Prepared by:

HALBORN

Last Updated 04/26/2024

Date of Engagement by: January 20th, 2022 - February 14th, 2022

Summary

96% of all REPORTED Findings have been addressed

All findings

23

Critical

0

High

0

Medium

4

Low

10

Informational

9

Table of Contents

- 1. Introduction

- 2. Audit summary

- 3. Test approach & methodology

- 4. Scope

- 5. Risk methodology

- 6. Scope

- 7. Assessment summary & findings overview

- 8. Findings & Tech Details

- 8.1 Use latestrounddata instead of latestanswer to run more validations

- 8.2 Unchecked transfer

- 8.3 Improper access control policy

- 8.4 Missing re-entrancy protection

- 8.5 Authorize account can set invalid base and max rewards

- 8.6 Authorize account can increase max reward delay to max int value

- 8.7 The contract function should approve(0) first

- 8.8 Erc20 approve method missing return value check

- 8.9 Missing safe engine address validation

- 8.10 Missing factory address validation

- 8.11 External function calls within loop

- 8.12 Ignore return values

- 8.13 Missing zero-address check

- 8.14 Use of deprecated now function

- 8.15 Authorize can remove himself and all other authorize account

- 8.16 Auction can be extended indefinitely

- 8.17 Seller can monopolize the auction bid price

- 8.18 Possible misuse of public functions

- 8.19 Using ++i consumes less gas than i++ in loops

- 8.20 Cache array length in for loops can save gas

- 8.21 Upgrade at least pragma 0.8.4

- 8.22 Constant with exponentiation can be improved

- 8.23 Missing success check on low level calls

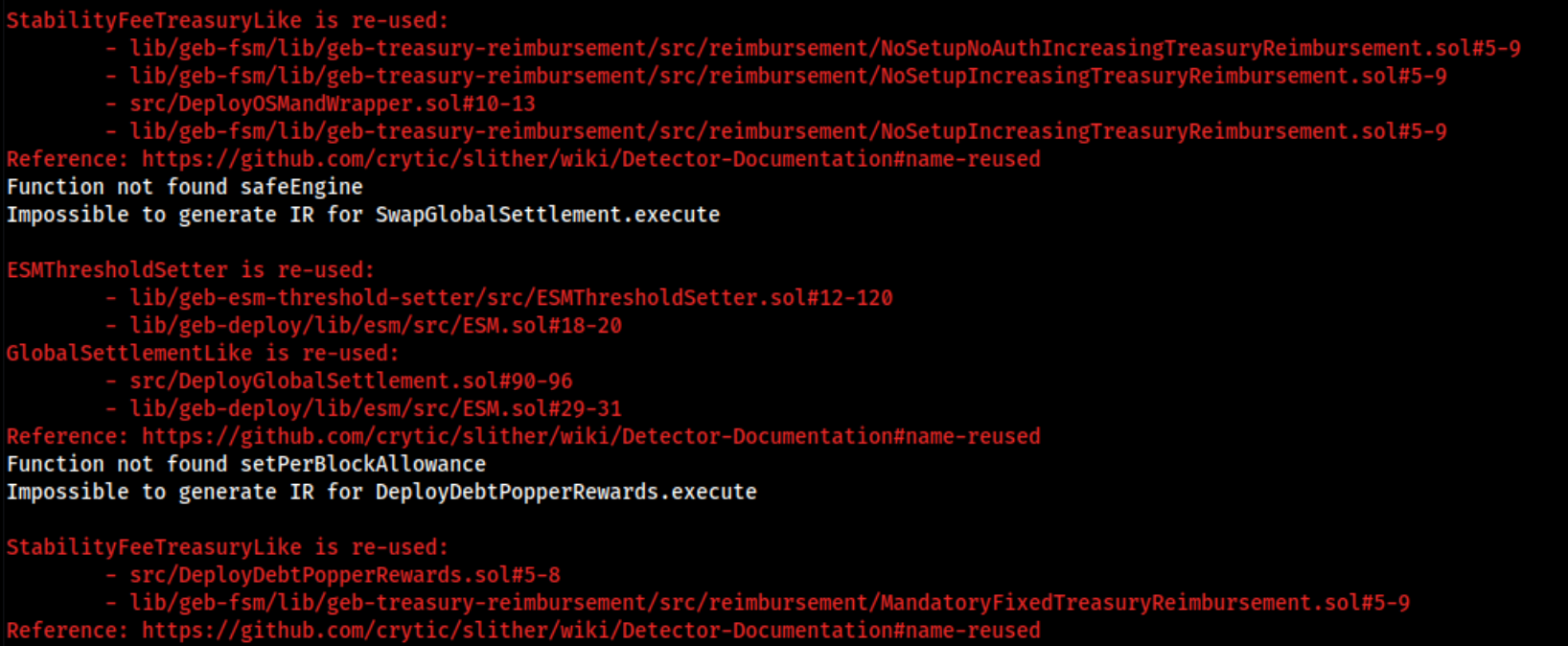

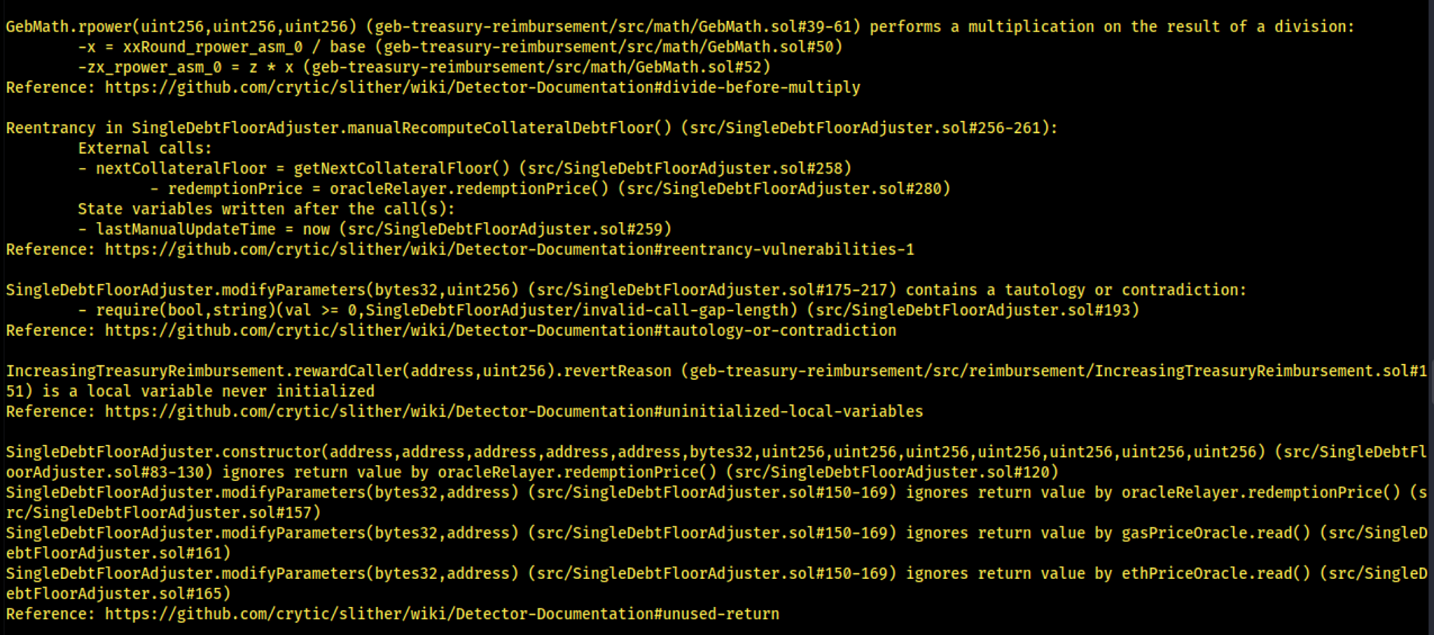

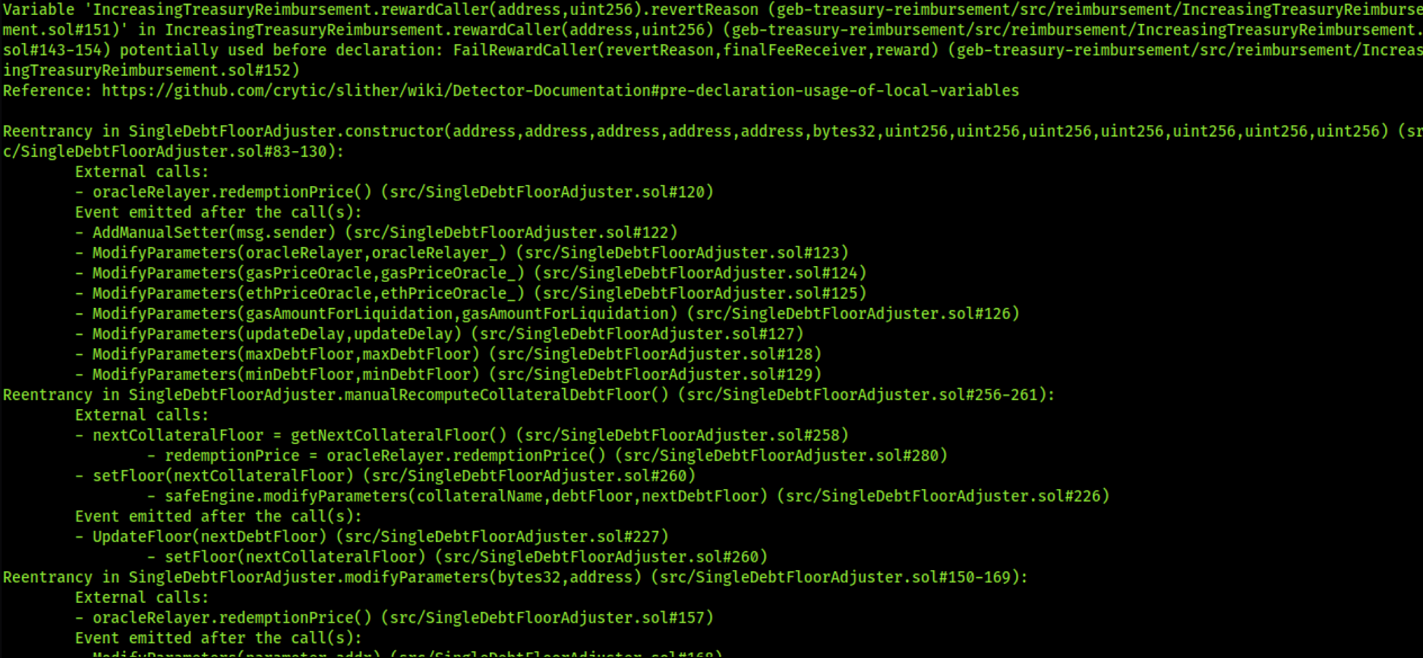

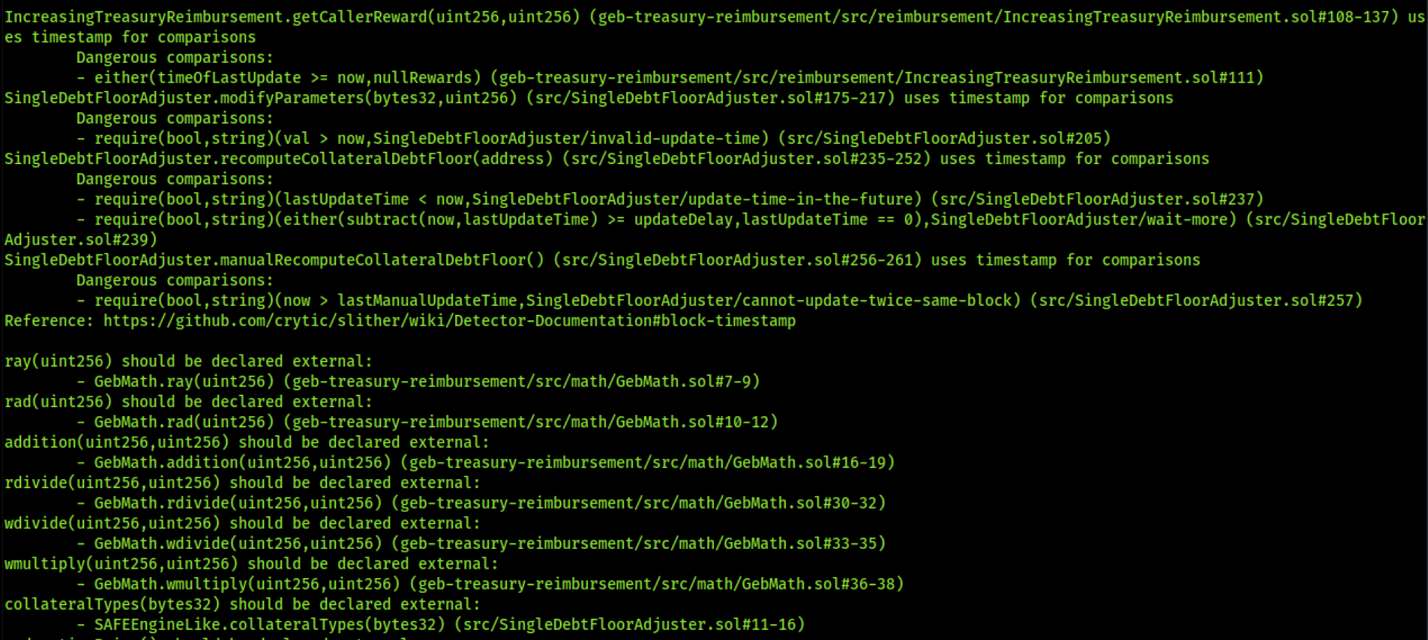

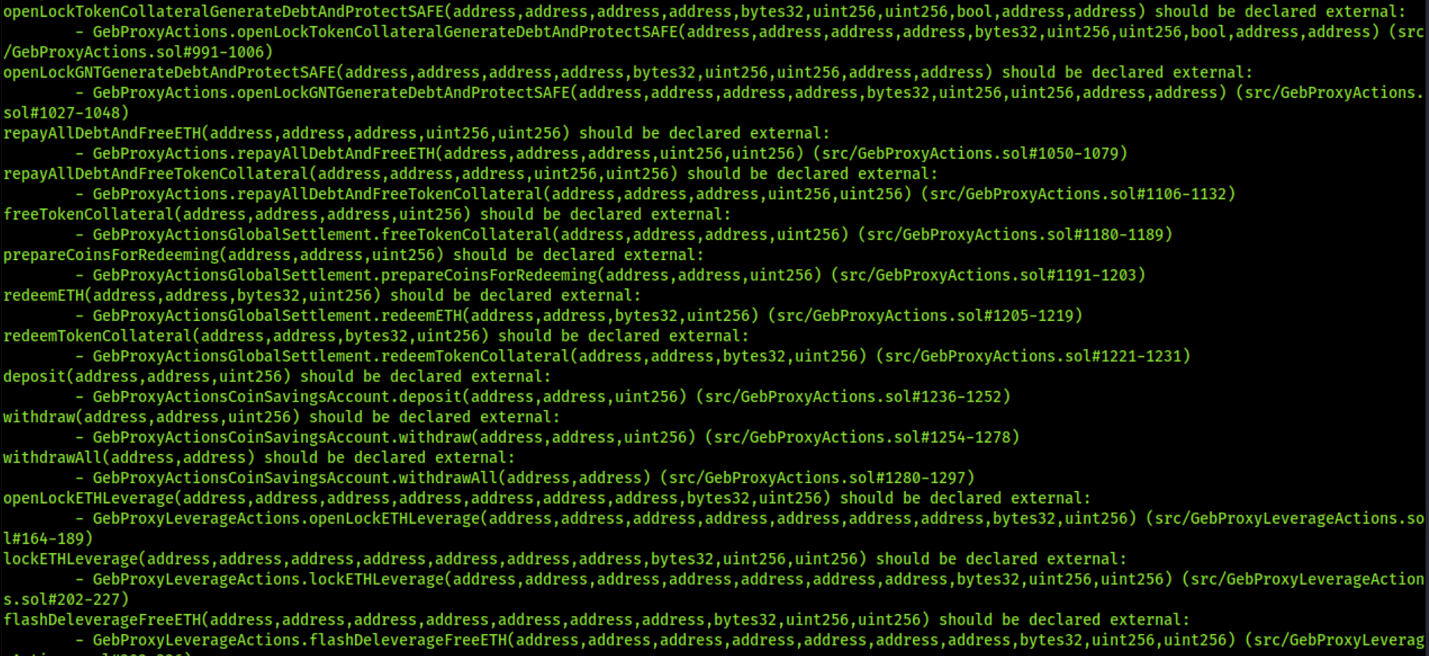

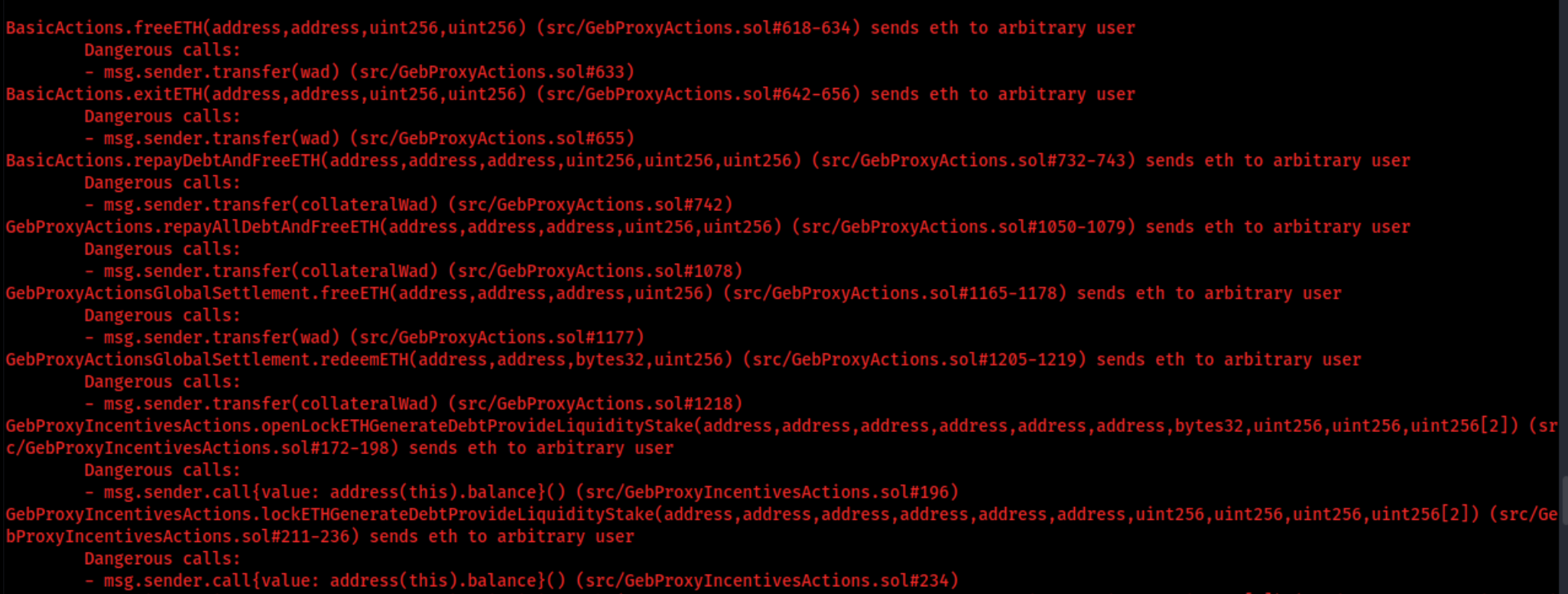

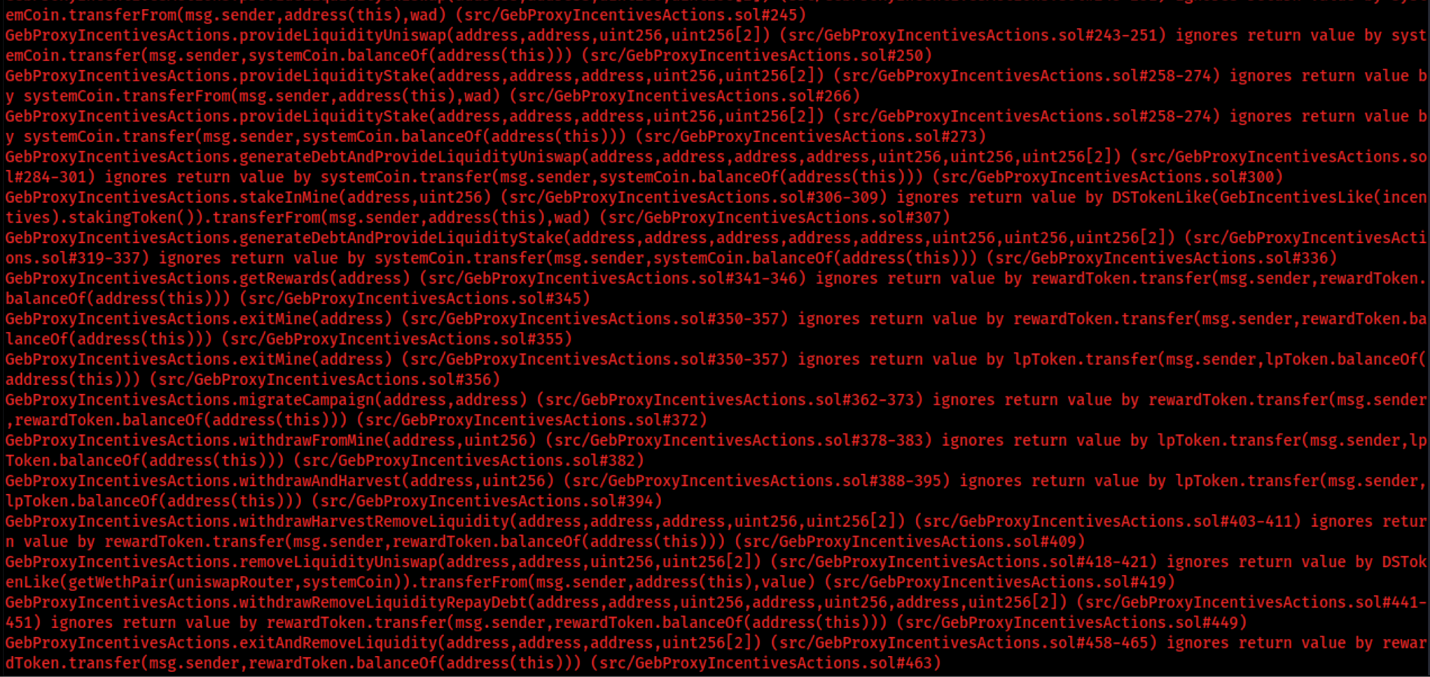

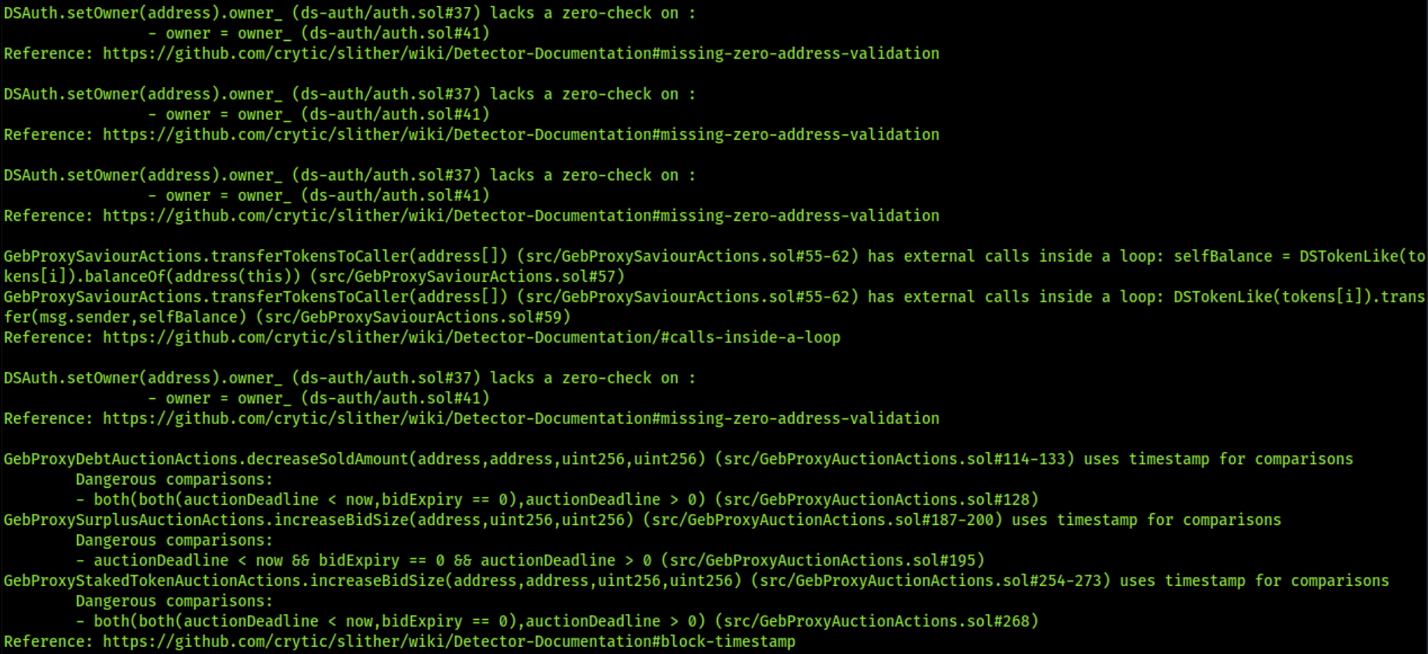

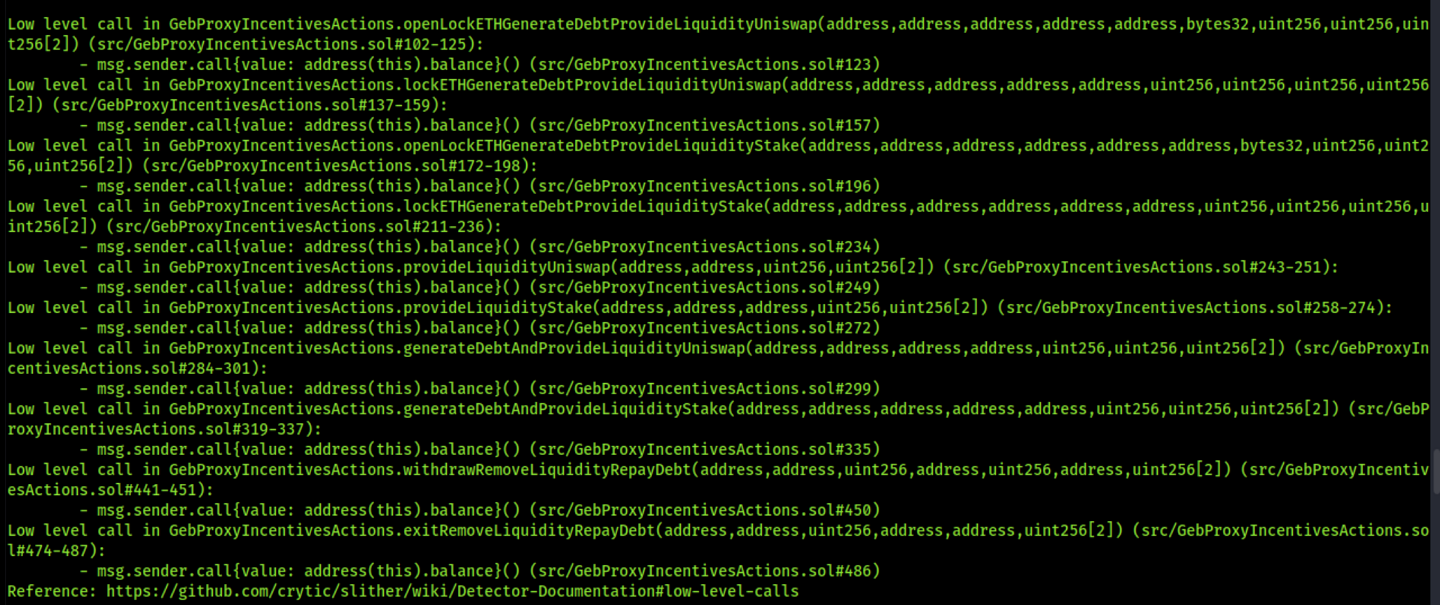

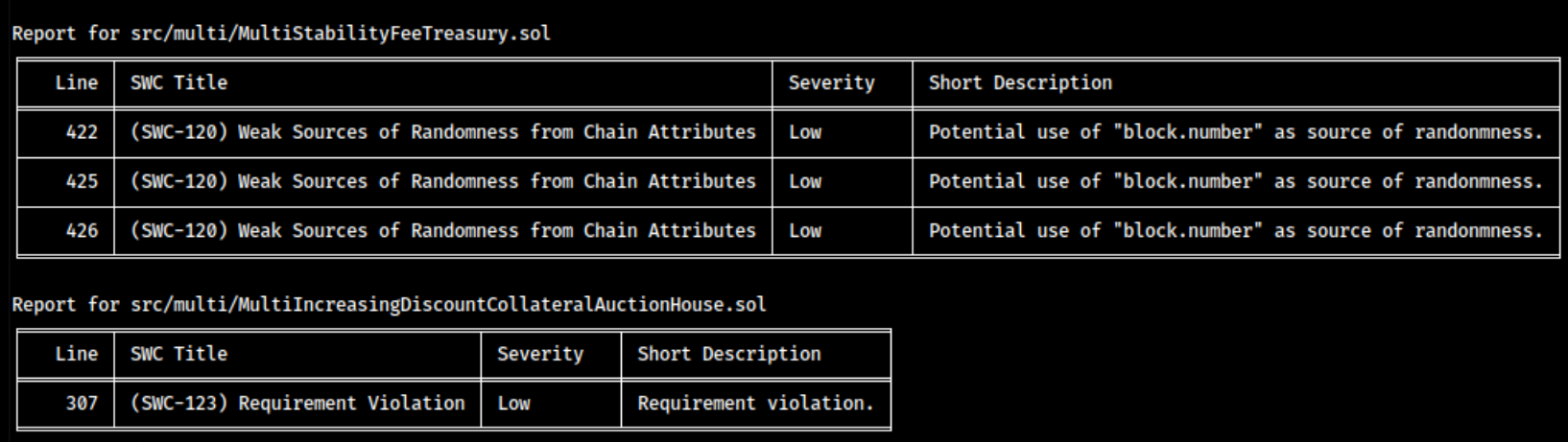

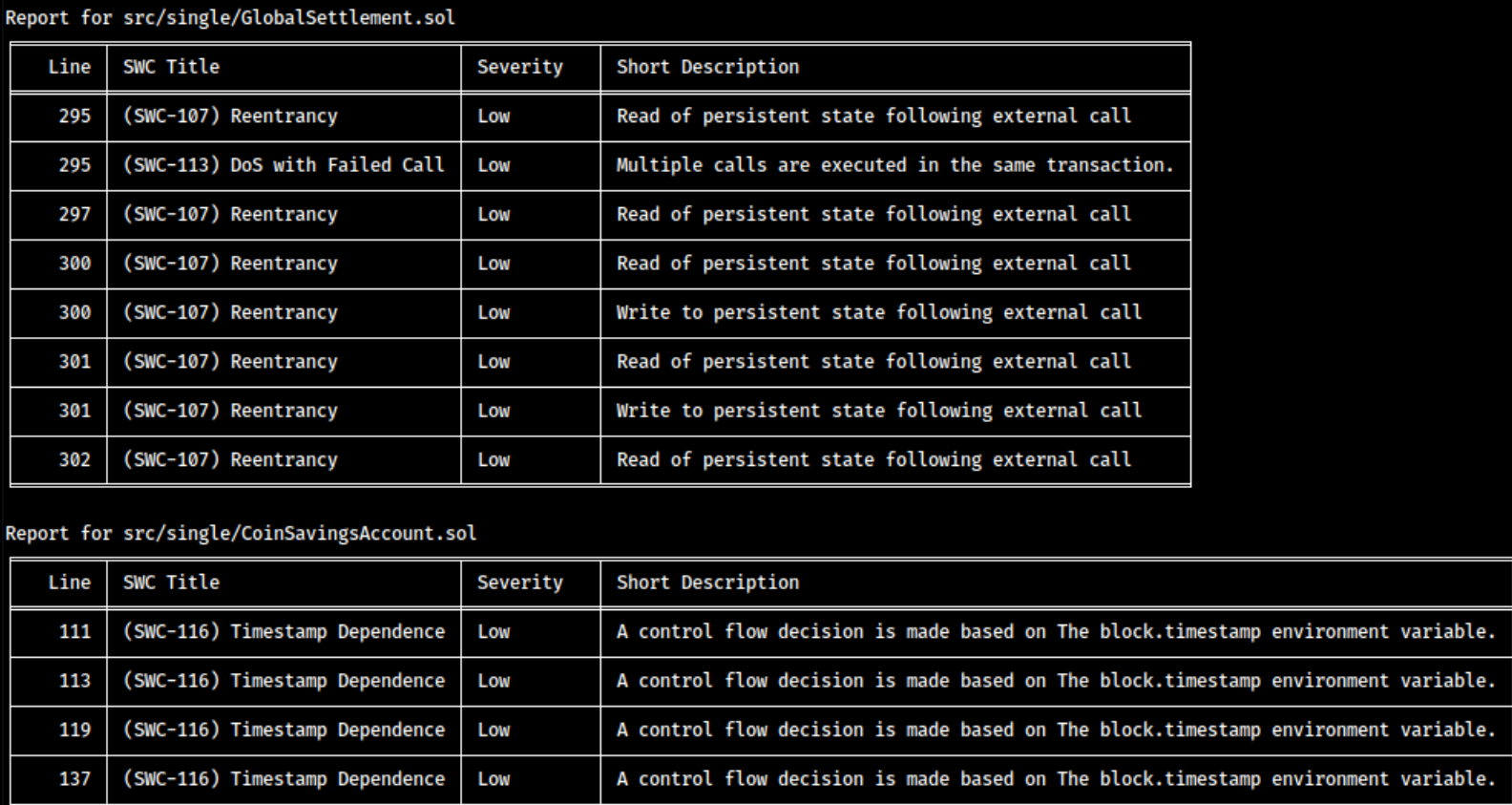

- 9. Automated Testing

1. INTRODUCTION

Ocean Protocol engaged Halborn to conduct a security audit on their smart contracts beginning on 2022-01-20 and ending on 2022-02-14. The security assessment was scoped to the smart contracts provided to the Halborn team.

2. AUDIT SUMMARY

The team at Halborn was provided four weeks for the engagement and assigned a full-time security engineer to audit the security of the smart contract. The security engineer is a blockchain and smart-contract security expert with advanced penetration testing, smart-contract hacking, and deep knowledge of multiple blockchain protocols.

The purpose of this audit is to:

Ensure that reflexer-lab and forked smart contract functions operate as intended

Identify potential security issues with the smart contracts

In summary, Halborn identified some security risks that were mostly addressed by the Ocean Protocol team.

3. TEST APPROACH & METHODOLOGY

Halborn performed a combination of manual and automated security testing to balance efficiency, timeliness, practicality, and accuracy in regard to the scope of this audit. While manual testing is recommended to uncover flaws in logic, process, and implementation; automated testing techniques help enhance coverage of the H2O contract solidity code and can quickly identify items that do not follow security best practices. The following phases and associated tools were used throughout the term of the audit:

Research into architecture and purpose.

Smart contract manual code review and walkthrough.

Graphing out functionality and contract logic/connectivity/functions (

solgraph)Manual assessment of use and safety for the critical Solidity variables and functions in scope to identify any arithmetic related vulnerability classes.

Manual testing by custom scripts.

Scanning of solidity files for vulnerabilities, security hotspots or bugs. (

MythX)Static Analysis of security for scoped contract, and imported functions. (

Slither)Testnet deployment (

Remix IDE)

4. SCOPE

IN-SCOPE : The security assessment was scoped to the following smart contract of reflexer-lab and stablecoin-research: Core base contracts

Core system contracts

Actions contracts

OUT-OF-SCOPE : External libraries, utils, test, mock and economics attacks

5. RISK METHODOLOGY

- 5 - Almost certain an incident will occur.

- 4 - High probability of an incident occurring.

- 3 - Potential of a security incident in the long term.

- 2 - Low probability of an incident occurring.

- 1 - Very unlikely issue will cause an incident.

- 5 - May cause devastating and unrecoverable impact or loss.

- 4 - May cause a significant level of impact or loss.

- 3 - May cause a partial impact or loss to many.

- 2 - May cause temporary impact or loss.

- 1 - May cause minimal or un-noticeable impact.

- 10 - CRITICAL

- 9 - 8 - HIGH

- 7 - 6 - MEDIUM

- 5 - 4 - LOW

- 3 - 1 - VERY LOW AND INFORMATIONAL

6. SCOPE

7. Assessment Summary & Findings Overview

Critical

0

High

0

Medium

4

Low

10

Informational

9

Impact x Likelihood

HAL-04

HAL-07

HAL-09

HAL-14

HAL-06

HAL-08

HAL-10

HAL-11

HAL-12

HAL-15

HAL-02

HAL-03

HAL-05

HAL-13

HAL-01

HAL-16

HAL-17

HAL-18

HAL-19

HAL-20

HAL-21

HAL-22

HAL-23

| Security analysis | Risk level | Remediation Date |

|---|---|---|

| USE LATESTROUNDDATA INSTEAD OF LATESTANSWER TO RUN MORE VALIDATIONS | Medium | Solved - 02/20/2022 |

| UNCHECKED TRANSFER | Medium | Risk Accepted |

| IMPROPER ACCESS CONTROL POLICY | Medium | Future Release |

| MISSING RE-ENTRANCY PROTECTION | Medium | Solved - 02/25/2022 |

| AUTHORIZE ACCOUNT CAN SET INVALID BASE AND MAX REWARDS | Low | Risk Accepted |

| AUTHORIZE ACCOUNT CAN INCREASE MAX REWARD DELAY TO MAX INT VALUE | Low | Risk Accepted |

| THE CONTRACT FUNCTION SHOULD APPROVE(0) FIRST | Low | Risk Accepted |

| ERC20 APPROVE METHOD MISSING RETURN VALUE CHECK | Low | Risk Accepted |

| MISSING SAFE ENGINE ADDRESS VALIDATION | Low | Solved - 02/20/2022 |

| MISSING FACTORY ADDRESS VALIDATION | Low | Solved - 03/05/2022 |

| EXTERNAL FUNCTION CALLS WITHIN LOOP | Low | Risk Accepted |

| IGNORE RETURN VALUES | Low | Risk Accepted |

| MISSING ZERO-ADDRESS CHECK | Low | Risk Accepted |

| USE OF DEPRECATED NOW FUNCTION | Low | Solved - 02/25/2022 |

| AUTHORIZE CAN REMOVE HIMSELF AND ALL OTHER AUTHORIZE ACCOUNT | Informational | - |

| AUCTION CAN BE EXTENDED INDEFINITELY | Informational | Acknowledged |

| SELLER CAN MONOPOLIZE THE AUCTION BID PRICE | Informational | Acknowledged |

| POSSIBLE MISUSE OF PUBLIC FUNCTIONS | Informational | Acknowledged |

| USING ++I CONSUMES LESS GAS THAN I++ IN LOOPS | Informational | Acknowledged |

| CACHE ARRAY LENGTH IN FOR LOOPS CAN SAVE GAS | Informational | Acknowledged |

| UPGRADE AT LEAST PRAGMA 0.8.4 | Informational | Acknowledged |

| CONSTANT WITH EXPONENTIATION CAN BE IMPROVED | Informational | Solved - 03/05/2022 |

| MISSING SUCCESS CHECK ON LOW LEVEL CALLS | Informational | Solved - 02/20/2022 |

8. Findings & Tech Details

8.1 USE LATESTROUNDDATA INSTEAD OF LATESTANSWER TO RUN MORE VALIDATIONS

// Medium

Description

Chainlink contract are calling latestAnswer to get the asset prices. The latestAnswer is deprecated. Freshness of the returned price should be checked, since it affects an account's health (and therefore liquidations). Stale prices that do not reflect the current market price anymore could be used, which would influence the liquidation pricing. This method will return the last value, but you won’t be able to check if the data is fresh. On the other hand, calling the method latestRoundData allow you to run some extra validations. Stale prices can put funds in a risk. According to Chainlink's documentation, This function does not error if no answer has been reached but returns 0, causing an incorrect price fed to the Price oracle. (https://docs.chain.link/docs/historical-price-data/#solidity). Furthermore, latestAnswer is deprecated. (https://docs.chain.link/docs/price-feeds-api-reference/))

Code Location

Chainlink Integration

function read() external view returns (uint256) {

// The relayer must not be null

require(address(chainlinkAggregator) != address(0), "ChainlinkRelayer/null-aggregator");

// Fetch values from Chainlink

uint256 medianPrice = multiply(uint(chainlinkAggregator.latestAnswer()), 10 ** uint(multiplier));

uint256 aggregatorTimestamp = chainlinkAggregator.latestTimestamp();

require(both(medianPrice > 0, subtract(now, aggregatorTimestamp) <= staleThreshold), "ChainlinkRelayer/invalid-price-feed");

return medianPrice;

}

Score

Likelihood: 3

Recommendation

SOLVED: The H2O team solved the above issue in the following commits

- b6cc5edc266b78a48a1f1f09bd9d229a73619c50

- 3a3ed51516b53d8ed16b703e07452f8edfb5019b

- eafcca39e12a33db609bc2a371275fd809e68815

As a result, the team added the additional validation and now uses latestRoundData.

8.2 UNCHECKED TRANSFER

// Medium

Description

In the contracts GebProxyActions.sol, GebProxyAuctionActions.sol, GebProxyIncentivesActions.sol, GebProxyLeverageActions.sol, GebProxySaviourActions.sol, the return values of the external transfer calls are not checked. It should be noted that token does not revert in case of failure and return false. If one of these tokens is used, a deposit would not revert if the transfer fails, and an attacker could deposit tokens for free.

Code Location

GebProxyActions.sol

function coinJoin_join(address apt, address safeHandler, uint wad) public {

// Gets COIN from the user's wallet

CoinJoinLike(apt).systemCoin().transferFrom(msg.sender, address(this), wad);

_coinJoin_join(apt, safeHandler, wad);

}

GebProxyAuctionActions.sol

function claimProxyFunds(address tokenAddress) public {

DSTokenLike token = DSTokenLike(tokenAddress);

token.transfer(msg.sender, token.balanceOf(address(this)));

}

GebProxyAuctionActions.sol

function settleAuction(address auctionHouse_, uint auctionId) public {

SurplusAuctionHouseLike auctionHouse = SurplusAuctionHouseLike(auctionHouse_);

DSTokenLike stakedToken = DSTokenLike(auctionHouse.stakedToken());

// Settle auction

auctionHouse.settleAuction(auctionId);

// Sends the staked tokens to the msg.sender

stakedToken.transfer(msg.sender, stakedToken.balanceOf(address(this)));

}

GebProxyIncentivesActions.sol

function exitAndRemoveLiquidity(address coinJoin, address incentives, address uniswapRouter, uint[2] calldata minTokenAmounts) external returns (uint amountA, uint amountB) {

GebIncentivesLike incentivesContract = GebIncentivesLike(incentives);

DSTokenLike rewardToken = DSTokenLike(incentivesContract.rewardsToken());

DSTokenLike lpToken = DSTokenLike(incentivesContract.stakingToken());

incentivesContract.exit();

rewardToken.transfer(msg.sender, rewardToken.balanceOf(address(this)));

return _removeLiquidityUniswap(uniswapRouter, address(CoinJoinLike(coinJoin).systemCoin()), lpToken.balanceOf(address(this)), msg.sender, minTokenAmounts);

}

GebProxyIncentivesActions.sol

function exitMine(address incentives) external {

GebIncentivesLike incentivesContract = GebIncentivesLike(incentives);

DSTokenLike rewardToken = DSTokenLike(incentivesContract.rewardsToken());

DSTokenLike lpToken = DSTokenLike(incentivesContract.stakingToken());

incentivesContract.exit();

rewardToken.transfer(msg.sender, rewardToken.balanceOf(address(this)));

lpToken.transfer(msg.sender, lpToken.balanceOf(address(this)));

}

GebProxyIncentivesActions.sol

function exitRemoveLiquidityRepayDebt(address manager, address coinJoin, uint safe, address incentives, address uniswapRouter, uint[2] calldata minTokenAmounts) external {

GebIncentivesLike incentivesContract = GebIncentivesLike(incentives);

DSTokenLike rewardToken = DSTokenLike(incentivesContract.rewardsToken());

DSTokenLike lpToken = DSTokenLike(incentivesContract.stakingToken());

DSTokenLike systemCoin = DSTokenLike(CoinJoinLike(coinJoin).systemCoin());

incentivesContract.exit();

rewardToken.transfer(msg.sender, rewardToken.balanceOf(address(this)));

_removeLiquidityUniswap(uniswapRouter, address(systemCoin), lpToken.balanceOf(address(this)), address(this), minTokenAmounts);

_repayDebt(manager, coinJoin, safe, systemCoin.balanceOf(address(this)), false);

msg.sender.call{value: address(this).balance}("");

}

GebProxyIncentivesActions.sol

function generateDebtAndProvideLiquidityStake(

address manager,

address taxCollector,

address coinJoin,

address uniswapRouter,

address incentives,

uint safe,

uint wad,

uint[2] calldata minTokenAmounts

) external payable {

DSTokenLike systemCoin = DSTokenLike(CoinJoinLike(coinJoin).systemCoin());

_generateDebt(manager, taxCollector, coinJoin, safe, wad, address(this));

_provideLiquidityUniswap(coinJoin, uniswapRouter, wad, msg.value, address(this), minTokenAmounts);

_stakeInMine(incentives);

// sending back any leftover tokens/eth, necessary to manage change from providing liquidity

msg.sender.call{value: address(this).balance}("");

systemCoin.transfer(msg.sender, systemCoin.balanceOf(address(this)));

}

GebProxyIncentivesActions.sol

function generateDebtAndProvideLiquidityUniswap(

address manager,

address taxCollector,

address coinJoin,

address uniswapRouter,

uint safe,

uint wad,

uint[2] calldata minTokenAmounts

) external payable {

DSTokenLike systemCoin = DSTokenLike(CoinJoinLike(coinJoin).systemCoin());

_generateDebt(manager, taxCollector, coinJoin, safe, wad, address(this));

_provideLiquidityUniswap(coinJoin, uniswapRouter, wad, msg.value, msg.sender, minTokenAmounts);

// sending back any leftover tokens/eth, necessary to manage change from providing liquidity

msg.sender.call{value: address(this).balance}("");

systemCoin.transfer(msg.sender, systemCoin.balanceOf(address(this)));

}

GebProxyIncentivesActions.sol

function getRewards(address incentives) public {

GebIncentivesLike incentivesContract = GebIncentivesLike(incentives);

DSTokenLike rewardToken = DSTokenLike(incentivesContract.rewardsToken());

incentivesContract.getReward();

rewardToken.transfer(msg.sender, rewardToken.balanceOf(address(this)));

}

GebProxyIncentivesActions.sol

function lockETHGenerateDebtProvideLiquidityStake(

address manager,

address taxCollector,

address ethJoin,

address coinJoin,

address uniswapRouter,

address incentives,

uint safe,

uint deltaWad,

uint liquidityWad,

uint[2] memory minTokenAmounts

) public payable {

DSTokenLike systemCoin = DSTokenLike(CoinJoinLike(coinJoin).systemCoin());

_lockETH(manager, ethJoin, safe, subtract(msg.value, liquidityWad));

_generateDebt(manager, taxCollector, coinJoin, safe, deltaWad, address(this));

_provideLiquidityUniswap(coinJoin, uniswapRouter, deltaWad, liquidityWad, address(this), minTokenAmounts);

_stakeInMine(incentives);

// sending back any leftover tokens/eth, necessary to manage change from providing liquidity

msg.sender.call{value: address(this).balance}("");

systemCoin.transfer(msg.sender, systemCoin.balanceOf(address(this)));

}

GebProxyIncentivesActions.sol

function lockETHGenerateDebtProvideLiquidityUniswap(

address manager,

address taxCollector,

address ethJoin,

address coinJoin,

address uniswapRouter,

uint safe,

uint deltaWad,

uint liquidityWad,

uint[2] calldata minTokenAmounts

) external payable {

DSTokenLike systemCoin = DSTokenLike(CoinJoinLike(coinJoin).systemCoin());

_lockETH(manager, ethJoin, safe, subtract(msg.value, liquidityWad));

_generateDebt(manager, taxCollector, coinJoin, safe, deltaWad, address(this));

_provideLiquidityUniswap(coinJoin, uniswapRouter, deltaWad, liquidityWad, msg.sender, minTokenAmounts);

// sending back any leftover tokens/eth, necessary to manage change from providing liquidity

msg.sender.call{value: address(this).balance}("");

systemCoin.transfer(msg.sender, systemCoin.balanceOf(address(this)));

}

GebProxyIncentivesActions.sol

function migrateCampaign(address _oldIncentives, address _newIncentives) external {

GebIncentivesLike incentives = GebIncentivesLike(_oldIncentives);

GebIncentivesLike newIncentives = GebIncentivesLike(_newIncentives);

require(incentives.stakingToken() == newIncentives.stakingToken(), "geb-incentives/mismatched-staking-tokens");

DSTokenLike rewardToken = DSTokenLike(incentives.rewardsToken());

DSTokenLike lpToken = DSTokenLike(incentives.stakingToken());

incentives.exit();

_stakeInMine(_newIncentives);

rewardToken.transfer(msg.sender, rewardToken.balanceOf(address(this)));

}

GebProxyIncentivesActions.sol

function openLockETHGenerateDebtProvideLiquidityStake(

address manager,

address taxCollector,

address ethJoin,

address coinJoin,

address uniswapRouter,

address incentives,

bytes32 collateralType,

uint256 deltaWad,

uint256 liquidityWad,

uint256[2] calldata minTokenAmounts

) external payable returns (uint safe) {

safe = openSAFE(manager, collateralType, address(this));

DSTokenLike systemCoin = DSTokenLike(CoinJoinLike(coinJoin).systemCoin());

_lockETH(manager, ethJoin, safe, subtract(msg.value, liquidityWad));

_generateDebt(manager, taxCollector, coinJoin, safe, deltaWad, address(this));

_provideLiquidityUniswap(coinJoin, uniswapRouter, deltaWad, liquidityWad, address(this), minTokenAmounts);

_stakeInMine(incentives);

// sending back any leftover tokens/eth, necessary to manage change from providing liquidity

msg.sender.call{value: address(this).balance}("");

systemCoin.transfer(msg.sender, systemCoin.balanceOf(address(this)));

}

GebProxyIncentivesActions.sol

function openLockETHGenerateDebtProvideLiquidityUniswap(

address manager,

address taxCollector,

address ethJoin,

address coinJoin,

address uniswapRouter,

bytes32 collateralType,

uint deltaWad,

uint liquidityWad,

uint[2] calldata minTokenAmounts

) external payable returns (uint safe) {

safe = openSAFE(manager, collateralType, address(this));

DSTokenLike systemCoin = DSTokenLike(CoinJoinLike(coinJoin).systemCoin());

_lockETH(manager, ethJoin, safe, subtract(msg.value, liquidityWad));

_generateDebt(manager, taxCollector, coinJoin, safe, deltaWad, address(this));

_provideLiquidityUniswap(coinJoin, uniswapRouter, deltaWad, liquidityWad, msg.sender, minTokenAmounts);

// sending back any leftover tokens/eth, necessary to manage change from providing liquidity

msg.sender.call{value: address(this).balance}("");

systemCoin.transfer(msg.sender, systemCoin.balanceOf(address(this)));

}

GebProxyIncentivesActions.sol

function provideLiquidityStake(

address coinJoin,

address uniswapRouter,

address incentives,

uint wad,

uint[2] memory minTokenAmounts

) public payable {

DSTokenLike systemCoin = DSTokenLike(CoinJoinLike(coinJoin).systemCoin());

systemCoin.transferFrom(msg.sender, address(this), wad);

_provideLiquidityUniswap(coinJoin, uniswapRouter, wad, msg.value, address(this), minTokenAmounts);

_stakeInMine(incentives);

// sending back any leftover tokens/eth, necessary to manage change from providing liquidity

msg.sender.call{value: address(this).balance}("");

systemCoin.transfer(msg.sender, systemCoin.balanceOf(address(this)));

}

GebProxyIncentivesActions.sol

function provideLiquidityUniswap(address coinJoin, address uniswapRouter, uint wad, uint[2] calldata minTokenAmounts) external payable {

DSTokenLike systemCoin = DSTokenLike(CoinJoinLike(coinJoin).systemCoin());

systemCoin.transferFrom(msg.sender, address(this), wad);

_provideLiquidityUniswap(coinJoin, uniswapRouter, wad, msg.value, msg.sender, minTokenAmounts);

// sending back any leftover tokens/eth, necessary to manage change from providing liquidity

msg.sender.call{value: address(this).balance}("");

systemCoin.transfer(msg.sender, systemCoin.balanceOf(address(this)));

}

GebProxyIncentivesActions.sol

function removeLiquidityUniswap(address uniswapRouter, address systemCoin, uint value, uint[2] calldata minTokenAmounts) external returns (uint amountA, uint amountB) {

DSTokenLike(getWethPair(uniswapRouter, systemCoin)).transferFrom(msg.sender, address(this), value);

return _removeLiquidityUniswap(uniswapRouter, systemCoin, value, msg.sender, minTokenAmounts);

}

GebProxyIncentivesActions.sol

function stakeInMine(address incentives, uint wad) external {

DSTokenLike(GebIncentivesLike(incentives).stakingToken()).transferFrom(msg.sender, address(this), wad);

_stakeInMine(incentives);

}

GebProxyIncentivesActions.sol

function withdrawAndHarvest(address incentives, uint value) external {

GebIncentivesLike incentivesContract = GebIncentivesLike(incentives);

DSTokenLike rewardToken = DSTokenLike(incentivesContract.rewardsToken());

DSTokenLike lpToken = DSTokenLike(incentivesContract.stakingToken());

incentivesContract.withdraw(value);

getRewards(incentives);

lpToken.transfer(msg.sender, lpToken.balanceOf(address(this)));

}

GebProxyIncentivesActions.sol

function withdrawFromMine(address incentives, uint value) external {

GebIncentivesLike incentivesContract = GebIncentivesLike(incentives);

DSTokenLike lpToken = DSTokenLike(incentivesContract.stakingToken());

incentivesContract.withdraw(value);

lpToken.transfer(msg.sender, lpToken.balanceOf(address(this)));

}

GebProxyIncentivesActions.sol

function withdrawHarvestRemoveLiquidity(address incentives, address uniswapRouter, address systemCoin, uint value, uint[2] memory minTokenAmounts) public returns (uint amountA, uint amountB) {

GebIncentivesLike incentivesContract = GebIncentivesLike(incentives);

DSTokenLike rewardToken = DSTokenLike(incentivesContract.rewardsToken());

DSTokenLike lpToken = DSTokenLike(incentivesContract.stakingToken());

incentivesContract.withdraw(value);

getRewards(incentives);

rewardToken.transfer(msg.sender, rewardToken.balanceOf(address(this)));

return _removeLiquidityUniswap(uniswapRouter, systemCoin, lpToken.balanceOf(address(this)), msg.sender, minTokenAmounts);

}

GebProxyIncentivesActions.sol

function withdrawRemoveLiquidityRepayDebt(address manager, address coinJoin, uint safe, address incentives, uint value, address uniswapRouter, uint[2] calldata minTokenAmounts) external {

GebIncentivesLike incentivesContract = GebIncentivesLike(incentives);

DSTokenLike rewardToken = DSTokenLike(incentivesContract.rewardsToken());

DSTokenLike systemCoin = DSTokenLike(CoinJoinLike(coinJoin).systemCoin());

incentivesContract.withdraw(value);

_removeLiquidityUniswap(uniswapRouter, address(systemCoin), value, address(this), minTokenAmounts);

_repayDebt(manager, coinJoin, safe, systemCoin.balanceOf(address(this)), false);

rewardToken.transfer(msg.sender, rewardToken.balanceOf(address(this)));

msg.sender.call{value: address(this).balance}("");

}

GebProxyLeverageActions.sol

function uniswapV2Call(address _sender, uint _amount0, uint _amount1, bytes calldata _data) external {

require(_sender == proxy, "invalid sender");

require(msg.sender == uniswapPair, "invalid uniswap pair");

// transfer coins

(address _tokenBorrow,,,,,,,address _proxy) = abi.decode(_data, (address, uint, address, bool, bool, bytes, address, address));

DSTokenLike(_tokenBorrow).transfer(proxy, (_amount0 > 0) ? _amount0 : _amount1);

// call proxy

(bool success,) = proxy.call(abi.encodeWithSignature("execute(address,bytes)", _proxy, msg.data));

require(success, "");

}

GebProxyLeverageActions.sol

function uniswapV2Call(address _sender, uint /* _amount0 */, uint /* _amount1 */, bytes calldata _data) external {

require(_sender == address(this), "only this contract may initiate");

DSAuth(address(this)).setAuthority(DSAuthority(address(0)));

// decode data

(

address _tokenBorrow,

uint _amount,

address _tokenPay,

bool _isBorrowingEth,

bool _isPayingEth,

bytes memory _userData,

address weth,

// address proxy

) = abi.decode(_data, (address, uint, address, bool, bool, bytes, address, address));

// unwrap WETH if necessary

if (_isBorrowingEth) {

WethLike(weth).withdraw(_amount);

}

// compute the amount of _tokenPay that needs to be repaid

// address pairAddress = permissionedPairAddress; // gas efficiency

uint pairBalanceTokenBorrow = DSTokenLike(_tokenBorrow).balanceOf(FlashSwapProxy(msg.sender).uniswapPair());

uint pairBalanceTokenPay = DSTokenLike(_tokenPay).balanceOf(FlashSwapProxy(msg.sender).uniswapPair());

uint amountToRepay = ((1000 * pairBalanceTokenPay * _amount) / (997 * pairBalanceTokenBorrow)) + 1;

// do whatever the user wants

if (_isBorrowingEth)

flashLeverageCallback(_amount, amountToRepay, _userData);

else

flashDeleverageCallback(_amount, amountToRepay, _userData);

// payback loan

// wrap ETH if necessary

if (_isPayingEth) {

WethLike(weth).deposit{value: amountToRepay}();

}

DSTokenLike(_tokenPay).transfer(FlashSwapProxy(msg.sender).uniswapPair(), amountToRepay);

}

GebProxySaviourActions.sol

function transferTokenFromAndApprove(address token, address target, uint256 amount) internal {

DSTokenLike(token).transferFrom(msg.sender, address(this), amount);

DSTokenLike(token).approve(target, 0);

DSTokenLike(token).approve(target, amount);

}

GebProxySaviourActions.sol

function transferTokensToCaller(address[] memory tokens) public {

for (uint i = 0; i < tokens.length; i++) {

uint256 selfBalance = DSTokenLike(tokens[i]).balanceOf(address(this));

if (selfBalance > 0) {

DSTokenLike(tokens[i]).transfer(msg.sender, selfBalance);

}

}

}

Score

Likelihood: 3

Recommendation

RISK ACCEPTED: The H2O team accepts the risk of this issue, claiming that all tokens in the system, i.e., the OCEAN collateral token, the stable coin and the governance token will be used in production revert on failure. Moreover, the team will add WARNING documentation to warn downstream users to use the H2O system only with tokens that revert to the failure.

8.3 IMPROPER ACCESS CONTROL POLICY

// Medium

Description

Implementing a valid Access Control policy in smart contracts is essential to maintain security and decentralize permissions on a token. Moreover, access Control gives the features to mint/burn tokens and pause contracts. For instance, Ownership is the most common form of Access Control. In other words, the owner of a contract (the account that deployed it by default) can do some administrative tasks on it. Nevertheless, different authorization levels are required to keep the principle of least privilege, also known as least authority. Briefly, any process, user, or program can only access the necessary resources or information. Otherwise, the ownership role is beneficial in simple systems, but more complex projects require more roles using Role-based access control.

In most scope contracts, The authorizedAccounts of the contract are the accounts that control all privileged functions. Everything is managed and controlled by the Authorized accounts, with no other access control. If this account is compromised, then all functionalities would be controlled by an attacker, such as removing all other authorized accounts, changing price source to a malicious address, restarting feed and setting it to 0, starting and stopping the DSM OSM, etc.

Code Location

In-Scope Contracts

constructor (address priceSource_) public {

authorizedAccounts[msg.sender] = 1;

In-Scope Contracts

constructor (address priceSource_, uint256 deviation) public {

require(deviation > 0 && deviation < WAD, "DSM/invalid-deviation");

authorizedAccounts[msg.sender] = 1;

Score

Likelihood: 2

Recommendation

PENDING: The team will fix the issue in a future release adding the below points.

- In case externally owned accounts (EOAs) are the authorized accounts, the team will implement RBAC according to the software engineering principle of separation of concerns by authorizing only a single proxy contract and implementing RBAC in the proxy contract configuration. For example, the DSRoles proxy contract implements permissions at an address method signature level.

- In other cases, if a smart contract is the authorized account; the team will only authorize smart contracts for which the code is known and trusted in advance.

8.4 MISSING RE-ENTRANCY PROTECTION

// Medium

Description

It was identified that some in-scope contracts of H2O branch are missing nonReentrant guard. In these function, write of persistent state and external calls following an external call is identified, making it vulnerable to a Reentrancy attack.

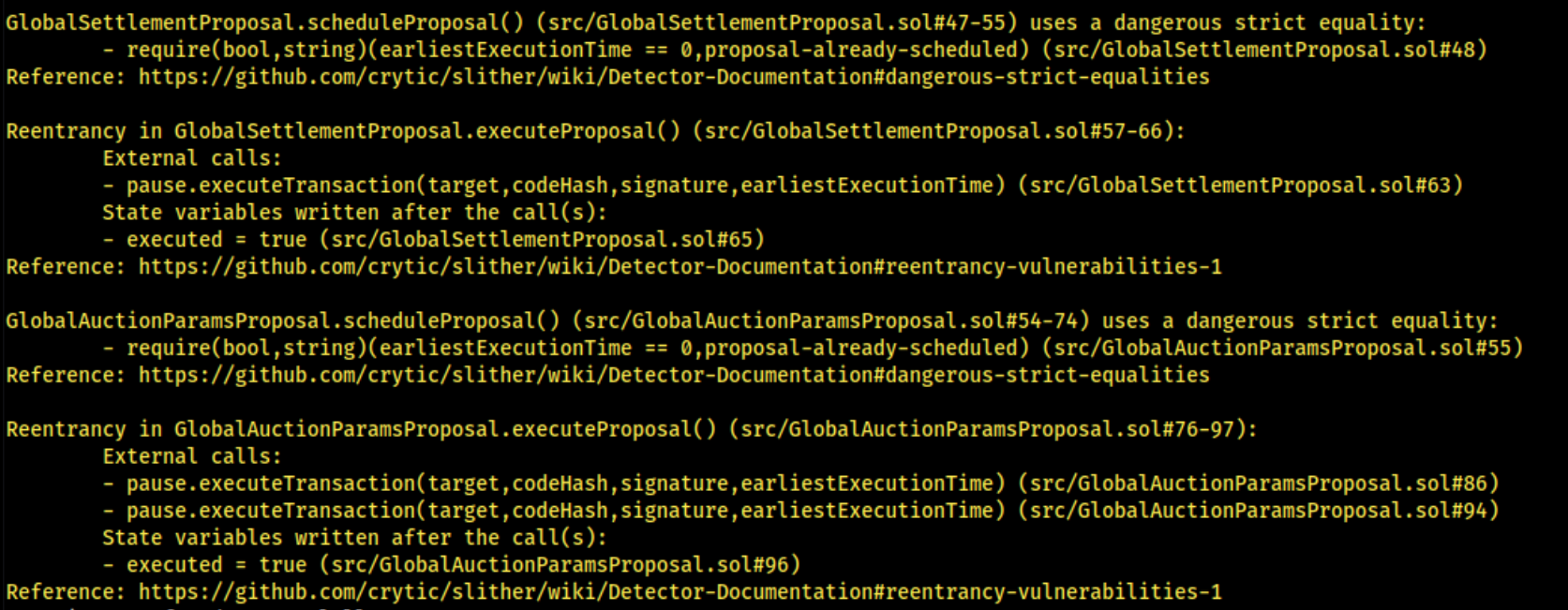

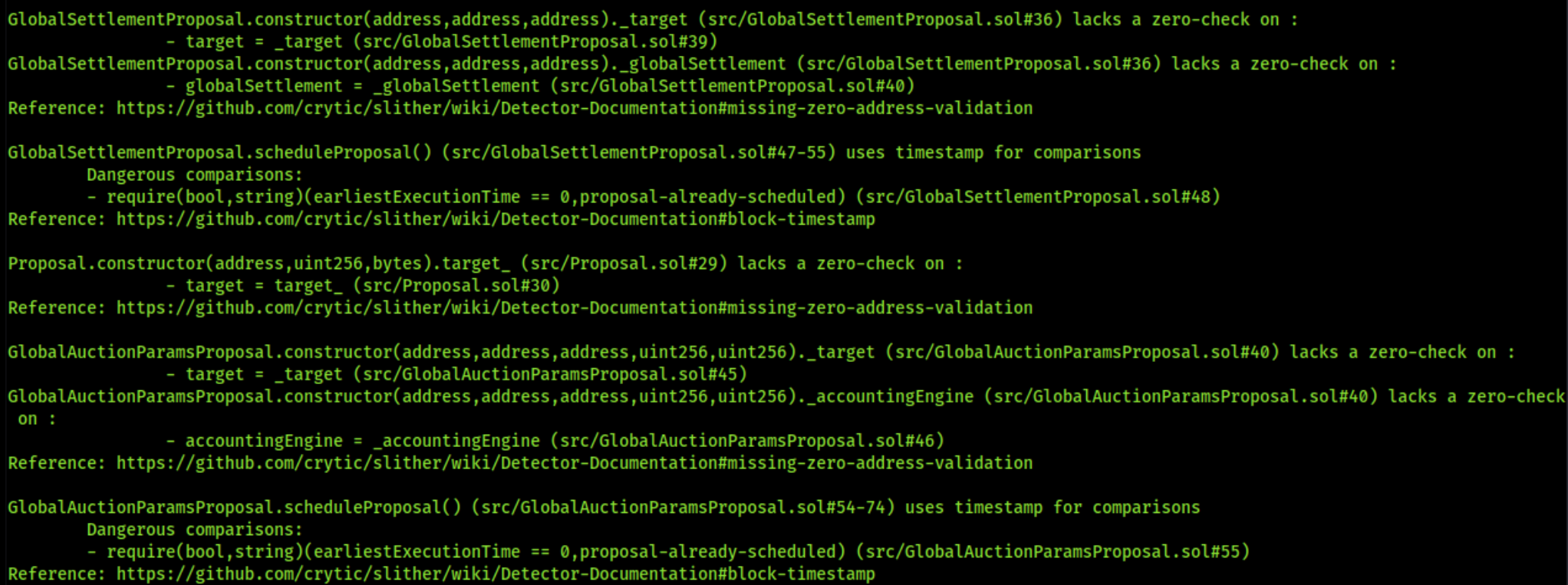

DebtCeilingProposal.solcontract functionexecuteProposalmissing nonReentrant guard.GlobalAuctionParamsProposal.solcontract functionexecuteProposalmissing nonReentrant guard.GlobalSettlementProposal.solcontract functionexecuteProposalmissing nonReentrant guard.

To protect against cross-function reentrancy attacks, it may be necessary to use a mutex. By using this lock, an attacker can no longer exploit the function with a recursive call. OpenZeppelin has its own mutex implementation called ReentrancyGuard which provides a modifier to any function called “nonReentrant” that guards the function with a mutex against the Reentrancy attacks.

Code Location

- state change

executed = truefollowing an external callpause.executeTransaction

DebtCeilingProposal.sol

function executeProposal() public { // exec

require(!executed, "proposal-already-executed");

pause.executeTransaction(target, codeHash, signature, earliestExecutionTime);

executed = true;

}

GlobalAuctionParamsProposal.sol

function executeProposal() public {

require(!executed, "proposal-already-executed");

bytes memory signature =

abi.encodeWithSignature(

"modifyParameters(address,bytes32,uint256)",

accountingEngine,

bytes32("initialDebtAuctionMintedTokens"),

initialDebtMintedTokens

);

pause.executeTransaction(target, codeHash, signature, earliestExecutionTime);

signature = abi.encodeWithSignature(

"modifyParameters(address,bytes32,uint256)",

accountingEngine,

bytes32("debtAuctionBidSize"),

debtAuctionBidSize

);

pause.executeTransaction(target, codeHash, signature, earliestExecutionTime);

executed = true;

}

GlobalSettlementProposal.sol

function executeProposal() public {

require(!executed, "proposal-already-executed");

bytes memory signature =

abi.encodeWithSignature("shutdownSystem(address)", globalSettlement);

pause.executeTransaction(target, codeHash, signature, earliestExecutionTime);

executed = true;

}

Score

Likelihood: 3

Recommendation

SOLVED: The H2O team solved the above issue in the commit 384b866ebf808831d3f5980f4f4f62dc17d9365d. As a result, the team added the nonReentrant modifier.

8.5 AUTHORIZE ACCOUNT CAN SET INVALID BASE AND MAX REWARDS

// Low

Description

In the scope contract FSMWrapper.sol, OSM.sol and DSM.sol, it is observed that the authorize accounts can set max and base rewards to an invalid value such as 0. It is possible, as no minimum and maximum value validation on the state variable baseUpdateCallerReward and maxUpdateCallerReward is performed.

Code Location

- Authorize accounts calling

modifyParameterswith byte32 value ofbaseUpdateCallerRewardas a parameter andvalas 0 setsbaseUpdateCallerRewardto0. After this, callmodifyParameterswith byte32 value ofmaxUpdateCallerRewardas a parameter andvalas 0 setsmaxUpdateCallerRewardto0.

FSMWrapper.sol, OSM.sol and DSM.sol

function modifyParameters(bytes32 parameter, uint256 val) external isAuthorized {

if (parameter == "baseUpdateCallerReward") {

require(val <= maxUpdateCallerReward, "FSMWrapper/invalid-base-caller-reward");

baseUpdateCallerReward = val;

}

else if (parameter == "maxUpdateCallerReward") {

require(val >= baseUpdateCallerReward, "FSMWrapper/invalid-max-caller-reward");

maxUpdateCallerReward = val;

}

Score

Likelihood: 2

Recommendation

RISK ACCEPTED: The H2O team accepts the risk of this issue, claiming that for the above issue, in case the delay is set incorrectly, you can use the same function call to set it to a correct value. Additionally, the team can add an extra layer by including a multisig system.

8.6 AUTHORIZE ACCOUNT CAN INCREASE MAX REWARD DELAY TO MAX INT VALUE

// Low

Description

In the scope contract FSMWrapper.sol, OSM.sol and DSM.sol, it is observed that the authorize accounts can set max reward increase delay to a vast number, as val is a type of uint256 a max value 2^256-1 could be supplied as an argument which ends up setting the state variable maxRewardIncreaseDelay to max INT value, this sets max reward not to increase for years.

Code Location

- Authorize accounts calling

modifyParameterswith byte32 value ofmaxRewardIncreaseDelayas a parameter andvalas2^256-1setsmaxRewardIncreaseDelayto max INT value.

FSMWrapper.sol, OSM.sol and DSM.sol

function modifyParameters(bytes32 parameter, uint256 val) external isAuthorized {

if (parameter == "baseUpdateCallerReward") {

require(val <= maxUpdateCallerReward, "FSMWrapper/invalid-base-caller-reward");

baseUpdateCallerReward = val;

}

else if (parameter == "maxUpdateCallerReward") {

require(val >= baseUpdateCallerReward, "FSMWrapper/invalid-max-caller-reward");

maxUpdateCallerReward = val;

}

else if (parameter == "perSecondCallerRewardIncrease") {

require(val >= RAY, "FSMWrapper/invalid-caller-reward-increase");

perSecondCallerRewardIncrease = val;

}

else if (parameter == "maxRewardIncreaseDelay") {

require(val > 0, "FSMWrapper/invalid-max-increase-delay");

maxRewardIncreaseDelay = val;

}

else if (parameter == "reimburseDelay") {

reimburseDelay = val;

}

else revert("FSMWrapper/modify-unrecognized-param");

emit ModifyParameters(

parameter,

val

);

}

Score

Likelihood: 1

Recommendation

RISK ACCEPTED: The H2O team accepts the risk of this issue, claiming that for the above issue, in case the delay is set incorrectly, you can use the same function call to set it to a correct value. Additionally, the team can add an extra layer by including a multisig system.

8.7 THE CONTRACT FUNCTION SHOULD APPROVE(0) FIRST

// Low

Description

Some tokens (like USDT L199) do not work when changing the allowance from an existing non-zero allowance value. They must first be approved by zero, and then the actual allowance must be approved.

IERC20(token).approve(address(operator), 0);

IERC20(token).approve(address(operator), amount);

Code Location

GebProxyIncentivesActions.sol

function _removeLiquidityUniswap(address uniswapRouter, address systemCoin, uint value, address to, uint[2] memory minTokenAmounts) internal returns (uint amountA, uint amountB) {

DSTokenLike(getWethPair(uniswapRouter, systemCoin)).approve(uniswapRouter, value);

return IUniswapV2Router02(uniswapRouter).removeLiquidityETH(

systemCoin,

value,

minTokenAmounts[0],

minTokenAmounts[1],

to,

block.timestamp

);

}

GebProxyIncentivesActions.sol

function _stakeInMine(address incentives) internal {

DSTokenLike lpToken = DSTokenLike(GebIncentivesLike(incentives).stakingToken());

lpToken.approve(incentives, uint(0 - 1));

GebIncentivesLike(incentives).stake(lpToken.balanceOf(address(this)));

}

Score

Likelihood: 2

Recommendation

RISK ACCEPTED: The H2O team accepts the risk of this issue, claiming that the issue will not be triggered as Uniswap LP tokens will be used in production. Moreover, the team will add documentation to warn downstream users using the H2O system only with tokens that do not exhibit this behavior in their approve functions.

8.8 ERC20 APPROVE METHOD MISSING RETURN VALUE CHECK

// Low

Description

The following contract functions perform an ERC20.approve() call, but does not check the success return value. Some tokens do not revert if the approval failed and return false instead of true.

Code Location

GebProxyActions.sol

function increaseBidSize(address auctionHouse, uint auctionId, uint bidSize) public {

SurplusAuctionHouseLike surplusAuctionHouse = SurplusAuctionHouseLike(auctionHouse);

DSTokenLike protocolToken = DSTokenLike(surplusAuctionHouse.protocolToken());

require(protocolToken.transferFrom(msg.sender, address(this), bidSize), "geb-proxy-auction-actions/transfer-from-failed");

protocolToken.approve(address(surplusAuctionHouse), bidSize);

// Restarts auction if inactive

(, uint amountToSell,, uint48 bidExpiry, uint48 auctionDeadline) = surplusAuctionHouse.bids(auctionId);

if (auctionDeadline < now && bidExpiry == 0 && auctionDeadline > 0) {

surplusAuctionHouse.restartAuction(auctionId);

}

// Bid

surplusAuctionHouse.increaseBidSize(auctionId, amountToSell, bidSize);

}

GebProxyActions.sol

function startAndIncreaseBidSize(address accountingEngineAddress, uint bidSize) public {

AccountingEngineLike accountingEngine = AccountingEngineLike(accountingEngineAddress);

SurplusAuctionHouseLike surplusAuctionHouse = SurplusAuctionHouseLike(accountingEngine.surplusAuctionHouse());

DSTokenLike protocolToken = DSTokenLike(surplusAuctionHouse.protocolToken());

// Starts auction

uint auctionId = accountingEngine.auctionSurplus();

require(protocolToken.transferFrom(msg.sender, address(this), bidSize), "geb-proxy-auction-actions/transfer-from-failed");

protocolToken.approve(address(surplusAuctionHouse), bidSize);

(, uint amountToSell,,,) = surplusAuctionHouse.bids(auctionId);

// Bids

surplusAuctionHouse.increaseBidSize(auctionId, amountToSell, bidSize);

}

GebProxyIncentivesActions.sol

function _provideLiquidityUniswap(address coinJoin, address uniswapRouter, uint tokenWad, uint ethWad, address to, uint[2] memory minTokenAmounts) internal {

CoinJoinLike(coinJoin).systemCoin().approve(uniswapRouter, tokenWad);

IUniswapV2Router02(uniswapRouter).addLiquidityETH{value: ethWad}(

address(CoinJoinLike(coinJoin).systemCoin()),

tokenWad,

minTokenAmounts[0],

minTokenAmounts[1],

to,

block.timestamp

);

}

GebProxyIncentivesActions.sol

function _removeLiquidityUniswap(address uniswapRouter, address systemCoin, uint value, address to, uint[2] memory minTokenAmounts) internal returns (uint amountA, uint amountB) {

DSTokenLike(getWethPair(uniswapRouter, systemCoin)).approve(uniswapRouter, value);

return IUniswapV2Router02(uniswapRouter).removeLiquidityETH(

systemCoin,

value,

minTokenAmounts[0],

minTokenAmounts[1],

to,

block.timestamp

);

}

GebProxyIncentivesActions.sol

function _stakeInMine(address incentives) internal {

DSTokenLike lpToken = DSTokenLike(GebIncentivesLike(incentives).stakingToken());

lpToken.approve(incentives, uint(0 - 1));

GebIncentivesLike(incentives).stake(lpToken.balanceOf(address(this)));

}

CollateralLike Abstract Interface

abstract contract CollateralLike {

function approve(address, uint) virtual public;

function transfer(address, uint) virtual public;

function transferFrom(address, address, uint) virtual public;

}

DSTokenLike Abstract Interface

abstract contract DSTokenLike {

function balanceOf(address) virtual public view returns (uint);

function approve(address, uint) virtual public;

function transfer(address, uint) virtual public returns (bool);

function transferFrom(address, address, uint) virtual public returns (bool);

}

WethLike Abstract Interface

abstract contract WethLike {

function balanceOf(address) virtual public view returns (uint);

function approve(address, uint) virtual public;

function transfer(address, uint) virtual public;

function transferFrom(address, address, uint) virtual public;

function deposit() virtual public payable;

function withdraw(uint) virtual public;

}

Score

Likelihood: 1

Recommendation

RISK ACCEPTED: The H2O team accepts the risk of this issue, claiming that all tokens to be used in production will be reverted in the event of a failure. Moreover, the team will add documentation to warn downstream users to use the H2O system only with tokens that will revert the ERC20.approve().

8.9 MISSING SAFE ENGINE ADDRESS VALIDATION

// Low

Description

It was noted that safeEngine_ address is not validated in SurplusAuctionHouse.sol contract. Lack of address validation has been found when assigning supplied address values to state variables directly. safeEngine_ address should be !=0 or add logic to check if the provided address is a valid Safe Engine Address.

Code Location

SurplusAuctionHouse.sol

constructor(address safeEngine_, address protocolToken_) public {

authorizedAccounts[msg.sender] = 1;

safeEngine = SAFEEngineLike(safeEngine_);

protocolToken = TokenLike(protocolToken_);

contractEnabled = 1;

emit AddAuthorization(msg.sender);

}

SAFEEngine.sol

constructor() public {

authorizedAccounts[msg.sender] = 1;

safeDebtCeiling = uint256(-1);

contractEnabled = 1;

emit AddAuthorization(msg.sender);

emit ModifyParameters("safeDebtCeiling", uint256(-1));

}

Score

Likelihood: 2

Recommendation

SOLVED: The H2O team solved the above issue in the commit 9c3225a836a570df867a8116eeac6f678b322a13. As a result, the team added the zero address check to safeEngine_ throughout the in-scope H2O system.

8.10 MISSING FACTORY ADDRESS VALIDATION

// Low

Description

It was noted that factory_ address is not validated in GebProxyRegistry.sol contract. Lack of address validation has been found when assigning supplied address values to state variables directly. factory_ address should be !=0 or add logic to check if the provided address is a valid Factory Address.

Code Location

GebProxyRegistry.sol

constructor(address factory_) public {

factory = DSProxyFactory(factory_);

}

proxy.sol

contract DSProxyFactory {

event Created(address indexed sender, address indexed owner, address proxy, address cache);

mapping(address=>bool) public isProxy;

DSProxyCache public cache;

constructor() public {

cache = new DSProxyCache();

}

Score

Likelihood: 2

Recommendation

SOLVED: The H2O team solved the above issue in the commit 48863e0b91e152c6900fb6d61d31566fa9819bb1. As a result, the team added the zero address check to factory_.

Updated Code

constructor(address factory_) public {

require(factory_ != address(0), "GebProxyRegistry/proxy-factory-address-invalid");

factory = DSProxyFactory(factory_);

}

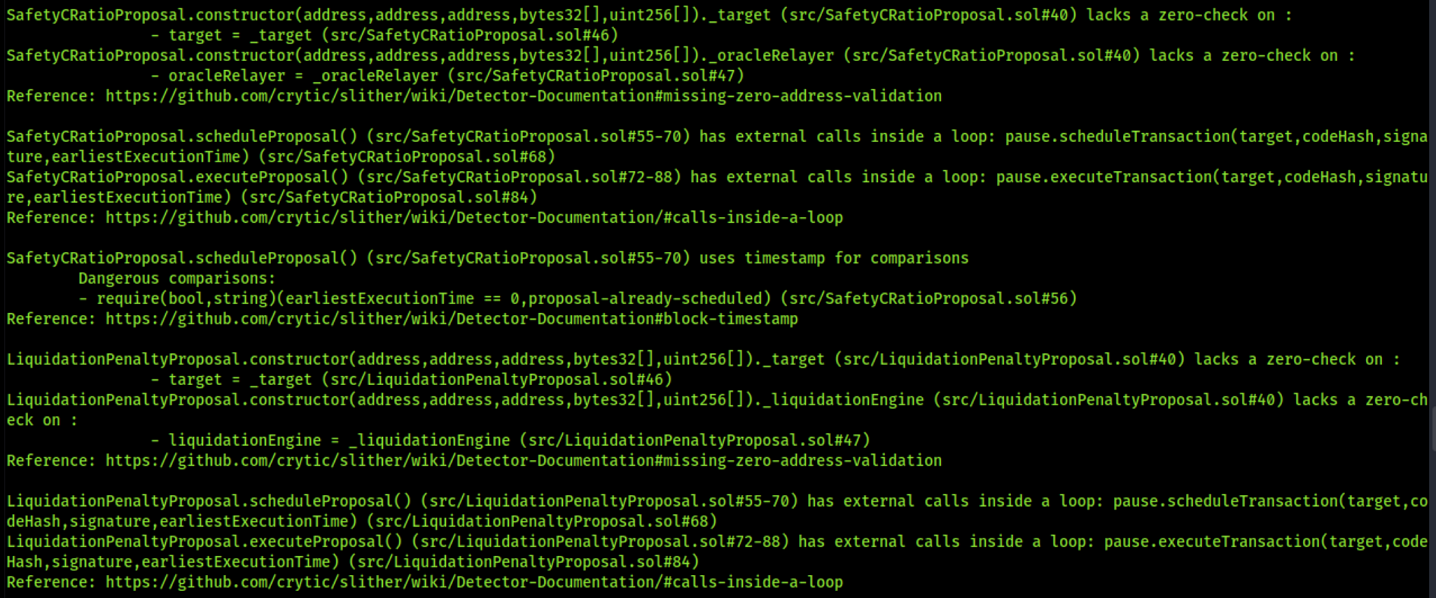

8.11 EXTERNAL FUNCTION CALLS WITHIN LOOP

// Low

Description

External calls inside a loop increase Gas usage or might lead to a denial-of-service attack. In GebProxySaviourActions.sol contract functions discovered, there is a for loop on variable i that iterates up to the tokens.length array length. Where, in AccessManagementProposal.sol, CollateralStabilityFeeProposal.sol, LiquidationCRatioProposal.sol, LiquidationPenaltyProposal.sol, MultiDebtCeilingProposal.sol, SafetyCRatioProposal.sol, SecondaryTaxReceiversProposal.sol contract functions discovered there is a for loop on variable i that iterates up to the gebModules.length, and collateralTypes.length array length and these loop has external calls inside a loop. If this integer is evaluated at huge numbers, this can cause a DoS.

Code Location

GebProxySaviourActions.sol

function transferTokensToCaller(address[] memory tokens) public {

for (uint i = 0; i < tokens.length; i++) {

uint256 selfBalance = DSTokenLike(tokens[i]).balanceOf(address(this));

if (selfBalance > 0) {

DSTokenLike(tokens[i]).transfer(msg.sender, selfBalance);

}

}

}

AccessManagementProposal.sol

function executeProposal() public {

require(!executed, "proposal-already-executed");

for (uint256 i = 0; i < gebModules.length; i++) {

bytes memory signature =

abi.encodeWithSignature(

(grantAccess[i] != 0) ? "addAuthorization(address,address)" : "removeAuthorization(address,address)",

gebModules[i],

addresses[i]

);

pause.executeTransaction(target, codeHash, signature, earliestExecutionTime);

}

executed = true;

}

AccessManagementProposal.sol

function scheduleProposal() public {

require(earliestExecutionTime == 0, "proposal-already-scheduled");

earliestExecutionTime = now + PauseLike(pause).delay();

for (uint256 i = 0; i < gebModules.length; i++) {

bytes memory signature =

abi.encodeWithSignature(

(grantAccess[i] != 0) ? "addAuthorization(address,address)" : "removeAuthorization(address,address)",

gebModules[i],

addresses[i]

);

pause.scheduleTransaction(target, codeHash, signature, earliestExecutionTime);

}

}

CollateralStabilityFeeProposal.sol

function deploy(address taxCollector, bytes32[] calldata collateralTypes, uint256[] calldata stabilityFees) external {

for (uint i = 0; i < collateralTypes.length; i++)

ConfigLike(taxCollector).modifyParameters(collateralTypes[i], "stabilityFee", stabilityFees[i]);

}

LiquidationCRatioProposal.sol

function executeProposal() public {

require(!executed, "proposal-already-executed");

for (uint256 i = 0; i < collateralTypes.length; i++) {

bytes memory signature =

abi.encodeWithSignature(

"modifyParameters(address,bytes32,bytes32,uint256)",

oracleRelayer,

collateralTypes[i],

bytes32("liquidationCRatio"),

liquidationCRatios[i]

);

pause.executeTransaction(target, codeHash, signature, earliestExecutionTime);

}

executed = true;

}

LiquidationCRatioProposal.sol

function scheduleProposal() public {

require(earliestExecutionTime == 0, "proposal-already-scheduled");

earliestExecutionTime = now + PauseLike(pause).delay();

for (uint256 i = 0; i < collateralTypes.length; i++) {

bytes memory signature =

abi.encodeWithSignature(

"modifyParameters(address,bytes32,bytes32,uint256)",

oracleRelayer,

collateralTypes[i],

bytes32("liquidationCRatio"),

liquidationCRatios[i]

);

pause.scheduleTransaction(target, codeHash, signature, earliestExecutionTime);

}

}

LiquidationPenaltyProposal.sol

function executeProposal() public {

require(!executed, "proposal-already-executed");

for (uint256 i = 0; i < collateralTypes.length; i++) {

bytes memory signature =

abi.encodeWithSignature(

"modifyParameters(address,bytes32,bytes32,uint256)",

liquidationEngine,

collateralTypes[i],

bytes32("liquidationPenalty"),

liquidationPenalties[i]

);

pause.executeTransaction(target, codeHash, signature, earliestExecutionTime);

}

executed = true;

}

LiquidationPenaltyProposal.sol

function scheduleProposal() public {

require(earliestExecutionTime == 0, "proposal-already-scheduled");

earliestExecutionTime = now + PauseLike(pause).delay();

for (uint256 i = 0; i < collateralTypes.length; i++) {

bytes memory signature =

abi.encodeWithSignature(

"modifyParameters(address,bytes32,bytes32,uint256)",

liquidationEngine,

collateralTypes[i],

bytes32("liquidationPenalty"),

liquidationPenalties[i]

);

pause.scheduleTransaction(target, codeHash, signature, earliestExecutionTime);

}

}

MultiDebtCeilingProposal.sol

function executeProposal() public {

require(!executed, "proposal-already-executed");

for (uint256 i = 0; i < collateralTypes.length; i++) {

bytes memory signature =

abi.encodeWithSignature(

"modifyParameters(address,bytes32,bytes32,uint256)",

safeEngine,

collateralTypes[i],

bytes32("debtCeiling"),

debtCeilings[i]

);

pause.executeTransaction(target, codeHash, signature, earliestExecutionTime);

}

executed = true;

}

MultiDebtCeilingProposal.sol

function scheduleProposal() public {

require(earliestExecutionTime == 0, "proposal-already-scheduled");

earliestExecutionTime = now + PauseLike(pause).delay();

for (uint256 i = 0; i < collateralTypes.length; i++) {

bytes memory signature =

abi.encodeWithSignature(

"modifyParameters(address,bytes32,bytes32,uint256)",

safeEngine,

collateralTypes[i],

bytes32("debtCeiling"),

debtCeilings[i]

);

pause.scheduleTransaction(target, codeHash, signature, earliestExecutionTime);

}

}

SafetyCRatioProposal.sol

function executeProposal() public {

require(!executed, "proposal-already-executed");

for (uint256 i = 0; i < collateralTypes.length; i++) {

bytes memory signature =

abi.encodeWithSignature(

"modifyParameters(address,bytes32,bytes32,uint256)",

oracleRelayer,

collateralTypes[i],

bytes32("safetyCRatio"),

safetyCRatios[i]

);

pause.executeTransaction(target, codeHash, signature, earliestExecutionTime);

}

executed = true;

}

SafetyCRatioProposal.sol

function scheduleProposal() public {

require(earliestExecutionTime == 0, "proposal-already-scheduled");

earliestExecutionTime = now + PauseLike(pause).delay();

for (uint256 i = 0; i < collateralTypes.length; i++) {

bytes memory signature =

abi.encodeWithSignature(

"modifyParameters(address,bytes32,bytes32,uint256)",

oracleRelayer,

collateralTypes[i],

bytes32("safetyCRatio"),

safetyCRatios[i]

);

pause.scheduleTransaction(target, codeHash, signature, earliestExecutionTime);

}

}

SecondaryTaxReceiversProposal.sol

function deploy(

address taxCollector,

bytes32[] calldata collateralTypes,

uint256[] calldata positions,

uint256[] calldata percentages,

address[] calldata secondaryReceivers)

external

{

for (uint i = 0; i < collateralTypes.length; i++)

ConfigLike(taxCollector).modifyParameters(collateralTypes[i], positions[i], percentages[i], secondaryReceivers[i]);

}

Score

Likelihood: 2

Recommendation

RISK ACCEPTED: The H2O team accepts the risk of this issue, claiming that for V1 of the system, the identified array lengths will not exceed more than a handful of values. However, in the case of collateralTypes, the length of the array is fixed at 1 for the lifetime of the V1 system. Furthermore, the team claims that the contracts in which these issues occur are optional and may not be seen in the deployment for the lifetime of V1. However, the team notified that in the V2 system, the team would address these issues.

8.12 IGNORE RETURN VALUES

// Low

Description

The return value of an external call is not stored in a local or state variable. In contract GebProxyIncentivesActions.sol, there is an instance where external method is being called, and return value is being ignored.

Code Location

GebProxyIncentivesActions.sol

function _provideLiquidityUniswap(address coinJoin, address uniswapRouter, uint tokenWad, uint ethWad, address to, uint[2] memory minTokenAmounts) internal {

CoinJoinLike(coinJoin).systemCoin().approve(uniswapRouter, tokenWad);

IUniswapV2Router02(uniswapRouter).addLiquidityETH{value: ethWad}(

address(CoinJoinLike(coinJoin).systemCoin()),

tokenWad,

minTokenAmounts[0],

minTokenAmounts[1],

to,

block.timestamp

);

}

Score

Likelihood: 3

Recommendation

RISK ACCEPTED: The H2O team accepts the risk of this issue, claiming that the implementation of addLiquidityETH throws on failure unless the codebase is used with an alternative implementation of Uniswap that doesn’t exhibit this behavior. Furthermore, the team claims that only addLiquidityETH implementations that revert on failure are used with this codebase. Moreover, the team will add documentation to WARN downstream users of this assumption.

8.13 MISSING ZERO-ADDRESS CHECK

// Low

Description

There are multiple instances found where Address validation is missing. Lack of zero address validation has been found when assigning user supplied address values to state variables directly.

-

In contract

AccessManagementProposal.sol:constructorlacks a zero address check on_target.

-

In contract

CollateralStabilityFeeProposal.sol:constructorlacks a zero address check on_pause.

-

In contract

DebtCeilingProposal.sol:constructorlacks a zero address check on_target,_cdpEngine.

-

In contract

GlobalAuctionParamsProposal.sol:constructorlacks a zero address check on_target,_accountingEngine.

-

In contract

GlobalSettlementProposal.sol:constructorlacks a zero address check on_target,_globalSettlement.

-

In contract

GlobalStabilityFeeProposal.sol:constructorlacks a zero address check on_pause.

-

In contract

LiquidationCRatioProposal.sol:constructorlacks a zero address check on_target,_oracleRelayer.

-

In contract

LiquidationPenaltyProposal.sol:constructorlacks a zero address check on_target,_liquidationEngine.

-

In contract

MultiDebtCeilingProposal.sol:constructorlacks a zero address check on_target,_safeEngine.

-

In contract

NewCollateralProposal.sol:constructorlacks a zero address check onpause_.

-

In contract

Proposal.sol:constructorlacks a zero address check ontarget_.

-

In contract

SafetyCRatioProposal.sol:constructorlacks a zero address check on_target,_oracleRelayer.

-

In contract

SecondaryTaxReceiversProposal.sol:constructorlacks a zero address check on_pause.

-

In contract

GebProxyLeverageActions.sol:constructorlacks a zero address check on_pair.uniswapV2Calllacks a zero address check on_proxy.

-

constructorlacks a zero address check on_target. -

constructorlacks a zero address check on_pause. -

constructorlacks a zero address check on_target,_cdpEngine. -

constructorlacks a zero address check on_target,_accountingEngine. -

constructorlacks a zero address check on_target,_globalSettlement. -

constructorlacks a zero address check on_pause. -

constructorlacks a zero address check on_target,_oracleRelayer. -

constructorlacks a zero address check on_target,_liquidationEngine. -

constructorlacks a zero address check on_target,_safeEngine. -

constructorlacks a zero address check onpause_. -

constructorlacks a zero address check ontarget_. -

constructorlacks a zero address check on_target,_oracleRelayer. -

constructorlacks a zero address check on_pause. -

constructorlacks a zero address check on_pair. uniswapV2Calllacks a zero address check on_proxy.

Code Location

Zero Address Validation missing before address assignment to this state variable.

AccessManagementProposal.sol

target = _target (#47)

CollateralStabilityFeeProposal.sol

pause = _pause (#43)

DebtCeilingProposal.sol

target = _target (#44)

cdpEngine = _cdpEngine (#45)

GlobalAuctionParamsProposal.sol

target = _target (#45)

accountingEngine = _accountingEngine (#46)

GlobalSettlementProposal.sol

target = _target (#39)

globalSettlement = _globalSettlement (#40)

GlobalStabilityFeeProposal.sol

pause = _pause (#37)

LiquidationCRatioProposal.sol

target = _target (#46)

oracleRelayer = _oracleRelayer (#47)

LiquidationPenaltyProposal.sol

target = _target (#46)

liquidationEngine = _liquidationEngine (#47)

MultiDebtCeilingProposal.sol

target = _target (#47)

safeEngine = _safeEngine (#48)

NewCollateralProposal.sol

pause = pause_ (#76)

Proposal.sol

target = target_ (#30)

SafetyCRatioProposal.sol

target = _target (#46)

oracleRelayer = _oracleRelayer (#47)

SecondaryTaxReceiversProposal.sol

pause = _pause (#60)

Score

Likelihood: 1

Recommendation

RISK ACCEPTED: The H2O team accepts the risk of this issue, claiming that these state variables are declared and assigned in scripts that mitigate human error compared to calling these functions manually; as a result, they do not appear to be a problem in practice.

8.14 USE OF DEPRECATED NOW FUNCTION

// Low

Description

In the entire smart contracts, Instead of block.timestamp, now is used, which is deprecated. block.timestamp is way more explicit in showing the intent, while now relates to the timestamp of the block controlled by the miner. Reference

Code Location

LiquidationPenaltyProposal.sol

function scheduleProposal() public {

require(earliestExecutionTime == 0, "proposal-already-scheduled");

earliestExecutionTime = now + PauseLike(pause).delay();

for (uint256 i = 0; i < collateralTypes.length; i++) {

bytes memory signature =

abi.encodeWithSignature(

"modifyParameters(address,bytes32,bytes32,uint256)",

liquidationEngine,

collateralTypes[i],

bytes32("liquidationPenalty"),

liquidationPenalties[i]

);

pause.scheduleTransaction(target, codeHash, signature, earliestExecutionTime);

}

}

MultiDebtCeilingProposal.sol

function executeProposal() public {

require(!executed, "proposal-already-executed");

for (uint256 i = 0; i < collateralTypes.length; i++) {

bytes memory signature =

abi.encodeWithSignature(

"modifyParameters(address,bytes32,bytes32,uint256)",

safeEngine,

collateralTypes[i],

bytes32("debtCeiling"),

debtCeilings[i]

);

pause.executeTransaction(target, codeHash, signature, earliestExecutionTime);

}

executed = true;

}

MultiDebtCeilingProposal.sol

function scheduleProposal() public {

require(earliestExecutionTime == 0, "proposal-already-scheduled");

earliestExecutionTime = now + PauseLike(pause).delay();

for (uint256 i = 0; i < collateralTypes.length; i++) {

bytes memory signature =

abi.encodeWithSignature(

"modifyParameters(address,bytes32,bytes32,uint256)",

safeEngine,

collateralTypes[i],

bytes32("debtCeiling"),

debtCeilings[i]

);

pause.scheduleTransaction(target, codeHash, signature, earliestExecutionTime);

}

}

Score

Likelihood: 2

Recommendation

SOLVED: The H2O team solved the above issue in the commit 54690e489294a144e56659b117ced4ac11de4400. As a result, the team replaces now with block.timestamp throughout the in-scope H2O system.

8.15 AUTHORIZE CAN REMOVE HIMSELF AND ALL OTHER AUTHORIZE ACCOUNT

// Informational

Description

Score

Likelihood:

8.16 AUCTION CAN BE EXTENDED INDEFINITELY

// Informational

Description

In the contract, SurplusAuctionHouse.sol observed that the function restartAuction lacks access control; thus, anyone can make an external call to this function. Furthermore, calling the restartAuction function just before the auction expires (no bid is issued) allows the auction to be extended by two days. An external call to restartAuction only requires a valid auction id, the auction id can easily be obtainable via the startAuction function emit event. This can be done repeatedly to extend the auction forever for any auction.

Code Location

- Default Auction length is of

twodays

```{language=solidity firstnumber=297 caption=SurplusAuctionHouse.sol hlines=298} // Total length of the auction uint48 public totalAuctionLength = 2 days;

- Active auction's `id` can be obtained via emit event of `startAuction` function

```{language=solidity firstnumber=386 caption=SurplusAuctionHouse.sol hlines=386}

emit StartAuction(id, auctionsStarted, amountToSell, initialBid, bids[id].auctionDeadline);

- Condition

bids[id].auctionDeadline < nowwill always be true ifrestartAuctionfunction is called just before an auction expires, as a result,bids[id].auctionDeadline = addUint48(uint48(now), totalAuctionLength);increase the auction length again by 2 days.

SurplusAuctionHouse.sol

function restartAuction(uint256 id) external {

require(bids[id].auctionDeadline < now, "RecyclingSurplusAuctionHouse/not-finished");

require(bids[id].bidExpiry == 0, "RecyclingSurplusAuctionHouse/bid-already-placed");

bids[id].auctionDeadline = addUint48(uint48(now), totalAuctionLength);

emit RestartAuction(id, bids[id].auctionDeadline);

}

Score

Likelihood: 1

Recommendation

ACKNOWLEDGED: The team claims the above issue is intended behavior. Moreover, the team will add the intended behavior note in the README documentation. Furthermore, the team added that, similar to MakerDAO and RAI, the H2O protocol is optimized to maximize the final bid amount rather than minimize the auction time. Therefore, auctions can be extended if there is no bid as this does not affect the outcome of other auctions or the operation of other parts of the protocol.

8.17 SELLER CAN MONOPOLIZE THE AUCTION BID PRICE

// Informational

Description

In the contract, SurplusAuctionHouse.sol observed no logic to stop a seller from being a buyer. Following HAL-16, a seller can restart if no bid is placed before the auction closes, resulting in an extension of the auction time by two days. Furthermore, If a valid buyer comes and sets a new bid, then just before the bid expires, a seller can raise the bid again via an external call to increaseBidSize and extend the bid duration by the following three hours. This scenario can continue, as the contract does not prevent the seller from becoming the buyer and controlling the auction's bid price.

Code Location

- Default extension to bid expiry after a new bid is submitted

SurplusAuctionHouse.sol

uint48 public bidDuration = 3 hours;

- No logic to stop

sellerfrom being abuyernow if a validbuyercomes and places a newbid,then just beforebidexpires, a seller can raise thebidagain and extend thebidduration by nextthreehours. The scenario can go on until the auction expires.

SurplusAuctionHouse.sol

function increaseBidSize(uint256 id, uint256 amountToBuy, uint256 bid) external {

require(contractEnabled == 1, "RecyclingSurplusAuctionHouse/contract-not-enabled");

require(bids[id].highBidder != address(0), "RecyclingSurplusAuctionHouse/high-bidder-not-set");

require(bids[id].bidExpiry > now || bids[id].bidExpiry == 0, "RecyclingSurplusAuctionHouse/bid-already-expired");

require(bids[id].auctionDeadline > now, "RecyclingSurplusAuctionHouse/auction-already-expired");

require(amountToBuy == bids[id].amountToSell, "RecyclingSurplusAuctionHouse/amounts-not-matching");

require(bid > bids[id].bidAmount, "RecyclingSurplusAuctionHouse/bid-not-higher");

require(multiply(bid, ONE) >= multiply(bidIncrease, bids[id].bidAmount), "RecyclingSurplusAuctionHouse/insufficient-increase");

if (msg.sender != bids[id].highBidder) {

protocolToken.move(msg.sender, bids[id].highBidder, bids[id].bidAmount);

bids[id].highBidder = msg.sender;

}

protocolToken.move(msg.sender, address(this), bid - bids[id].bidAmount);

bids[id].bidAmount = bid;

bids[id].bidExpiry = addUint48(uint48(now), bidDuration);

emit IncreaseBidSize(id, msg.sender, amountToBuy, bid, bids[id].bidExpiry);

}

Score

Likelihood: 1

Recommendation

ACKNOWLEDGED: The team claims the above issue is intended behavior. Moreover, the team will add the intended behavior note in the README documentation. Furthermore, the team added that, the protocol intends to maximize the amount of capital raised through the auction mechanism rather than minimize the auction duration or restrict participation; therefore, limiting any means of increasing the bid price is undesirable.

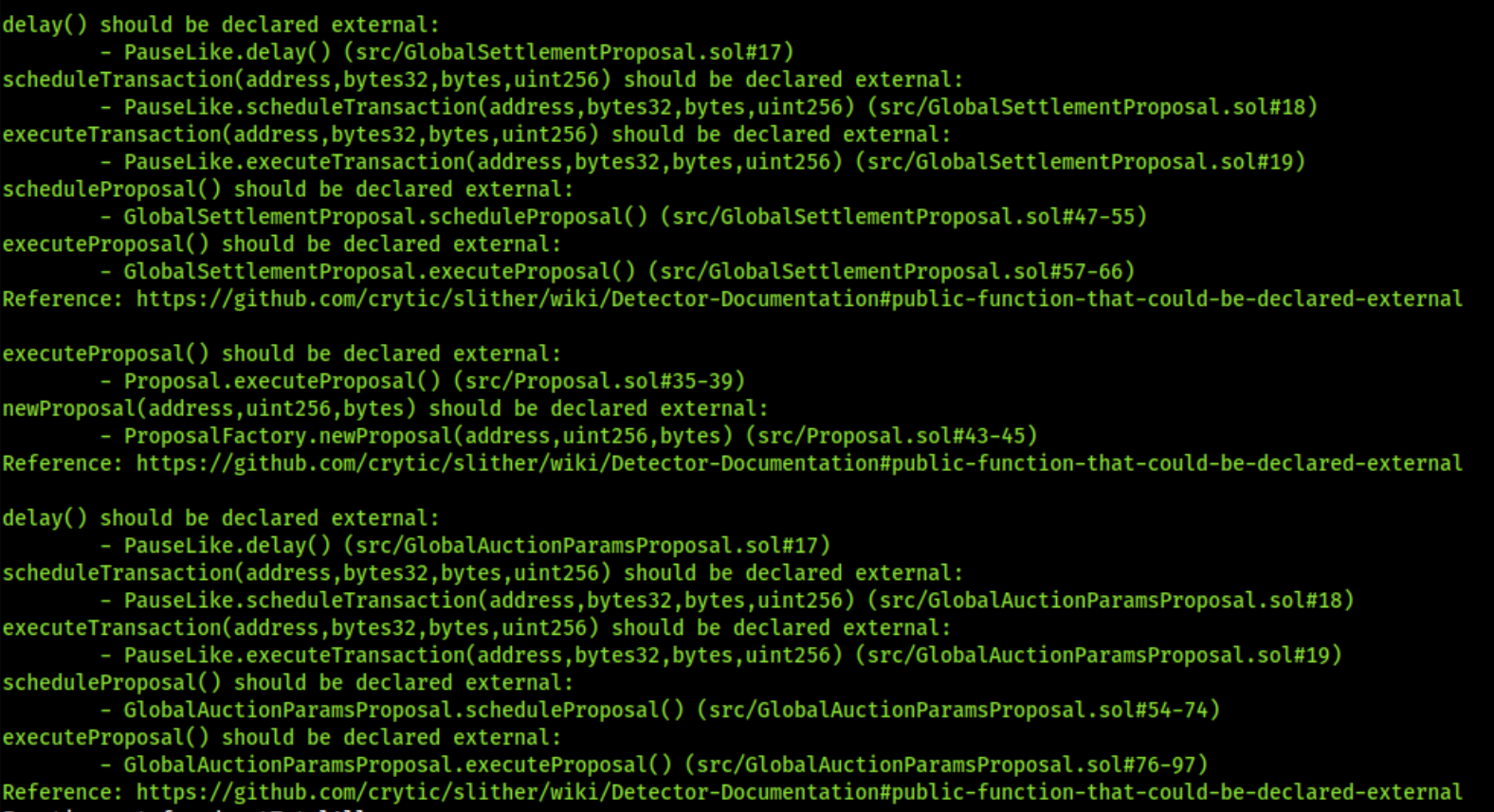

8.18 POSSIBLE MISUSE OF PUBLIC FUNCTIONS

// Informational

Description

In public functions, array arguments are immediately copied to memory, while external functions can read directly from calldata. Reading calldata is cheaper than memory allocation. Public functions need to write the arguments to memory because public functions may be called internally. Internal calls are passed internally by pointers to memory. Thus, the function expects its arguments being located in memory when the compiler generates the code for an internal function.

Furthermore, methods do not necessarily have to be public if they are only called within the contract-in such case they should be marked internal.

Code Location

Below are smart contracts and their corresponding functions affected: \textbf{\underline{AccessManagementProposal.sol}:} executeProposal() scheduleProposal()

\textbf{\underline{CollateralStabilityFeeProposal.sol}:} executeProposal()

\textbf{\underline{ConfigLike.sol}:} addAuthorization(address) initializeCollateralType(bytes32) modifyParameters(bytes32,bytes32,address) modifyParameters(bytes32,bytes32,uint256) modifyParameters(bytes32,uint256) modifyParameters(bytes32,uint256,uint256,address)

\textbf{\underline{DebtCeilingProposal.sol}:} executeProposal() scheduleProposal()

\textbf{\underline{DeployCollateralAuctionThottler.sol}:} execute(address,address,address)

\textbf{\underline{DeployDebtPopperRewards.sol}:} execute(address,address)

\textbf{\underline{DeployDSMandWrapper.sol}:} execute(address,address,address,bytes32,uint256)

\textbf{\underline{DeployGlobalSettlement.sol}:} execute(address)

\textbf{\underline{DeployIncreasingDiscountCollateralHouse.sol}:} execute(address,LiquidationEngineLike,bytes32,address)

\textbf{\underline{DeployOSMandWrapper.sol}:} execute(address,address,address)

\textbf{\underline{DeployPIRateSetter.sol}:} execute(address)

\textbf{\underline{DeploySingleSpotDebtCeilingSetter.sol}:} execute(address,address,address,bytes32,address)

\textbf{\underline{DeployUniswapMedianizer.sol}:} execute(address,address,address,address,address,uint256,uint256)

\textbf{\underline{DeployUniswapTWAP.sol}:} execute(address)

\textbf{\underline{GlobalAuctionParamsProposal.sol}:} executeProposal() scheduleProposal()

\textbf{\underline{GlobalSettlementProposal.sol}:} executeProposal() scheduleProposal()

\textbf{\underline{GlobalStabilityFeeProposal.sol}:} executeProposal()

\textbf{\underline{LiquidationCRatioProposal.sol}:} executeProposal() scheduleProposal()

\textbf{\underline{LiquidationPenaltyProposal.sol}:} executeProposal() scheduleProposal()

\textbf{\underline{MerkleDistributionManagement.sol}:} deployDistributor(address,bytes32,uint256,bool) dropDistributorAuth(address,uint256) getBackTokensFromDistributor(address,uint256,uint256) sendTokensToCustom(address,address,uint256) sendTokensToDistributor(address,uint256)

\textbf{\underline{MultiDebtCeilingProposal.sol}:} executeProposal() scheduleProposal()

\textbf{\underline{NewCollateralProposal.sol}:} executeProposal()

\textbf{\underline{OldRateSetterLike.sol}:} treasury()

\textbf{\underline{OldTwapLike.sol}:} treasury()

\textbf{\underline{OracleRelayerLike.sol}:} updateCollateralPrice(bytes32)

\textbf{\underline{PauseLike.sol}:} delay() executeTransaction(address,bytes32,bytes,uint256) scheduleTransaction(address,bytes32,bytes,uint256)

\textbf{\underline{Proposal.sol}:} executeProposal() newProposal(address,uint256,bytes) scheduleProposal()

\textbf{\underline{ProposalFactory.sol}:} newProposal(address,uint256,bytes)

\textbf{\underline{SafetyCRatioProposal.sol}:} executeProposal() scheduleProposal()

\textbf{\underline{SecondaryTaxReceiversProposal.sol}:} executeProposal()

\textbf{\underline{SwapGlobalSettlement.sol}:} execute(address,address)

Score

Likelihood: 1

Recommendation

ACKNOWLEDGED: The H2O team acknowledged this issue.

8.19 USING ++I CONSUMES LESS GAS THAN I++ IN LOOPS

// Informational

Description

In the loop below, the variable i is incremented using i++. It is known that, in loops, using ++i costs less gas per iteration than i++.

Code Location

AccessManagementProposal.sol

function executeProposal() public {

require(!executed, "proposal-already-executed");

for (uint256 i = 0; i < gebModules.length; i++) {

bytes memory signature =

abi.encodeWithSignature(

(grantAccess[i] != 0) ? "addAuthorization(address,address)" : "removeAuthorization(address,address)",

gebModules[i],

addresses[i]

);

pause.executeTransaction(target, codeHash, signature, earliestExecutionTime);

}

executed = true;

}

AccessManagementProposal.sol

function scheduleProposal() public {

require(earliestExecutionTime == 0, "proposal-already-scheduled");

earliestExecutionTime = now + PauseLike(pause).delay();

for (uint256 i = 0; i < gebModules.length; i++) {

bytes memory signature =

abi.encodeWithSignature(

(grantAccess[i] != 0) ? "addAuthorization(address,address)" : "removeAuthorization(address,address)",

gebModules[i],

addresses[i]

);

pause.scheduleTransaction(target, codeHash, signature, earliestExecutionTime);

}

}

CollateralStabilityFeeProposal.sol

function deploy(address taxCollector, bytes32[] calldata collateralTypes, uint256[] calldata stabilityFees) external {

for (uint i = 0; i < collateralTypes.length; i++)

ConfigLike(taxCollector).modifyParameters(collateralTypes[i], "stabilityFee", stabilityFees[i]);

}

LiquidationCRatioProposal.sol

function executeProposal() public {

require(!executed, "proposal-already-executed");

for (uint256 i = 0; i < collateralTypes.length; i++) {

bytes memory signature =

abi.encodeWithSignature(

"modifyParameters(address,bytes32,bytes32,uint256)",

oracleRelayer,

collateralTypes[i],

bytes32("liquidationCRatio"),

liquidationCRatios[i]

);

pause.executeTransaction(target, codeHash, signature, earliestExecutionTime);

}

executed = true;

}

LiquidationCRatioProposal.sol

function scheduleProposal() public {

require(earliestExecutionTime == 0, "proposal-already-scheduled");

earliestExecutionTime = now + PauseLike(pause).delay();

for (uint256 i = 0; i < collateralTypes.length; i++) {

bytes memory signature =

abi.encodeWithSignature(

"modifyParameters(address,bytes32,bytes32,uint256)",

oracleRelayer,

collateralTypes[i],

bytes32("liquidationCRatio"),

liquidationCRatios[i]

);

pause.scheduleTransaction(target, codeHash, signature, earliestExecutionTime);

}

}

LiquidationPenaltyProposal.sol

function executeProposal() public {

require(!executed, "proposal-already-executed");

for (uint256 i = 0; i < collateralTypes.length; i++) {

bytes memory signature =

abi.encodeWithSignature(

"modifyParameters(address,bytes32,bytes32,uint256)",

liquidationEngine,

collateralTypes[i],

bytes32("liquidationPenalty"),

liquidationPenalties[i]

);

pause.executeTransaction(target, codeHash, signature, earliestExecutionTime);

}

executed = true;

}

LiquidationPenaltyProposal.sol

function scheduleProposal() public {

require(earliestExecutionTime == 0, "proposal-already-scheduled");

earliestExecutionTime = now + PauseLike(pause).delay();

for (uint256 i = 0; i < collateralTypes.length; i++) {

bytes memory signature =

abi.encodeWithSignature(

"modifyParameters(address,bytes32,bytes32,uint256)",

liquidationEngine,

collateralTypes[i],

bytes32("liquidationPenalty"),

liquidationPenalties[i]

);

pause.scheduleTransaction(target, codeHash, signature, earliestExecutionTime);

}

}

MultiDebtCeilingProposal.sol

function executeProposal() public {

require(!executed, "proposal-already-executed");

for (uint256 i = 0; i < collateralTypes.length; i++) {

bytes memory signature =

abi.encodeWithSignature(

"modifyParameters(address,bytes32,bytes32,uint256)",

safeEngine,

collateralTypes[i],

bytes32("debtCeiling"),

debtCeilings[i]

);

pause.executeTransaction(target, codeHash, signature, earliestExecutionTime);

}

executed = true;

}

MultiDebtCeilingProposal.sol

function scheduleProposal() public {

require(earliestExecutionTime == 0, "proposal-already-scheduled");

earliestExecutionTime = now + PauseLike(pause).delay();

for (uint256 i = 0; i < collateralTypes.length; i++) {

bytes memory signature =

abi.encodeWithSignature(

"modifyParameters(address,bytes32,bytes32,uint256)",

safeEngine,

collateralTypes[i],

bytes32("debtCeiling"),

debtCeilings[i]

);

pause.scheduleTransaction(target, codeHash, signature, earliestExecutionTime);

}

}

SafetyCRatioProposal.sol

function executeProposal() public {

require(!executed, "proposal-already-executed");

for (uint256 i = 0; i < collateralTypes.length; i++) {

bytes memory signature =

abi.encodeWithSignature(

"modifyParameters(address,bytes32,bytes32,uint256)",

oracleRelayer,

collateralTypes[i],

bytes32("safetyCRatio"),

safetyCRatios[i]

);

pause.executeTransaction(target, codeHash, signature, earliestExecutionTime);

}

executed = true;

}

SafetyCRatioProposal.sol

function scheduleProposal() public {

require(earliestExecutionTime == 0, "proposal-already-scheduled");

earliestExecutionTime = now + PauseLike(pause).delay();

for (uint256 i = 0; i < collateralTypes.length; i++) {

bytes memory signature =

abi.encodeWithSignature(

"modifyParameters(address,bytes32,bytes32,uint256)",

oracleRelayer,

collateralTypes[i],

bytes32("safetyCRatio"),

safetyCRatios[i]

);

pause.scheduleTransaction(target, codeHash, signature, earliestExecutionTime);

}

}

SecondaryTaxReceiversProposal.sol

function deploy(

address taxCollector,

bytes32[] calldata collateralTypes,

uint256[] calldata positions,

uint256[] calldata percentages,

address[] calldata secondaryReceivers)

external

{

for (uint i = 0; i < collateralTypes.length; i++)

ConfigLike(taxCollector).modifyParameters(collateralTypes[i], positions[i], percentages[i], secondaryReceivers[i]);

}

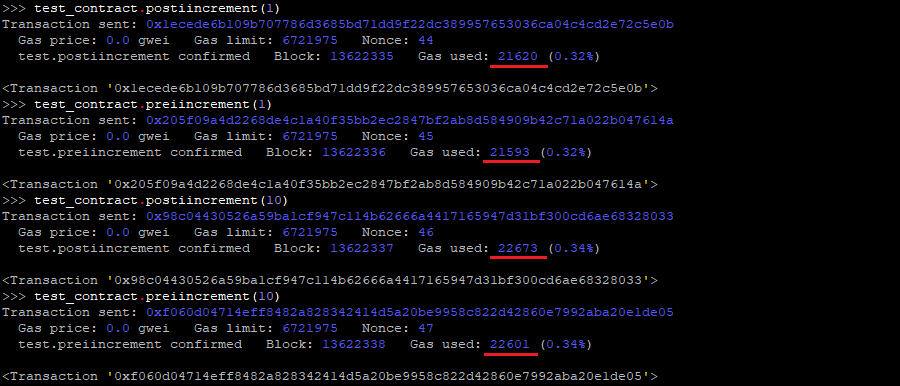

For example, based in the following test contract:

Test.sol

//SPDX-License-Identifier: MIT

pragma solidity 0.8.9;

contract test {

function postiincrement(uint256 iterations) public {

for (uint256 i = 0; i < iterations; i++) {

}

}

function preiincrement(uint256 iterations) public {

for (uint256 i = 0; i < iterations; ++i) {

}

}

}

We can see the difference in the gas costs:

Score

Likelihood: 1

Recommendation

ACKNOWLEDGED: The H2O team acknowledged this issue.

8.20 CACHE ARRAY LENGTH IN FOR LOOPS CAN SAVE GAS

// Informational

Description

Reading array length at each iteration of the loop takes 6 gas (3 for mload and 3 to place memory_offset) in the stack. Caching the array length in the stack saves around 3 gas per iteration.

Code Location

AccessManagementProposal.sol

function executeProposal() public {

require(!executed, "proposal-already-executed");

for (uint256 i = 0; i < gebModules.length; i++) {

bytes memory signature =

abi.encodeWithSignature(

(grantAccess[i] != 0) ? "addAuthorization(address,address)" : "removeAuthorization(address,address)",

gebModules[i],

addresses[i]

);

pause.executeTransaction(target, codeHash, signature, earliestExecutionTime);

}

executed = true;

}

AccessManagementProposal.sol