (siloAsset_ != address(baseAsset_)) {

address[] memory siloAssets_ = silo.getAssets();

uint256 length = siloAssets_.length;

uint256 i;

while (i < length) {

if (siloAssets_[i] == address(baseAsset_)) {

break;

}

unchecked {

i++;

}

}

if (i == length) revert AssetDivergence();

}

siloIncentivesController = ISiloIncentivesController(siloIncentivesController_);

ISilo.AssetStorage memory assetStorage = silo.assetStorage(address(baseAsset_));

collateralToken = IERC20(assetStorage.collateralToken);

// prepare rewardTokens array

uint256 rewardsLength = extraRewardAssets.length;

RewardToken[] memory rewardTokenArray = new RewardToken[](rewardsLength + 1);

// assign the silo reward token first and then process the extra reward tokens

address[] memory rewards = getRewardTokenAddresses();

rewardTokenArray[0] = RewardToken(IERC20(rewards[0]), rewardFee_, 0);

for (uint256 i = 0; i < rewardsLength;) {

rewardTokenArray[i+1] = RewardToken(IERC20(extraRewardAssets[i]), extraRewardFees[i], 0);

unchecked {

i++;

}

}

if (address(collateralToken) == address(0)) revert InvalidAssetAddress();

__StrategyBase_init(

baseAsset_,

string.concat("Concrete Earn SiloV1 ", metaERC20.symbol(), " Strategy"),

string.concat("ctSlV1-", metaERC20.symbol()),

feeRecipient_,

type(uint256).max,

owner_,

rewardTokenArray,

vault_

);

//slither-disable-next-line unused-return

baseAsset_.approve(address(silo), type(uint256).max);

}constructor(

IERC20 baseAsset_,

address feeRecipient_,

address owner_,

uint256 rewardFee_,

address addressesProvider_,

address vault_

) {

IERC20Metadata metaERC20 = IERC20Metadata(address(baseAsset_));

addressesProvider = ILendingPoolAddressesProvider(addressesProvider_);

lendingPool = ILendingPool(addressesProvider.getLendingPool());

DataTypes.ReserveData memory reserveData = lendingPool.getReserveData(address(baseAsset_));

rToken = IAToken(reserveData.aTokenAddress);

if (rToken.UNDERLYING_ASSET_ADDRESS() != address(baseAsset_)) {

revert AssetDivergence();

}

rewardsEnabled = false;

incentiveController = IChefIncentivesController(rToken.getIncentivesController());

__StrategyBase_init(

baseAsset_,

string.concat("Concrete Earn RadiantV2 ", metaERC20.symbol(), " Strategy"),

string.concat("ctRdV2-", metaERC20.symbol()),

feeRecipient_,

type(uint256).max,

owner_,

_getRewardTokens(rewardFee_),

vault_

);

//slither-disable-next-line unused-return

baseAsset_.approve(address(lendingPool), type(uint256).max);

}BVSS

Recommendation

Consider adding proper checks on the constructor.

Remediation

SOLVED: The Concrete team solved the issue by applying recommendations.

Remediation Hash

7.22 Unrestricted Reward Enabling

//

Description

The setEnableRewards function allows the owner to enable or disable rewards without any checks. If rewards are enabled when they should not be, this could lead to issues.

/**

* @dev by setting rewardsEnabled to true the strategy will be able to handle rdnt rewards.

* check the eligibility criteria before enabling rewards here:

* https://docs.radiant.capital/radiant/project-info/dlp/eligibility

*/

function setEnableRewards(bool _rewardsEnabled) external onlyOwner {

rewardsEnabled = _rewardsEnabled;

emit SetEnableRewards(msg.sender, _rewardsEnabled);

}BVSS

Recommendation

Consider as the owner verifies eligibility before enabling rewards. Adding a require statement might help to enforce checks:

function setEnableRewards(bool _rewardsEnabled) external onlyOwner {

// Add any necessary checks here

require(checkEligibilityCriteria(), "Not eligible for rewards");

rewardsEnabled = _rewardsEnabled;

emit SetEnableRewards(msg.sender, _rewardsEnabled);

}

function checkEligibilityCriteria() internal view returns (bool) {

// Implement the eligibility check logic

}Remediation

ACKNOWLEDGED: The Concrete team acknowledged the issue.

7.23 Centralization risk: retireStrategy

//

Description

Although retireStrategy is restricted to the owner, retiring a strategy is a critical function. Additional checks and safeguards should be considered to prevent misuse.

Centralization Risk Analysis

Owner Control:

Risk: The owner has significant control over the contract, including the ability to retire the strategy at any time. This centralization means that users of the strategy must trust the owner to act in their best interests.

Mitigation: Consider implementing a multi-signature wallet for the owner role to ensure that multiple parties must agree before critical functions like

retireStrategycan be executed.

Sudden Withdrawal:

Risk: The

retireStrategyfunction can withdraw all assets from the strategy, potentially without prior notice to the users. This could disrupt users' investment plans and cause a sudden loss of yield.Mitigation: Implement a time-lock mechanism that delays the execution of the

retireStrategyfunction, providing users with notice and an opportunity to withdraw their funds if they choose to.

BVSS

Recommendation

To address the centralization risks and enhance the security of the retireStrategy function, consider the following improvements:

Time-Lock Mechanism: Introduce a delay between the initiation and execution of the

retireStrategyfunction.

uint256 public retireStrategyTimestamp;

uint256 public constant TIMELOCK_DURATION = 2 days;

function initiateRetireStrategy() external onlyOwner {

retireStrategyTimestamp = block.timestamp + TIMELOCK_DURATION;

}

function executeRetireStrategy() external onlyOwner {

require(block.timestamp >= retireStrategyTimestamp, "Timelock not expired");

_getRewardsToStrategy();

_protocolWithdraw(rToken.balanceOf(address(this)), 0);

retireStrategyTimestamp = 0; // Reset the timestamp

}

2. Emergency Withdraw Mechanism: Allow users to withdraw their funds in case of emergency, without waiting for the owner to retire the strategy.

function emergencyWithdraw() external {

uint256 userBalance = balanceOf(msg.sender);

_protocolWithdraw(userBalance, 0);

_transfer(msg.sender, userBalance);

}3. Notification System: Implement a notification system to alert users when the retireStrategy function is initiated.

Remediation

ACKNOWLEDGED: The Concrete team acknowledged the issue.

7.24 No Events for claim function

//

Description

The claim function in _getRewardsToStrategy uses a try-catch block, which is a good practice. However, consider logging the error for better traceability.

function _getRewardsToStrategy() internal override {

if (!rewardsEnabled) return;

if (address(incentiveController) == address(0)) return;

address[] memory _assets = new address[](1);

_assets[0] = address(rToken);

//slither-disable-next-line unused-return

try incentiveController.claim(address(this), _assets) {} catch {}

}BVSS

Recommendation

Consider logging the error for better traceability.

try incentiveController.claim(address(this), _assets) {} catch (bytes memory reason) {

emit ClaimFailed(reason);

}

event ClaimFailed(bytes reason);Remediation

ACKNOWLEDGED: The Concrete team acknowledged the issue.

Halborn strongly recommends conducting a follow-up assessment of the project either within six months or immediately following any material changes to the codebase, whichever comes first. This approach is crucial for maintaining the project’s integrity and addressing potential vulnerabilities introduced by code modifications.

Table of Contents

- 1. Introduction

- 2. Assessment summary

- 3. Test approach and methodology

- 4. Risk methodology

- 5. Scope

- 6. Assessment summary & findings overview

- 7. Findings & Tech Details

- 7.1 Logic issue on vault removal

- 7.2 Potential denial of service on prepare withdrawal function

- 7.3 Unchecked return values of erc20 functions

- 7.4 Denial of service on _getstrategy function

- 7.5 Claimrouter contract is using a mock interface

- 7.6 Single step ownership transfer process

- 7.7 Owner can renounce ownership

- 7.8 A single compromised account can lock up the protocol

- 7.9 Potential denial of service on removevault with block gas limit

- 7.10 Checked increments in for loops increases gas consumption

- 7.11 Incomplete error handling in retirestrategy

- 7.12 Missing checks for index out of bounds

- 7.13 Use external instead of public methods

- 7.14 Push0 is not supported by all chains

- 7.15 Missing zero address checks

- 7.16 Checked increments in for loops increases gas consumption

- 7.17 Lack of validation on protectstrategy

- 7.18 Duplicated imports

- 7.19 Events for function calls

- 7.20 Centralization risk: lack of access control in requestfunds

- 7.21 Missing zero address checks on constructor

- 7.22 Unrestricted reward enabling

- 7.23 Centralization risk: retirestrategy

- 7.24 No events for claim function

// Download the full report

* Use Google Chrome for best results

** Check "Background Graphics" in the print settings if needed