Prepared by:

HALBORN

Last Updated 07/06/2024

Date of Engagement by: June 5th, 2024 - June 12th, 2024

Summary

100% of all REPORTED Findings have been addressed

All findings

8

Critical

0

High

0

Medium

0

Low

2

Informational

6

Table of Contents

- 1. Introduction

- 2. Assessment summary

- 3. Test approach and methodology

- 4. Risk methodology

- 5. Scope

- 6. Assessment summary & findings overview

- 7. Findings & Tech Details

- 7.1 User deposits can be burned

- 7.2 Changedepositories can 'hide' users' deposits

- 7.3 Open todo in comments

- 7.4 Redundant code in uupsupgradeable override

- 7.5 Lack of zero checks for amounts

- 7.6 Lack of event emission during state changes

- 7.7 Use of unchecked in returndeposit function

- 7.8 Inappropriate condition check for openzeppelin's erc20 implementation

- 8. Automated Testing

1. Introduction

Plural Energy engaged Halborn to conduct a security assessment of their Plural Protocol beginning on June 5th and ending on June 12th. The security assessment was scoped to three updated smart contracts provided in the Plural-Energy's GitHub repository. Commit hash and further details can be found in the Scope section of this report.

In Plural Protocol contract updates, we find:

The

Secondarycontract is a decentralized exchange (DEX) that allows users to buy and sell tokens on the Plural protocol.The

AssetTokencontract is an implementation of a fungible token on the Ethereum blockchain that represents assets within the Plural protocol.The

Offeringcontract is responsible for managing token sales on the Plural protocol. It allows authorized entities (such as project teams or investment funds) to create and manage token offerings.

2. Assessment Summary

Halborn was provided one week for the engagement and assigned one full-time security engineer to review the security of the smart contract in scope. The engineer is a blockchain and smart contract security expert with advanced penetration testing and smart contract hacking skills, and deep knowledge of multiple blockchain protocols.

The purpose of the assessment is to:

Identify potential security issues within the smart contracts in scope.

Ensure that smart contract functionality operates as intended.

In summary, Halborn identified some security recommendations that were mostly addressed by the Plural Energy team.

3. Test Approach and Methodology

Halborn performed a combination of manual and automated security testing to balance efficiency, timeliness, practicality, and accuracy in regard to the scope of this assessment. While manual testing is recommended to uncover flaws in logic, process, and implementation; automated testing techniques help enhance coverage of the code and can quickly identify items that do not follow the security best practices. The following phases and associated tools were used during the assessment:

Research into architecture and purpose.

Smart contract manual code review and walkthrough.

Graphing out functionality and contract logic/connectivity/functions (

solgraph).Manual assessment of use and safety for the critical Solidity variables and functions in scope to identify any arithmetic-related vulnerability classes.

Manual testing by custom scripts.

Static Analysis of security for scoped contracts (

slither,aderynand4naly3er).Symbolic Analysis (

Halmos).

4. RISK METHODOLOGY

4.1 EXPLOITABILITY

Attack Origin (AO):

Attack Cost (AC):

Attack Complexity (AX):

Metrics:

| EXPLOITABILITY METRIC () | METRIC VALUE | NUMERICAL VALUE |

|---|---|---|

| Attack Origin (AO) | Arbitrary (AO:A) Specific (AO:S) | 1 0.2 |

| Attack Cost (AC) | Low (AC:L) Medium (AC:M) High (AC:H) | 1 0.67 0.33 |

| Attack Complexity (AX) | Low (AX:L) Medium (AX:M) High (AX:H) | 1 0.67 0.33 |

4.2 IMPACT

Confidentiality (C):

Integrity (I):

Availability (A):

Deposit (D):

Yield (Y):

Metrics:

| IMPACT METRIC () | METRIC VALUE | NUMERICAL VALUE |

|---|---|---|

| Confidentiality (C) | None (I:N) Low (I:L) Medium (I:M) High (I:H) Critical (I:C) | 0 0.25 0.5 0.75 1 |

| Integrity (I) | None (I:N) Low (I:L) Medium (I:M) High (I:H) Critical (I:C) | 0 0.25 0.5 0.75 1 |

| Availability (A) | None (A:N) Low (A:L) Medium (A:M) High (A:H) Critical (A:C) | 0 0.25 0.5 0.75 1 |

| Deposit (D) | None (D:N) Low (D:L) Medium (D:M) High (D:H) Critical (D:C) | 0 0.25 0.5 0.75 1 |

| Yield (Y) | None (Y:N) Low (Y:L) Medium (Y:M) High (Y:H) Critical (Y:C) | 0 0.25 0.5 0.75 1 |

4.3 SEVERITY COEFFICIENT

Reversibility (R):

Scope (S):

Metrics:

| SEVERITY COEFFICIENT () | COEFFICIENT VALUE | NUMERICAL VALUE |

|---|---|---|

| Reversibility () | None (R:N) Partial (R:P) Full (R:F) | 1 0.5 0.25 |

| Scope () | Changed (S:C) Unchanged (S:U) | 1.25 1 |

| Severity | Score Value Range |

|---|---|

| Critical | 9 - 10 |

| High | 7 - 8.9 |

| Medium | 4.5 - 6.9 |

| Low | 2 - 4.4 |

| Informational | 0 - 1.9 |

5. SCOPE

- src/AssetToken.sol

- src/Offering.sol

- src/Secondary.sol

6. Assessment Summary & Findings Overview

Critical

0

High

0

Medium

0

Low

2

Informational

6

| Security analysis | Risk level | Remediation Date |

|---|---|---|

| User deposits can be burned | Low | Solved - 06/18/2024 |

| changeDepositories can 'hide' users' deposits | Low | Solved - 06/18/2024 |

| Open TODO in comments | Informational | Solved - 06/18/2024 |

| Redundant Code in UUPSUpgradeable Override | Informational | Solved - 06/18/2024 |

| Lack of Zero Checks for Amounts | Informational | Solved - 06/18/2024 |

| Lack of event emission during state changes | Informational | Solved - 06/18/2024 |

| Use of unchecked in returnDeposit Function | Informational | Acknowledged |

| Inappropriate Condition Check for OpenZeppelin's ERC20 Implementation | Informational | Solved - 06/18/2024 |

7. Findings & Tech Details

7.1 User deposits can be burned

// Low

Description

The burn function has the potential to burn tokens deposited by users into the "depository" address. This unintended behavior can result in the loss of user funds, undermining trust and integrity in the contract.

Besides, if tokens are burned incorrectly, the user's balance ownedBalanceOf could become negative, causing an underflow error. This compromises the accuracy of balance tracking and poses significant risks to contract stability and security. Implementing proper safeguards in the burn function is essential to prevent these underflow issues and ensure reliable balance management.

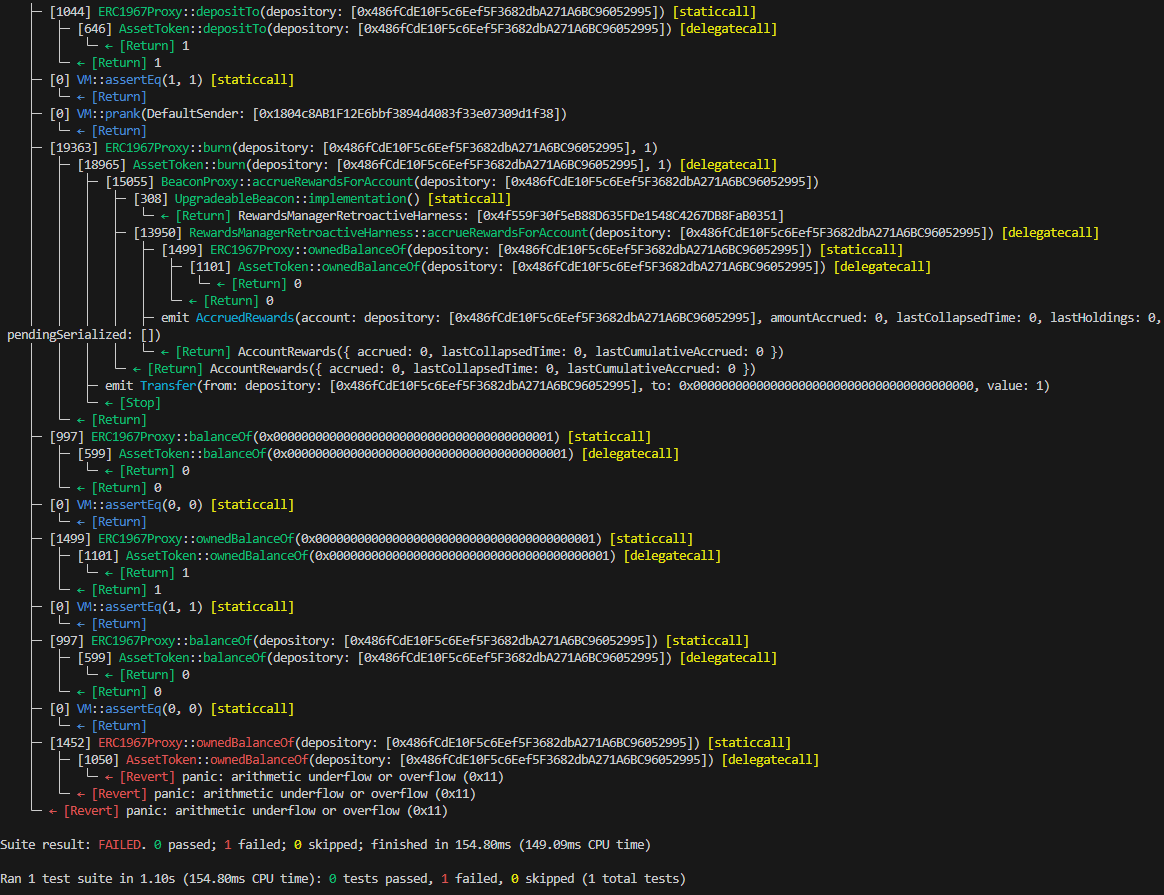

Proof of Concept

Following test have been made to prove this issue:

function test_Burn_Deposited(address _holder, uint256 _amount) public {

vm.assume(_holder != address(0));

vm.assume(_holder != _depository);

vm.assume(_amount != 0);

_forceNotPlural(_holder);

test_TakeDeposit_Working(_holder, _amount);

vm.prank(_manager);

assetToken.burn(_depository, _amount);

assertEq(assetToken.balanceOf(_holder), uint256(0));

assertEq(assetToken.ownedBalanceOf(_holder), _amount);

assertEq(assetToken.balanceOf(_depository), 0);

assertEq(assetToken.ownedBalanceOf(_depository), uint256(0));

}With following result

BVSS

Recommendation

To prevent this, it is crucial to implement checks ensuring that only eligible tokens are burned, safeguarding user deposits and maintaining the contract's reliability.

Remediation Plan

SOLVED: The Plural Energy team added a check in order to confirm if the user from has still funds deposited to avoid burning tokens.

Remediation Hash

References

7.2 changeDepositories can 'hide' users' deposits

// Low

Description

The changeDepositories function alters the accounts designated for storing user deposits. If deposits exist in an old account, these deposits will be "hidden" from user balances once the depository is changed. This can lead to discrepancies in user balances, causing confusion and potential loss of funds visibility.

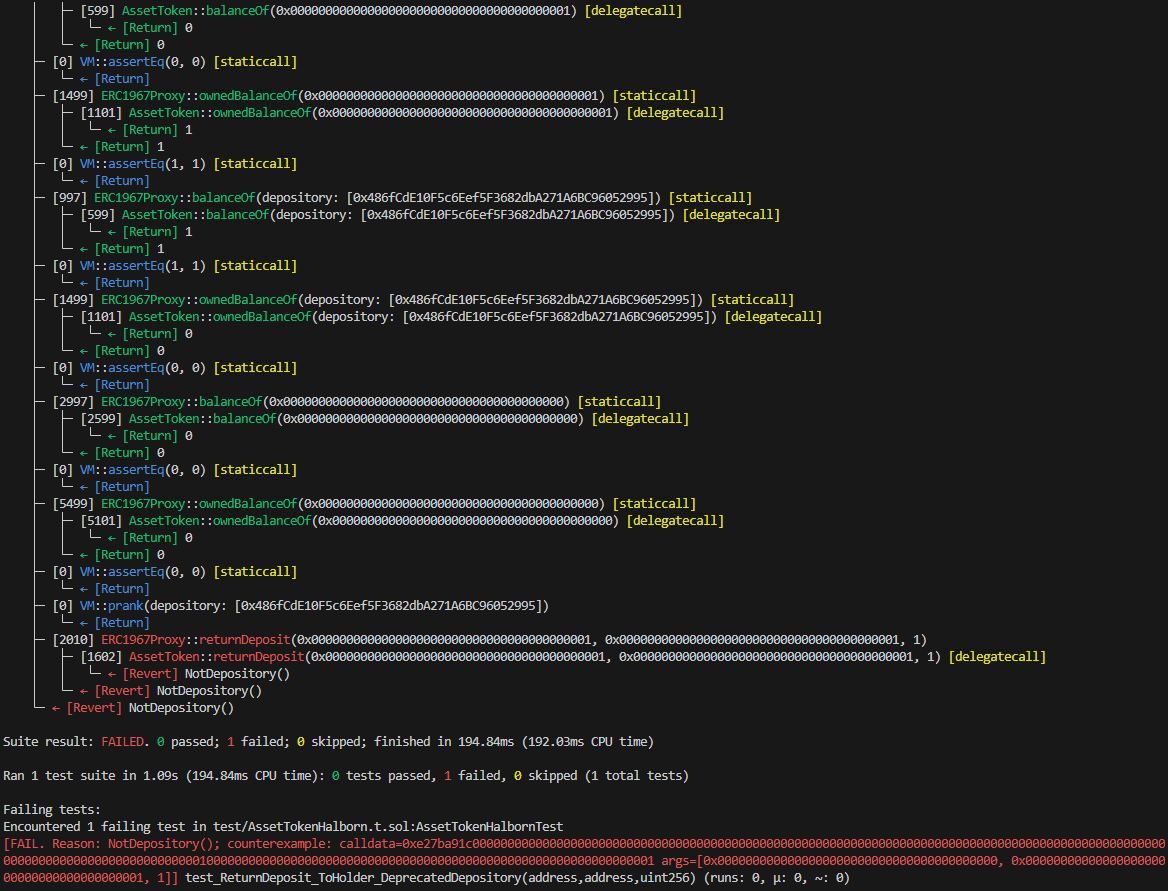

Proof of Concept

Following tests confirm this issue:

function test_ReturnDeposit_ToHolder_DeprecatedDepository(address _newDepository, address _holder, uint256 _amount) public {

vm.assume(_holder != address(0));

vm.assume(_holder != _depository);

vm.assume(_newDepository != _depository);

vm.assume(_amount != 0);

test_TakeDeposit_Working(_holder, _amount);

vm.prank(_manager);

assetToken.changeDepositories(toDyn([_newDepository]));

assertEq(assetToken.balanceOf(_holder), uint256(0));

assertEq(assetToken.ownedBalanceOf(_holder), _amount);

assertEq(assetToken.balanceOf(_depository), _amount);

assertEq(assetToken.ownedBalanceOf(_depository), uint256(0));

assertEq(assetToken.balanceOf(_newDepository), 0);

assertEq(assetToken.ownedBalanceOf(_newDepository), uint256(0));

vm.prank(_depository);

assetToken.returnDeposit(_holder, _holder, _amount);

assertEq(assetToken.depositFrom(_holder), uint256(0));

assertEq(assetToken.depositTo(_depository), uint256(0));

}

function test_ReturnDeposit_ToHolder_NewDepository(address _newDepository, address _holder, uint256 _amount) public {

vm.assume(_holder != address(0));

vm.assume(_holder != _depository);

vm.assume(_newDepository != _depository);

vm.assume(_amount != 0);

test_TakeDeposit_Working(_holder, _amount);

vm.prank(_manager);

assetToken.changeDepositories(toDyn([_newDepository]));

assertEq(assetToken.balanceOf(_holder), uint256(0));

assertEq(assetToken.ownedBalanceOf(_holder), _amount);

assertEq(assetToken.balanceOf(_depository), _amount);

assertEq(assetToken.ownedBalanceOf(_depository), uint256(0));

assertEq(assetToken.balanceOf(_newDepository), 0);

assertEq(assetToken.ownedBalanceOf(_newDepository), uint256(0));

vm.prank(_newDepository);

assetToken.returnDeposit(_holder, _holder, _amount);

assertEq(assetToken.depositFrom(_holder), uint256(0));

assertEq(assetToken.depositTo(_depository), uint256(0));

}With following results:

BVSS

Recommendation

To prevent this, it's crucial to implement a mechanism to transfer existing deposits to the new depository or properly account for them during the transition, ensuring accurate balance tracking and user trust.

Remediation Plan

SOLVED: The Plural Energy team added convenient checks and events to prevent changing depositories until they are empty.

Remediation Hash

References

7.3 Open TODO in comments

// Informational

Description

The codebase contains TODOs and developer notes, indicating incomplete features or areas requiring further attention. These placeholders suggest that the contract may not be fully implemented or tested, posing potential risks for deployment.

Score

Recommendation

Addressing these TODOs and reviewing the notes is crucial to ensure the contract's functionality, security, and readiness for production. Proper documentation and resolution of these items are essential to maintain code quality and reliability.

Remediation Plan

SOLVED: The Plural Energy team has removed the comment from the codebase.

Remediation Hash

References

7.4 Redundant Code in UUPSUpgradeable Override

// Informational

Description

The contract overrides the _upgradeTo function from UUPSUpgradeable to add the onlyOwner modifier, but it also overrides _authorizeUpgrade with the same purpose. This results in redundant code, as both functions are essentially performing the same access control check.

Score

Recommendation

To streamline the code and improve maintainability, it is recommended to use only _authorizeUpgrade for the ownership check and remove the redundancy in _upgradeTo. This approach maintains the necessary security while reducing code duplication and potential errors.

Remediation Plan

SOLVED: The Plural Energy team proceed to delete _upgradeTo overrided function.

Remediation Hash

References

7.5 Lack of Zero Checks for Amounts

// Informational

Description

The contract lacks validation checks for zero amounts in its functions. Failing to verify that amounts are non-zero can lead to unintended behavior, such as unnecessary transactions or logic execution. Implementing zero checks ensures that only meaningful and valid transactions are processed, enhancing contract efficiency, security, and reliability. This preventive measure reduces potential errors and maintains the integrity of the contract’s operations.

Score

Recommendation

To address this issue, add checks to ensure amounts are greater than zero before proceeding with function logic.

Example implementation:

function transfer(address recipient, uint256 amount) public returns (bool) {

require(amount > 0, "Amount must be greater than zero");

// existing transfer logic

}By incorporating such checks, the contract ensures that only valid, non-zero transactions are processed, improving overall robustness and preventing unnecessary operations.

Remediation Plan

SOLVED: The Plural Energy team added convenient checks to their codebase.

Remediation Hash

References

7.6 Lack of event emission during state changes

// Informational

Description

The contract AssetToken does not emit events during critical state changes in takeDeposit nor returnDeposit, resulting in a lack of transparency and traceability.

Event emissions are crucial for monitoring contract activity, debugging, and providing real-time updates to users and external systems. Implementing event emissions ensures that state changes are recorded on the blockchain, enabling better auditing and enhancing user trust.

Score

Recommendation

To address this issue, include event emissions in functions where state changes occur.

Example implementation:

event StateChanged(address indexed user, uint256 newValue);

function changeState(uint256 newValue) public {

// existing state change logic

emit StateChanged(msg.sender, newValue);

}By emitting events during state changes, the contract provides clear and transparent logs of its activities, improving overall accountability and reliability.

Remediation Plan

SOLVED: The Plural Energy team added convenient events to their codebase.

Remediation Hash

References

7.7 Use of unchecked in returnDeposit Function

// Informational

Description

The returnDeposit function can modify depositFrom and depositTo using the unchecked keyword because these values are already validated to prevent underflow.

Leveraging unchecked in this context can optimize gas usage by avoiding redundant checks, given that the necessary validations are already in place.

Score

Recommendation

Example implementation demonstrating the safe use of unchecked:

function returnDeposit(

address holder,

address tokenRecipient,

uint amount

) public override onlyDepository {

// Validate

if (holder == address(0)) revert ZeroAddress();

if (tokenRecipient == address(0)) revert ZeroAddress();

if (depositFrom[holder] < amount) revert InsufficientDeposit(holder);

if (depositTo[msg.sender] < amount)

revert InsufficientDeposit(msg.sender);

........

unchecked {

depositFrom[holder] -= amount;

depositTo[msg.sender] -= amount;

}

_transfer(tokenRecipient, amount, false);

}By implementing unchecked in the returnDeposit function after proper validation, the contract enhances efficiency without compromising security.

Remediation Plan

ACKNOWLEDGED: The Plural Energy team acknowledged this finding.

References

7.8 Inappropriate Condition Check for OpenZeppelin's ERC20 Implementation

// Informational

Description

Methods _transfer and _transferFrom are using a condition to check the outcome of OpenZeppelin's ERC20 functions, which revert on failure instead of returning a boolean. This can lead to incorrect error handling and unexpected behavior. OpenZeppelin's ERC20 functions use revert to signal failures, making conditional checks ineffective for these cases. Proper error handling should be implemented to catch these reverts and handle them accordingly.

Score

Recommendation

Error handling by using try/catch is a solution, but just receiving the revert coming from the ERC20, could be enough.

Remediation Plan

SOLVED: The Plural Energy team decided to relay in OpenZeppelin's ERC20 revert behavior so deleted the conditionals from their codebase.

Remediation Hash

References

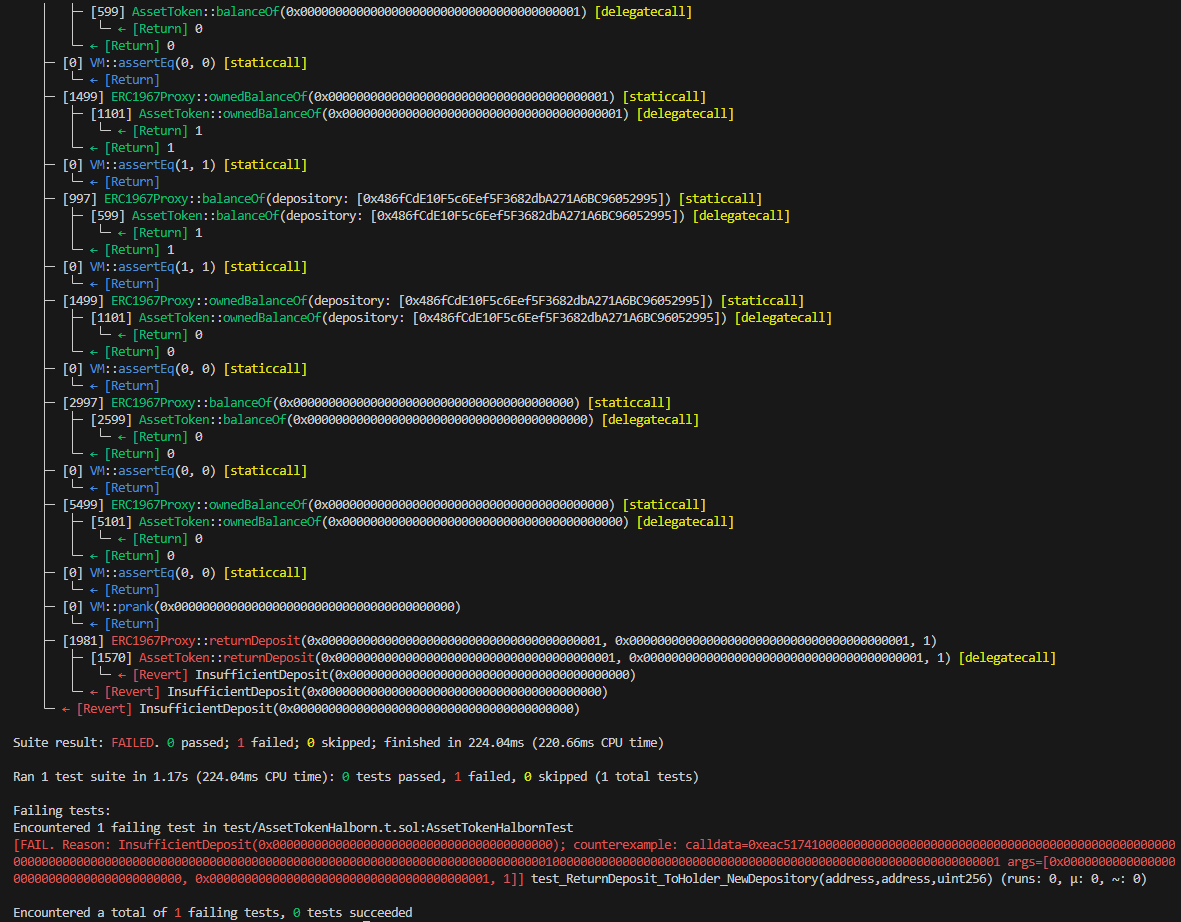

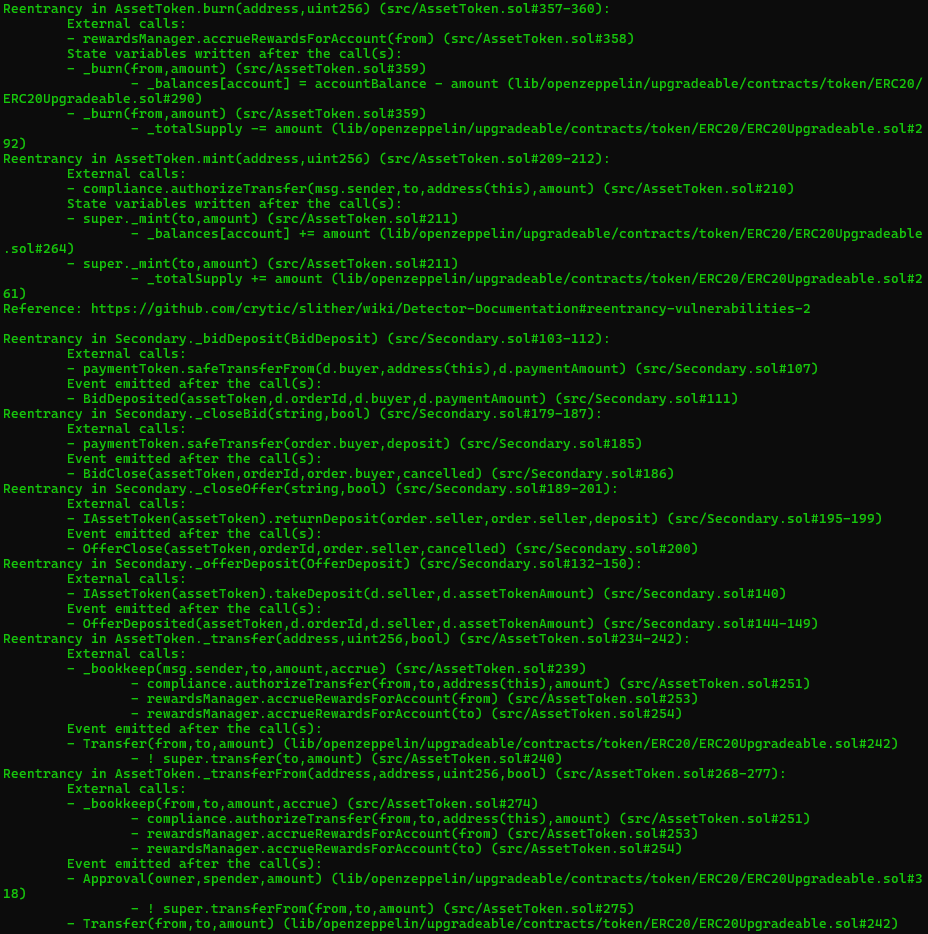

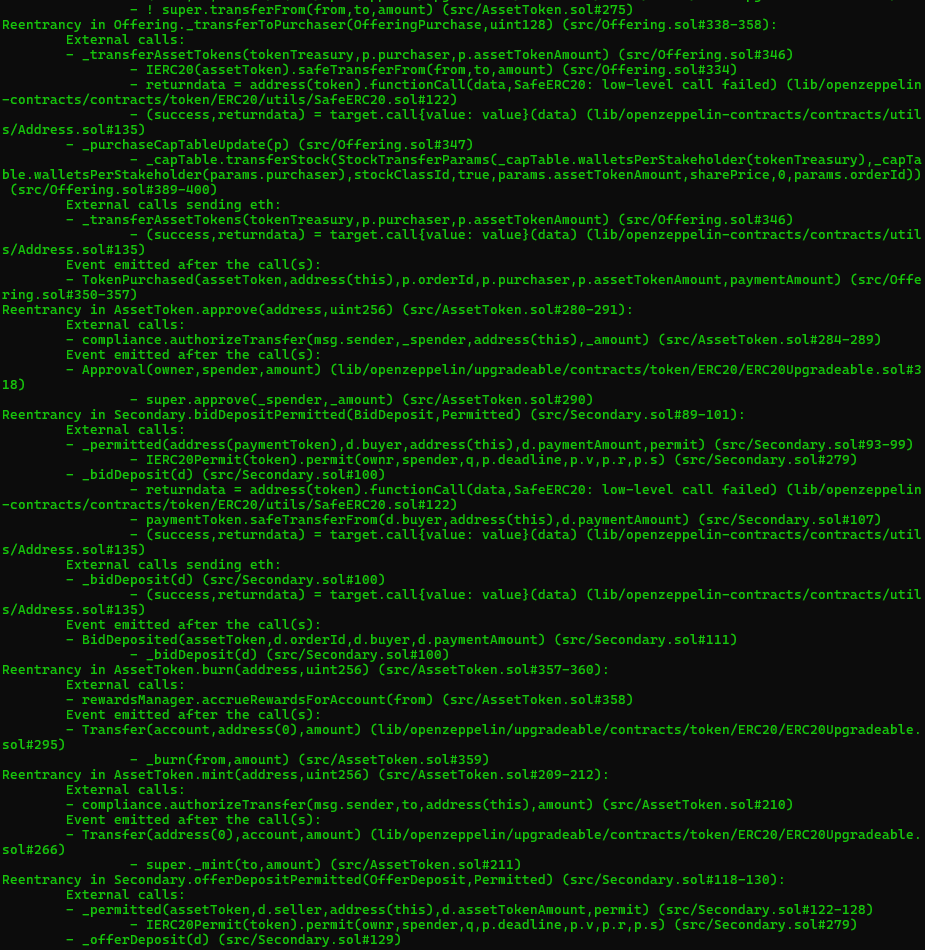

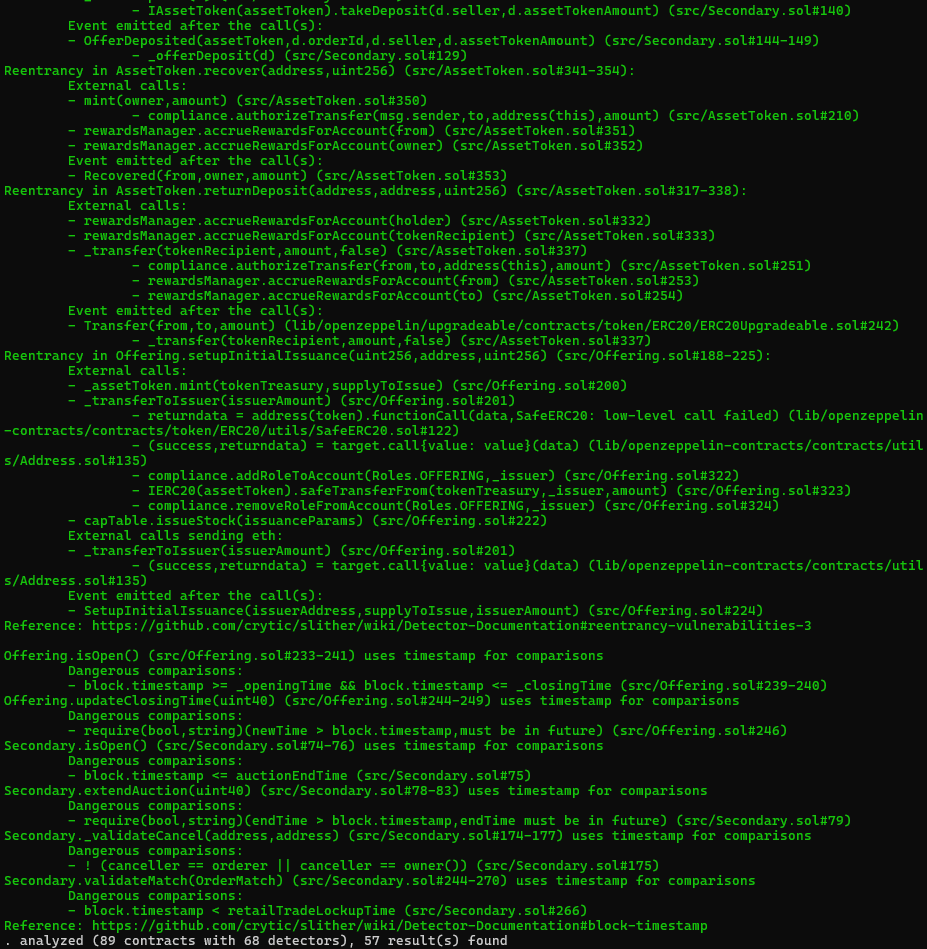

8. Automated Testing

Halborn used automated testing techniques to enhance the coverage of certain areas of the smart contract in scope. Among the tools used was Slither, a Solidity static analysis framework. After Halborn verified the smart contract in the repository and was able to compile it correctly into their ABI and binary format, Slither was run against the contract. This tool can statically verify mathematical relationships between Solidity variables to detect invalid or inconsistent usage of the contract's API across the entire code-base.

The security team assessed all findings identified by the Slither software, and findings with severity Information and Optimization are excluded in the below results.

Results includes several security findings which were confirmed to be false positives or are already included in this report as findings.

Halborn strongly recommends conducting a follow-up assessment of the project either within six months or immediately following any material changes to the codebase, whichever comes first. This approach is crucial for maintaining the project’s integrity and addressing potential vulnerabilities introduced by code modifications.

Table of Contents

- 1. Introduction

- 2. Assessment summary

- 3. Test approach and methodology

- 4. Risk methodology

- 5. Scope

- 6. Assessment summary & findings overview

- 7. Findings & Tech Details

- 7.1 User deposits can be burned

- 7.2 Changedepositories can 'hide' users' deposits

- 7.3 Open todo in comments

- 7.4 Redundant code in uupsupgradeable override

- 7.5 Lack of zero checks for amounts

- 7.6 Lack of event emission during state changes

- 7.7 Use of unchecked in returndeposit function

- 7.8 Inappropriate condition check for openzeppelin's erc20 implementation

- 8. Automated Testing

// Download the full report

* Use Google Chrome for best results

** Check "Background Graphics" in the print settings if needed