Prepared by:

HALBORN

Last Updated 01/30/2025

Date of Engagement: January 2nd, 2025 - January 24th, 2025

Summary

0% of all REPORTED Findings have been addressed

All findings

6

Critical

0

High

0

Medium

2

Low

3

Informational

1

Table of Contents

- 1. Introduction

- 2. Assessment summary

- 3. Test approach and methodology

- 4. Risk methodology

- 5. Scope

- 6. Assessment summary & findings overview

- 7. Findings & Tech Details

- 7.1 Decimal mismatch in reward calculations

- 7.2 Missing slippage checks in multiple locations

- 7.3 Potential reentrancy

- 7.4 Vaultv1 upgradeable contract is missing storage gap

- 7.5 Outdated solidity version

- 7.6 Minimal event emissions for key state changes

- 8. Automated Testing

1. Introduction

Harvest Finance engaged Halborn to conduct a security assessment on their smart contracts beginning on January 2nd, 2025 and ending on January 27th, 2025. The security assessment was scoped to the smart contracts provided in the private repository provided to Halborn. Further details can be found in the Scope section of this report.

2. Assessment Summary

Halborn was provided 16 days for the engagement, and assigned one full-time security engineer to review the security of the smart contracts in scope. The engineer is a blockchain and smart contract security expert with advanced penetration testing and smart contract hacking skills, and deep knowledge of multiple blockchain protocols.

The purpose of the assessment is to:

Identify potential security issues within the smart contracts.

Ensure that smart contract functionality operates as intended.

In summary, Halborn identified some improvements to reduce the likelihood and impact of risks, which should be addressed by the Harvest Finance team:

Use a single consistent precision factor (e.g., 1e18) for accumulating rewards across all tokens.Replace amountOutMin = 1 with a slippage-aware calculation.Implement a _claimRewards() function that retrieves external rewards from the lending protocol.Consider adding a nonReentrant modifier (from OpenZeppelin’s ReentrancyGuard) in all functions across the code-base performing external calls to potentially untrusted contracts.Add a storage gap in upgradeable contracts that are parent contracts.Upgrade the Solidity version to 0.8.x.

3. Test Approach and Methodology

Halborn performed a combination of manual and automated security testing to balance efficiency, timeliness, practicality, and accuracy in regard to the scope of this assessment. While manual testing is recommended to uncover flaws in logic, process, and implementation; automated testing techniques help enhance coverage of the code and can quickly identify items that do not follow the security best practices. The following phases and associated tools were used during the assessment:

Research into architecture and purpose.

Smart contract manual code review and walkthrough.

Graphing out functionality and contract logic/connectivity/functions (

solgraph).Manual assessment of use and safety for the critical Solidity variables and functions in scope to identify any arithmetic related vulnerability classes.

Manual testing by custom scripts.

Static Analysis of security for scoped contract, and imported functions (

slither).Testnet deployment (

Foundry).

4. RISK METHODOLOGY

4.1 EXPLOITABILITY

Attack Origin (AO):

Attack Cost (AC):

Attack Complexity (AX):

Metrics:

| EXPLOITABILITY METRIC () | METRIC VALUE | NUMERICAL VALUE |

|---|---|---|

| Attack Origin (AO) | Arbitrary (AO:A) Specific (AO:S) | 1 0.2 |

| Attack Cost (AC) | Low (AC:L) Medium (AC:M) High (AC:H) | 1 0.67 0.33 |

| Attack Complexity (AX) | Low (AX:L) Medium (AX:M) High (AX:H) | 1 0.67 0.33 |

4.2 IMPACT

Confidentiality (C):

Integrity (I):

Availability (A):

Deposit (D):

Yield (Y):

Metrics:

| IMPACT METRIC () | METRIC VALUE | NUMERICAL VALUE |

|---|---|---|

| Confidentiality (C) | None (I:N) Low (I:L) Medium (I:M) High (I:H) Critical (I:C) | 0 0.25 0.5 0.75 1 |

| Integrity (I) | None (I:N) Low (I:L) Medium (I:M) High (I:H) Critical (I:C) | 0 0.25 0.5 0.75 1 |

| Availability (A) | None (A:N) Low (A:L) Medium (A:M) High (A:H) Critical (A:C) | 0 0.25 0.5 0.75 1 |

| Deposit (D) | None (D:N) Low (D:L) Medium (D:M) High (D:H) Critical (D:C) | 0 0.25 0.5 0.75 1 |

| Yield (Y) | None (Y:N) Low (Y:L) Medium (Y:M) High (Y:H) Critical (Y:C) | 0 0.25 0.5 0.75 1 |

4.3 SEVERITY COEFFICIENT

Reversibility (R):

Scope (S):

Metrics:

| SEVERITY COEFFICIENT () | COEFFICIENT VALUE | NUMERICAL VALUE |

|---|---|---|

| Reversibility () | None (R:N) Partial (R:P) Full (R:F) | 1 0.5 0.25 |

| Scope () | Changed (S:C) Unchanged (S:U) | 1.25 1 |

| Severity | Score Value Range |

|---|---|

| Critical | 9 - 10 |

| High | 7 - 8.9 |

| Medium | 4.5 - 6.9 |

| Low | 2 - 4.4 |

| Informational | 0 - 1.9 |

5. SCOPE

- base/interface/IDex.sol

- base/interface/IUpgradableStrategy.sol

- base/interface/IVault.sol

6. Assessment Summary & Findings Overview

Critical

0

High

0

Medium

2

Low

3

Informational

1

| Security analysis | Risk level | Remediation Date |

|---|---|---|

| HAL-01 - Decimal mismatch in reward calculations | Medium | - |

| HAL-02 - Missing slippage checks in multiple locations | Medium | - |

| HAL-03 - Potential reentrancy | Low | - |

| HAL-04 - VaultV1 upgradeable contract is missing storage gap | Low | - |

| HAL-05 - Outdated Solidity version | Low | - |

| HAL-06 - Minimal event emissions for key state changes | Informational | - |

7. Findings & Tech Details

7.1 (HAL-01) Decimal mismatch in reward calculations

//

Description

When computing rewards, the PotPool contract uses the pool’s LP token decimals (set via _setupDecimals) in rewardPerToken(...) and then divides by 10^(rewardToken.decimals()) in the earned(...) function. In other words:

rewardPerToken(rt)multiplies by10^(poolDecimals)earned(rt, account)divides by10^(rewardToken.decimals())

- contracts/base/PotPool.sol

function rewardPerToken(address rt) public view returns (uint256) {

if (totalSupply() == 0) {

return rewardPerTokenStoredForToken[rt];

}

return

rewardPerTokenStoredForToken[rt].add(

lastTimeRewardApplicable(rt)

.sub(lastUpdateTimeForToken[rt])

.mul(rewardRateForToken[rt])

.mul(10**uint256(decimals()))

.div(totalSupply())

);

} function earned(address rt, address account) public view returns (uint256) {

return

stakedBalanceOf[account]

.mul(rewardPerToken(rt).sub(userRewardPerTokenPaidForToken[rt][account]))

.div(10**uint256(ERC20(rt).decimals()))

.add(rewardsForToken[rt][account]);

}If the reward token’s decimals differ from the LP token’s decimals, the final reward amounts could be scaled incorrectly or lead to unexpected rounding.

BVSS

Recommendation

It is recommended to:

Use a single consistent precision factor (e.g.,

1e18) for accumulating rewards across all tokens.Alternatively, ensure that the reward token’s decimals always match the LP token’s decimals if that is the intended design.

Clearly document any difference between the pool’s decimal usage and the reward token’s decimal usage so that integrators are aware of potential rounding effects.

7.2 (HAL-02) Missing slippage checks in multiple locations

//

Description

In multiple strategies, when converting reward tokens back to the underlying asset, the code commonly passes a minimum output of 1:

IUniversalLiquidator(...).swap(rewardToken, underlying, balance, 1, address(this));This does not protect against front-running or sandwich attacks. If a large slippage event occurs, the strategy might receive far fewer tokens than expected, negatively impacting user yields.

In the RewardForwarder contract, when calling IUniversalLiquidator(liquidator).swap(...), the code sets amountOutMin = 1. This effectively means “accept any non-zero swap output,” which can lead to highly unfavorable slippage if the market shifts or if the liquidator is front-run. Attackers could exploit this to cause near-zero returns on token swaps:

function _notifyFee(

address _token,

uint256 _profitSharingFee,

uint256 _strategistFee,

uint256 _platformFee

) internal {

address _controller = controller();

address liquidator = IController(_controller).universalLiquidator();

uint totalTransferAmount = _profitSharingFee.add(_strategistFee).add(_platformFee);

require(totalTransferAmount > 0, "totalTransferAmount should not be 0");

IERC20(_token).safeTransferFrom(msg.sender, address(this), totalTransferAmount);

address _targetToken = IController(_controller).targetToken();

if (_token != _targetToken) {

IERC20(_token).safeApprove(liquidator, 0);

IERC20(_token).safeApprove(liquidator, _platformFee);

uint amountOutMin = 1;

if (_platformFee > 0) {

IUniversalLiquidator(liquidator).swap(

_token,

_targetToken,

_platformFee,

amountOutMin,

IController(_controller).protocolFeeReceiver()

);

}

} else {

IERC20(_targetToken).safeTransfer(IController(_controller).protocolFeeReceiver(), _platformFee);

}

if (_token != iFARM) {

IERC20(_token).safeApprove(liquidator, 0);

IERC20(_token).safeApprove(liquidator, _profitSharingFee.add(_strategistFee));

uint amountOutMin = 1;

if (_profitSharingFee > 0) {

IUniversalLiquidator(liquidator).swap(

_token,

iFARM,

_profitSharingFee,

amountOutMin,

IController(_controller).profitSharingReceiver()

);

}

if (_strategistFee > 0) {

IUniversalLiquidator(liquidator).swap(

_token,

iFARM,

_strategistFee,

amountOutMin,

IStrategy(msg.sender).strategist()

);

}

} else {

if (_strategistFee > 0) {

IERC20(iFARM).safeTransfer(IStrategy(msg.sender).strategist(), _strategistFee);

}

IERC20(iFARM).safeTransfer(IController(_controller).profitSharingReceiver(), _profitSharingFee);

}

}Within the _liquidateReward() function, the code calls the Universal Liquidator with minAmountOut set to 1:

IUniversalLiquidator(_universalLiquidator).swap(

_rewardToken,

_underlying,

remainingRewardBalance,

1,

address(this)

);A minAmountOut of 1 leaves no meaningful protection against large price slippage or sandwich attacks. In a hostile environment, a manipulated or malicious swap could cause the strategy to receive far fewer underlying tokens than expected, resulting in lost yield for strategy users.

Seen In:

CompoundStrategy (in

_liquidateReward())AerodromeStableStrategy / AerodromeVolatileStrategy (in

_liquidateReward())ExtraFiLendStrategy (in

_liquidateRewards())FluidLendStrategy (in

_liquidateRewards())MoonwellFoldStrategyV2 (in

_liquidateRewards())

BVSS

Recommendation

To solve issues related to missing slippage checks, it is recommended to:

Replace

amountOutMin = 1with a slippage-aware calculation. For example, pass in a minimum expected output from off-chain price checks or keep track of a tolerance limit.If dynamic slippage is not practical, at least allow the caller (strategy or governance) to specify a suitable

amountOutMinto protect against front-running or illiquid markets.

7.3 (HAL-03) Potential reentrancy

//

Description

In the PotPool contract, pushAllRewards(address recipient) calls updateRewards(recipient) and transfers rewards to recipient. Unlike getAllRewards or withdraw, pushAllRewards does not have the nonReentrant or defense modifiers. Although it is restricted to governance only, if recipient is a malicious contract, it could potentially re-enter via token callbacks (depending on the token used):

function pushAllRewards(address recipient) external updateRewards(recipient) onlyGovernance {

bool rewardPayout = (!smartContractStakers[recipient] || !IController(controller()).greyList(recipient));

for(uint256 i = 0 ; i < rewardTokens.length; i++ ){

uint256 reward = earned(rewardTokens[i], recipient);

if (reward > 0) {

rewardsForToken[rewardTokens[i]][recipient] = 0;

if (rewardPayout) {

IERC20(rewardTokens[i]).safeTransfer(recipient, reward);

emit RewardPaid(recipient, rewardTokens[i], reward);

} else {

emit RewardDenied(recipient, rewardTokens[i], reward);

}

}

}Moving forward, most strategies do not implement a nonReentrant guard. Although many DeFi protocols do not expose arbitrary callbacks, if a reward token or external lending/pool contract allowed reentrant calls, the strategy’s state-changing logic could be re-invoked unexpectedly.

Seen in:

CompoundStrategy (internal calls to

IComet, nononReentrant)Aerodrome*Strategy (calls

IGauge,IPool, nononReentrant)ExtraFiLendStrategy, FluidLendStrategy (calls external vaults)

MoonwellFoldStrategyV2 (flash loan from Balancer

bVault, no standard reentrancy guard)

BVSS

Recommendation

In order to solve this issue, it is recommended to:

If

liquidatoris trusted and never calls back intoRewardForwarder, re-entrancy is likely not an issue. However, if future changes might allow untrusted or user-supplied liquidators, consider adding anonReentrantmodifier (from OpenZeppelin’sReentrancyGuard) in all functions across the code-base performing external calls to potentially untrusted contracts.Keep documentation indicating that only a trusted liquidator is intended.

If external protocols are trusted and have no callbacks, the risk is low. Otherwise, consider adding ReentrancyGuard to state-changing functions.

Keep track of potential tokens or new protocol features that could introduce callback functions in the future.

7.4 (HAL-04) VaultV1 upgradeable contract is missing storage gap

//

Description

The VaultV1 contract, which inherits or acts as an upgradeable parent contract, does not reserve a storage gap at the end of its contract variables. In the context of upgradeable contracts, a storage gap is critical to preventing storage layout conflicts when future state variables are added in subsequent contract versions. Without a storage gap, any future modifications to the contract’s storage layout could overwrite existing state variables, leading to unpredictable behavior or loss of state.

BVSS

Recommendation

In order to resolve this issue, it is recommended to:

Add a reserved storage gap array (e.g.,

uint256[50] private __gap;) at the end of the contract to preserve the current storage layout.Ensure all future variables are added above this gap array, maintaining the existing layout for previously deployed contract instances.

7.5 (HAL-05) Outdated Solidity version

//

Description

Several contracts utilize the older Solidity 0.6.x compiler version, which lacks the newest language features, improvements in error handling, and security enhancements introduced in later releases. Continuing to use a legacy compiler version may expose these contracts to known bugs and limit compatibility with modern tooling and best practices.

BVSS

Recommendation

To solve this issue, it is recommended to:

Migrate the codebase to a more recent Solidity version (e.g., 0.8.x), after confirming no breaking changes in dependencies.

Leverage updated compiler checks, safe math built-ins (

uncheckedblocks in Solidity 0.8+), and other improvements to enhance the contracts’ reliability and maintainability.

7.6 (HAL-06) Minimal event emissions for key state changes

//

Description

Several strategies do not emit events when critical parameters change (e.g., changing gauges, adding reward tokens, toggling folding, or pausing investments). This hinders off-chain analytics and transparency.

Seen In:

CompoundStrategy (no events for certain changes like

market()updates)AerodromeStable/VolatileStrategy (no events for

setGauge,addRewardToken, etc.)ExtraFiLendStrategy (no events for adjusting fees or

marketupdates)FluidLendStrategy (no events for

addRewardToken, emergency exit, etc.)MoonwellFoldStrategyV2 (no events on factor updates, toggling folding)

BVSS

Recommendation

To solve this issue, it is recommended to:

Emit events (e.g.,

GaugeChanged,RewardTokenAdded,FoldingToggled, etc.) with relevant parameters (old/new values).Include

indexedparameters to facilitate off-chain querying.

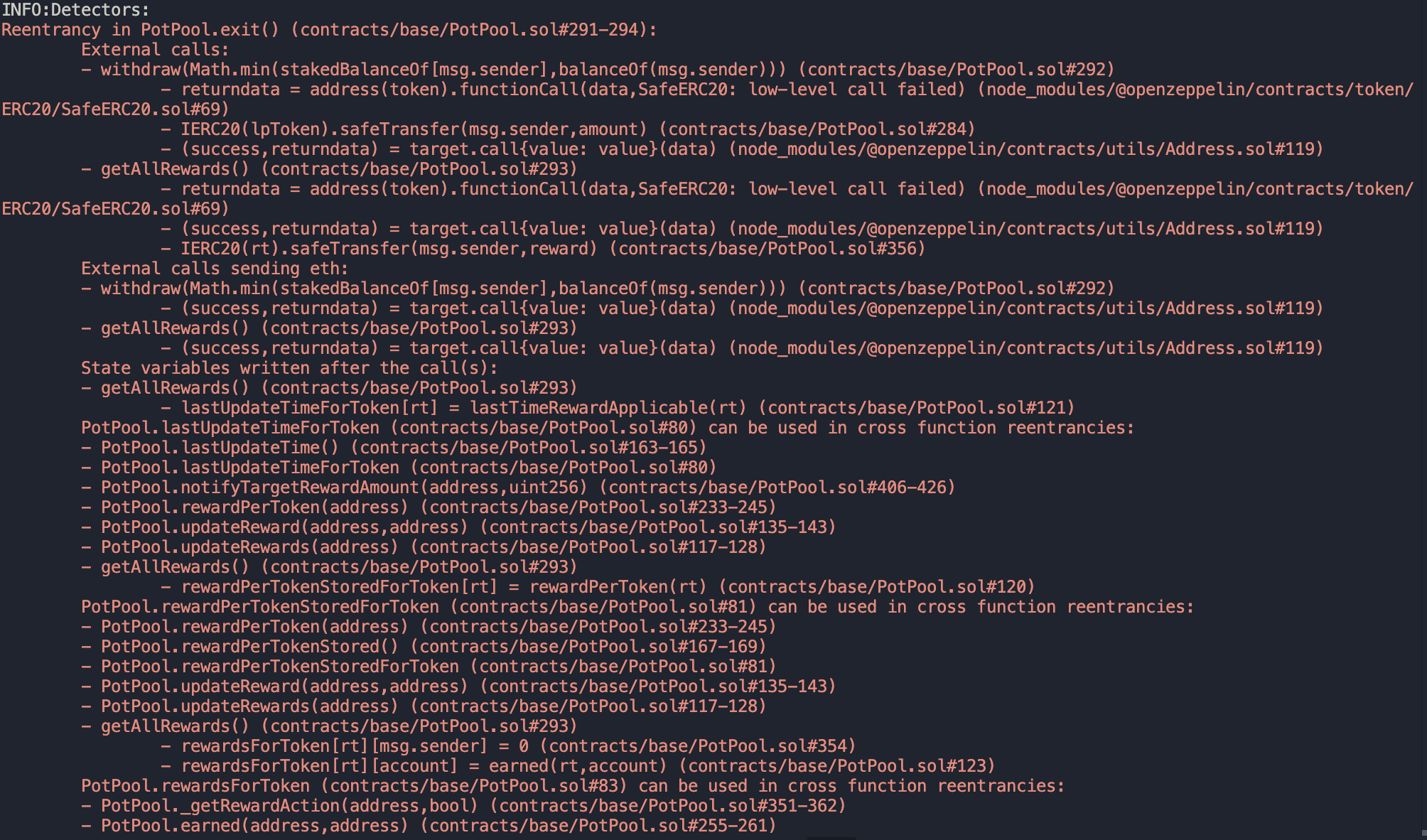

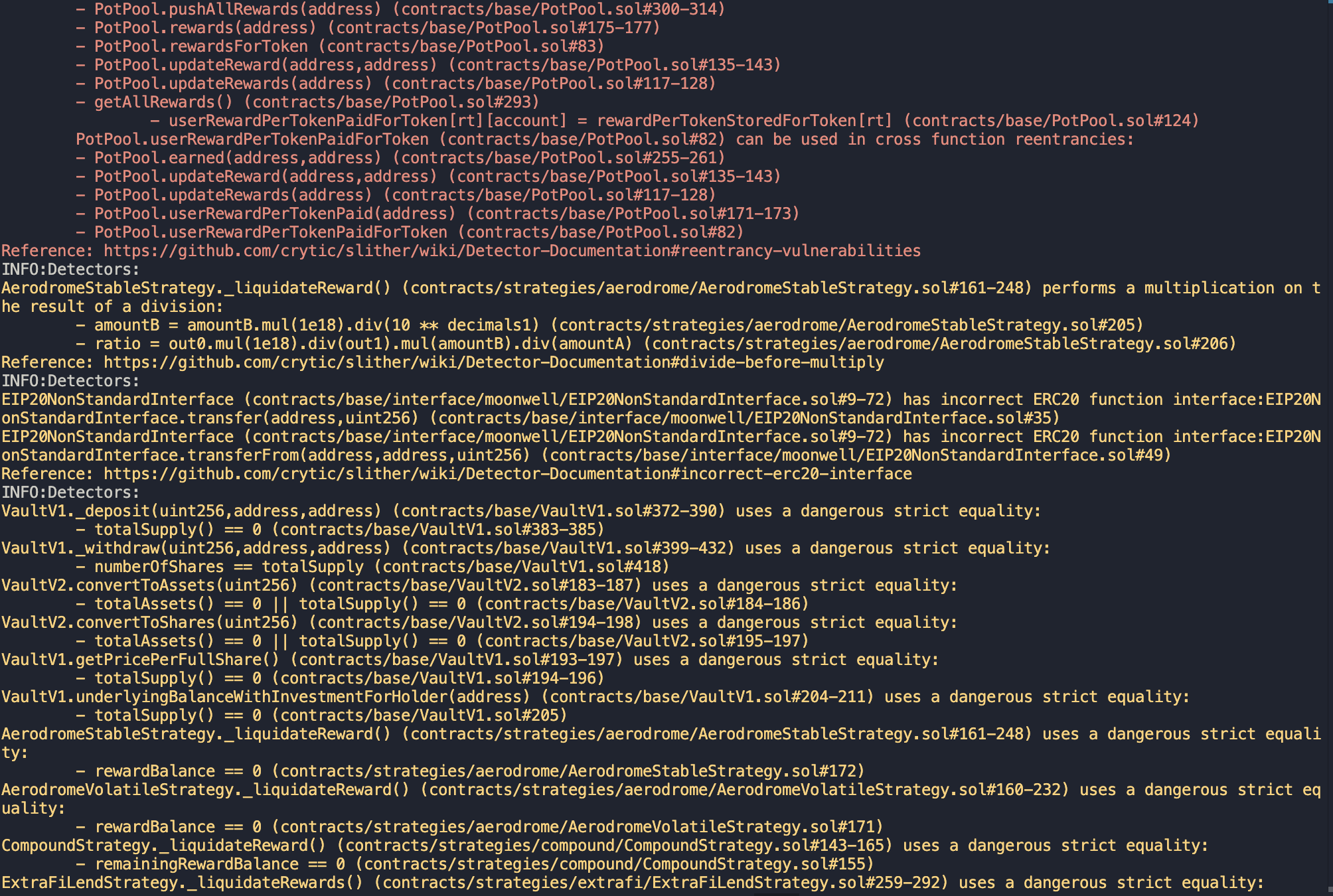

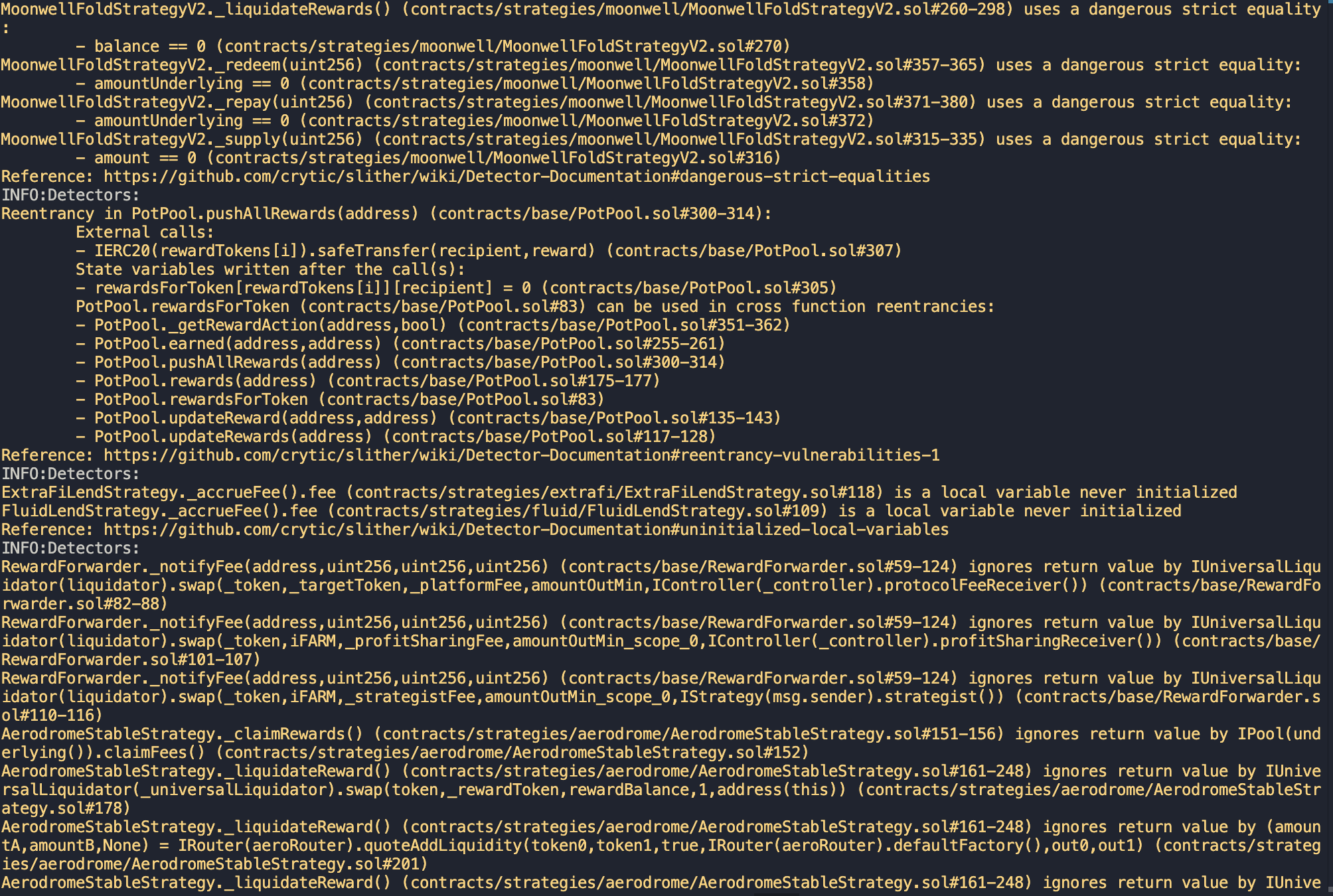

8. Automated Testing

Introduction

Halborn used automated testing techniques to enhance the coverage of certain areas of the smart contracts in scope. Among the tools used was Slither, a Solidity static analysis framework. After Halborn verified the smart contracts in the repository and was able to compile them correctly into their ABIs and binary format, Slither was run against the contracts. This tool can statically verify mathematical relationships between Solidity variables to detect invalid or inconsistent usage of the contracts' APIs across the entire code-base.

The security team conducted a comprehensive review of all findings generated by the Slither static analysis tool.

After careful examination and consideration of the flagged issues, it was determined that within the project's specific context and scope, all were false positives or irrelevant.

Halborn strongly recommends conducting a follow-up assessment of the project either within six months or immediately following any material changes to the codebase, whichever comes first. This approach is crucial for maintaining the project’s integrity and addressing potential vulnerabilities introduced by code modifications.

Table of Contents

- 1. Introduction

- 2. Assessment summary

- 3. Test approach and methodology

- 4. Risk methodology

- 5. Scope

- 6. Assessment summary & findings overview

- 7. Findings & Tech Details

- 7.1 Decimal mismatch in reward calculations

- 7.2 Missing slippage checks in multiple locations

- 7.3 Potential reentrancy

- 7.4 Vaultv1 upgradeable contract is missing storage gap

- 7.5 Outdated solidity version

- 7.6 Minimal event emissions for key state changes

- 8. Automated Testing

// Download the full report

* Use Google Chrome for best results

** Check "Background Graphics" in the print settings if needed